While I’ve recently discussed what is driving outperformance in the consumer discretionary sector and the communications sector, the industrial sector has recently looked more interesting. This past week, aerospace and defense companies like Raytheon Technologies (RTX) and Lockheed Martin (LMT) have beat on earnings results with better-than-expected revenues which they attribute to higher air travel demand, defense systems demand, and easing of supply chains. While Raytheon and Lockheed Martin are some of the largest companies within the industrials sector. The sector is much more diversified than just aerospace and defense companies. The industrial sector also includes companies involved in manufacturing, construction, transportation, and machinery which are often large-cap stocks and leading indicators for the economy. This note takes a look at some of the largest industrial ETFs, what’s inside, and other thematic alternatives for investors.

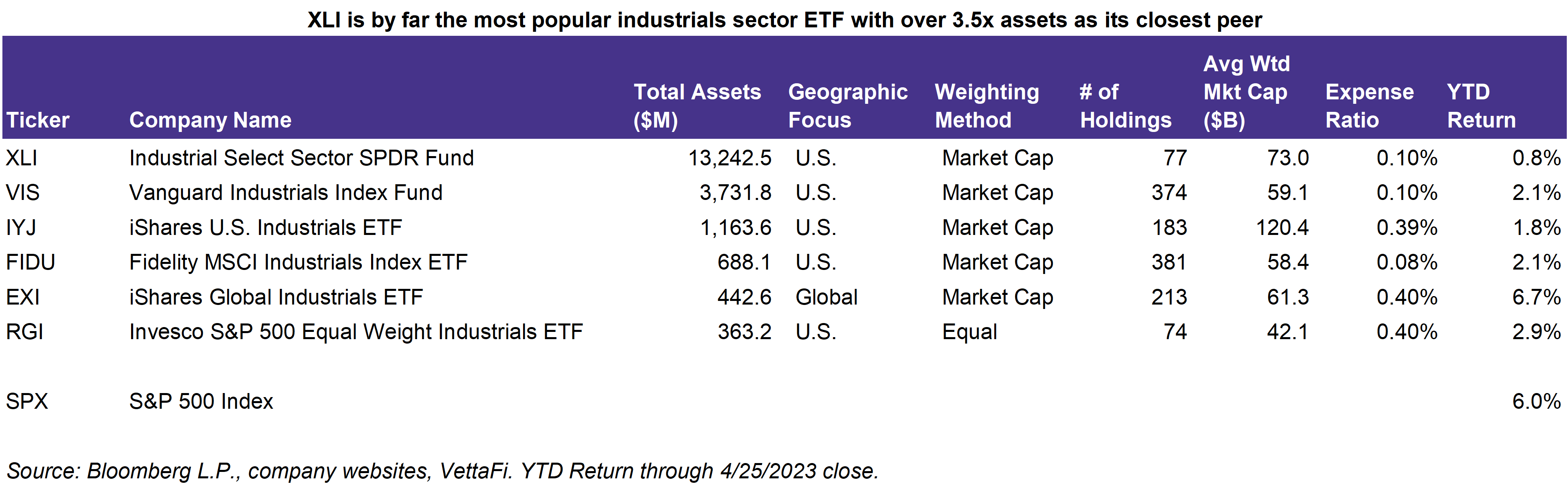

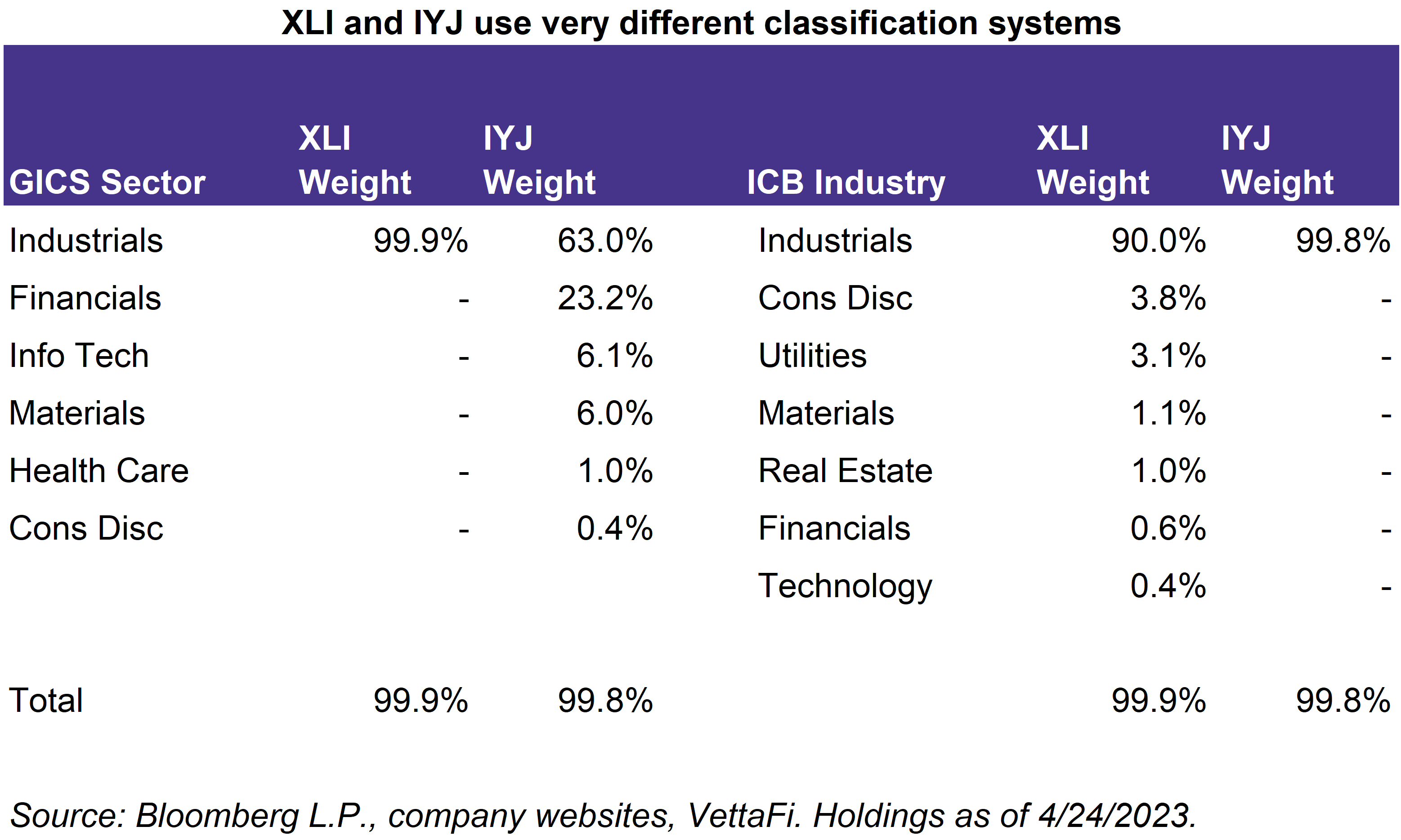

The industrials sector can look substantially different depending on what ETF you use. The largest and most popular industrial ETF is the Industrial Select Sector SPDR Fund (XLI) which has $13.2 billion in assets — more than 3.5x its closest peer. Out of its peers, there is a significant difference between XLI and the iShares U.S. Industrials ETF (IYJ) due to XLI following an index that uses the Global Industry Classification Standard (GICS) system and IYJ following an index that uses the Industry Classification Benchmark (ICB) system. Because many investors are accustomed to the GICS sector system, IYJ may be broader and more diversified than investors would expect. Here are some of the main differences between the two ETFs:

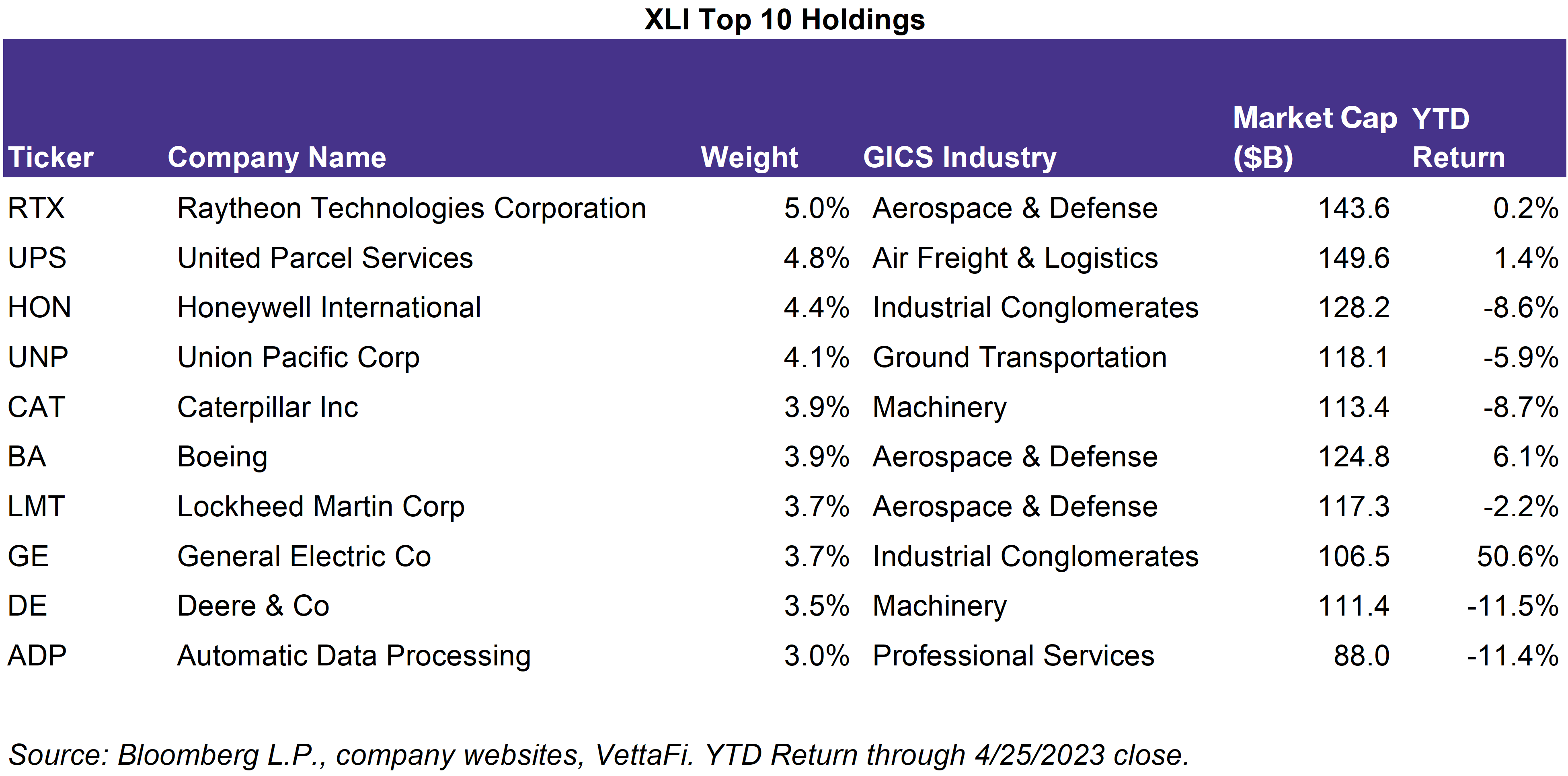

For XLI, about 20.7% of the total ETF is aerospace and defense companies including Raytheon and Lockheed Martin, in addition to Boeing (BA) and Northrop Grumman (NOC). These companies often benefit from government support and long-term contracts. Approximately 20.3% of the ETF is machinery companies like Caterpillar (CAT), Deere & Co (DE), Paccar (PCAR), and Cummins (CMI) which manufacture construction, agricultural, and freight machinery and vehicles. 17.1% of the ETF includes ground transportation, airfreight, and logistics companies. Railroad companies like Union Pacific (UNP) haul industrial goods (chemicals, metals, constructions, etc.), bulk (coal, grain, etc.), and premium shipments (auto, consumer goods), while parcel delivery companies like UPS and FDX haul mostly consumer goods. These industries are also found in IYJ — the only industry found in XLI that is not in IYJ is the passenger airlines industry, which is only 2.3% of the ETF weight. In ICB methodology, airline companies are actually considered to be consumer discretionary stocks which is why they are not included in IYJ.

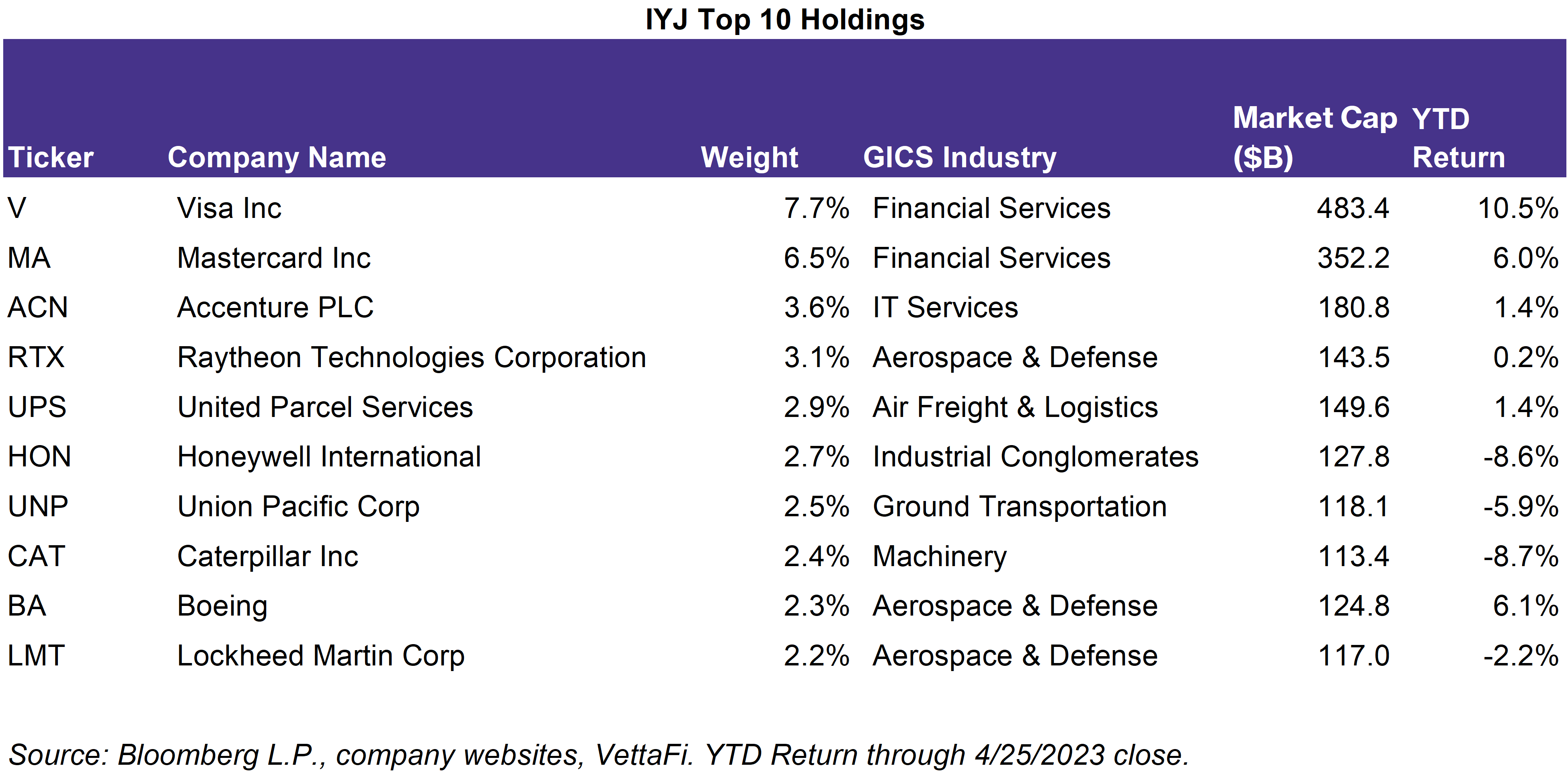

While IYJ’s top holdings are very similar to XLI’s, the differences can be surprising. If you translate IYJ’s holdings into GICS sectors, the ETF is only 63% industrials, with 23.2% weight in financial, 6.1% in information technology, and 6.0% in materials. But if you further divide that into GICS Industries, the ETF has its largest industry allocation to financial services companies (20.3% of the ETF’s weight). Many of these financial companies are in its top holdings including Visa (V) and Mastercard (MA) with over 14% of the total ETF weight. Its second largest industry is machinery (14.2%), and aerospace & defense is only its third largest industry (13.7%). Unlike XLI, IYJ also has exposure to IT services companies like Accenture (ACN), consumer finance companies, and chemical companies.

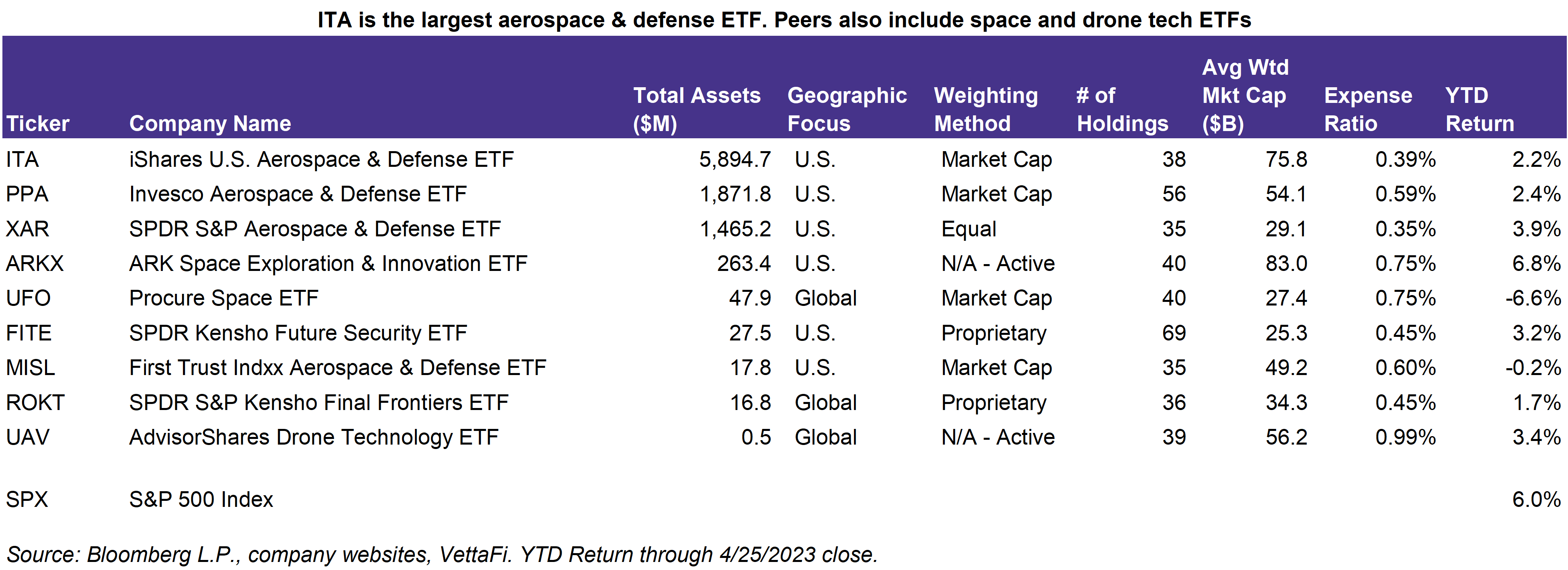

Since the GICS industrial sector’s largest industry exposure is the aerospace & defense industry, many investors may want more focused exposure to this particular industry rather than be exposed to areas like transportation companies (which are largely driven by consumer spending) or fintech companies (which probably don’t fit into many people’s definitions of an industrials stock). The top ETF in this industry is the iShares U.S. Aerospace & Defense ETF (ITA) which has almost as many assets as all of XLI’s peers listed in the first table. Out of sector equity ETFs, ITA has the largest ETF inflows YTD after the Financial Select Sector SPDR Fund (XLF) and the Communication Services Select Sector SPDR Fund (XLC). ITA and other aerospace & defense ETFs like PPA and XAR have actually outperformed broader industrials ETFs YTD. Some investors may also seek thematic funds that are adjacent to the aerospace & defense industry including the ARK Space Exploration & Innovation ETF (ARKX) and the Procure Space ETF (UFO). UFO, for example, holds many of the aerospace & defense companies like Boeing and Northrop Grumman in addition to satellite/communications companies like Iridium Communications (IRDM) and Viasat (VSAT). For more details on UFO, see this recent note.

For more news, information, and analysis, visit the Disruptive Technology Channel.