While investors have renewed interest in the tech sector this year, this week, however, the sector lagged with news of PC shipments falling 29% y/y globally in 1Q23 due to excess inventory and decreased consumer demand. All of the top manufacturers saw declines of 24% to 40% in shipments including Lenovo, HP, Dell, Asus, and Apple (Apple was down the most at 40.5% y/y). These issues are expected to persist until at least the middle of the year, but this hasn’t been a complete surprise. There was increased demand for personal computers during the pandemic, which has since diminished.

During its earnings call in February, Apple had already warned that sales for Macs and iPads would decline by double digits in the quarter. Like most other computer manufacturers, most of Apple’s net sales are derived from its devices (iPhone, Mac, iPad, Wearables and Home Accessories), while the services segment is currently only 17.7% of its net revenues for the most recent quarter ending December 2022.

Meanwhile, other internet-related companies may be less sensitive to changes in PC, smartphone, or even semiconductor inventory. In contrast to manufacturers which earn money from device or hardware sales, companies like Meta Platforms (META) generate substantially all of their revenue from advertising, which is driven by user engagement. A large majority of people in developed countries already own at least one device, so additional devices or replacement devices won’t necessarily grow the number of active users. According to Pew Research, 85% of U.S. adults own a smartphone and 77% own either a desktop or laptop. These figures are from February 2021, so the percentage is likely larger in 2023. For Meta’s family of apps (including Facebook, Instagram, and WhatsApp), this aligns with its historical user growth. Its monthly active users have grown slowly between 0% – 2% in each of the last seven quarters, which is mostly driven by countries like India, Nigeria, and Bangladesh. Engagement and time spent on the apps would hold equal or maybe even more weight vs. number of users since ad revenue is typically based on clicks or impressions delivered (which increases with time spent).

What do communication ETFs really look like?

Internet companies like META and Alphabet (GOOGL/GOOG) are actually considered part of the communication services sector after a GICS reclassification in September 2018. The sector was formed after media companies and internet services companies joined traditional telecommunications companies like ATT (T) and Verizon (VZ). Most communication sector ETFs have actually been outperforming technology ETFs YTD. The Communication Services Select Sector SPDR Fund (XLC) is up 22.2% YTD relative to the Technology Select SPDR Fund (XLK) which is up 18.6%. For market-cap weighted communication ETFs like XLC, Meta Platforms and Google make up one-third to close to a half of the ETF’s weight. The two companies make up 46.5% of XLC, 35.4% of VOX, 39.6% of FCOM, and 36.5% of IXP. For investors who want more diversification away from those two companies and small-cap exposure, the Invesco S&P 500 Equal Weight Communication Service ETF (EWCO) has only 10.1% allocation to these two stocks due to its equal weight methodology.

The communications sector is one of the fastest changing sectors.

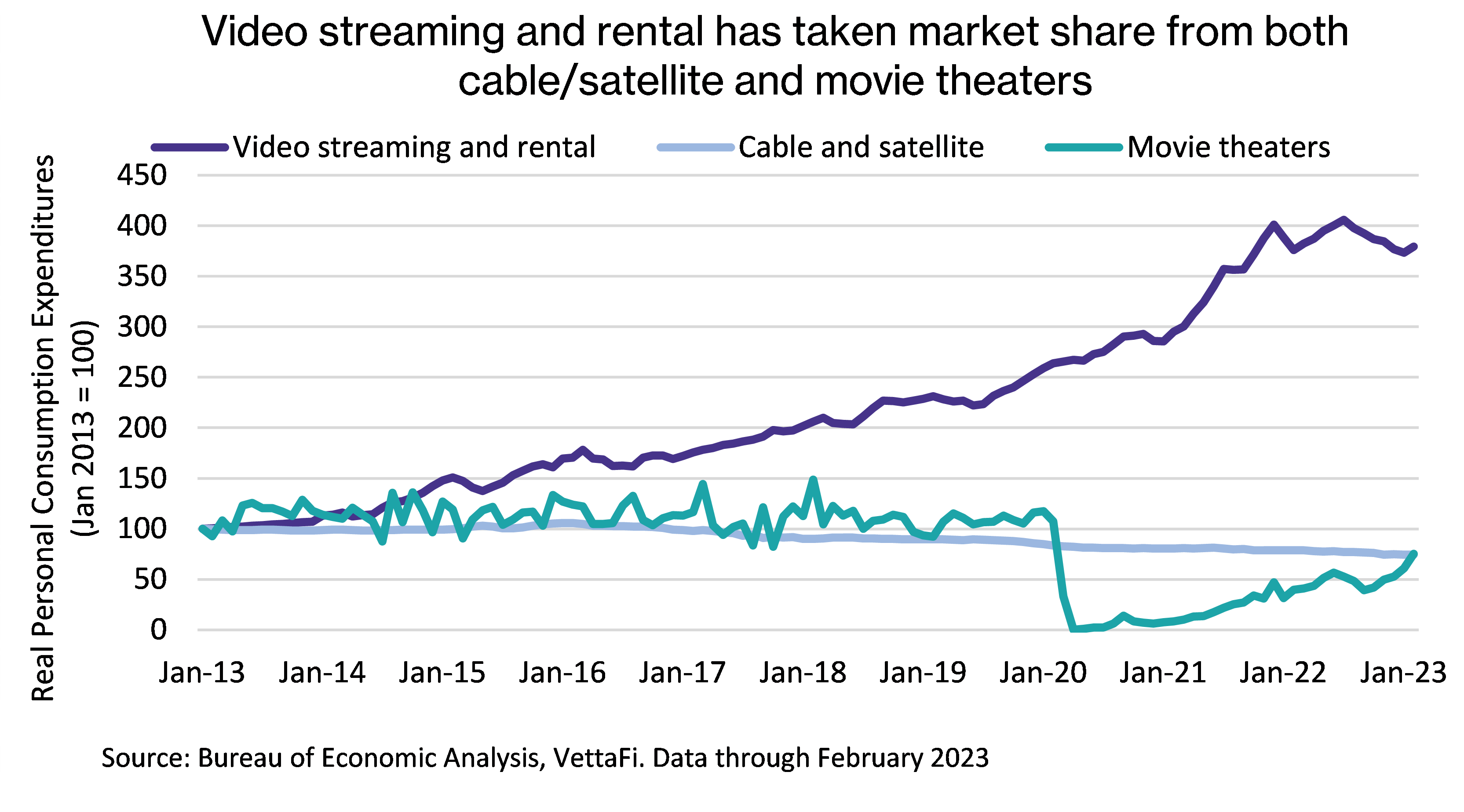

As alluded to above, the communication sector continues to evolve over the years. Telecom companies were once essentially utilities and now they’re evolving along with technology, social media, and other trends. Media companies are similarly evolving from live TV to video-on-demand to streaming. ETFs like the VanEck Video Gaming and eSports ETF (ESPO) and the First Trust S-Network Streaming and Gaming ETF (BNGE) stand out for focusing on streaming audio, video, and gaming companies which have grown in popularity over the past few years — particularly video streaming and rental which has been able to take market share from both cable and satellite TV and movie theaters. Streaming is still in its relatively early stages—so there’s potentially more room for growth. The segment is led by Netflix (NFLX), which has been in the streaming industry since 2007, in addition to companies like Walt Disney (DIS), and Warner Bros Discovery (WBD) which have launched newer streaming channels Disney Plus (2019) and HBOMax (2020), respectively. See more on Netflix and video streaming here.

Video game companies are also missing from broader domestic communication services ETF since many of them are based in Japan or other parts of Asia and Europe. Companies like Nintendo (7974 JP), Bandai Namco (7832 JP), Nexon (3659 JP), Capcom (9697 JP), and Ubisoft Entertainment (UBI FP) are among the foreign companies found in ESPO. Video games have also been increasingly shifting toward online subscription-based models which: 1) offer the ability for gaming to be more social, 2) move away from physical discs to higher-margin digital downloads, and 3) provide the company with a stable monthly revenue stream. For example, Nintendo increased its digital sales by 21.5% y/y for YTD through F3Q12, while also increasing the proportion of digital sales to 46.0% from 40.2%. See more about the video game industry here.

Bottom Line:

While the tech sector has seen some short-term concern with diminishing PC demand, internet companies should be less sensitive to inventory cycles for PCs, smartphones, and even semiconductors. The communication services sector continues to evolve with consumer preferences particularly in the streaming video, audio, and gaming industries.

For more news, information, and analysis, visit VettaFi | ETF Trends.