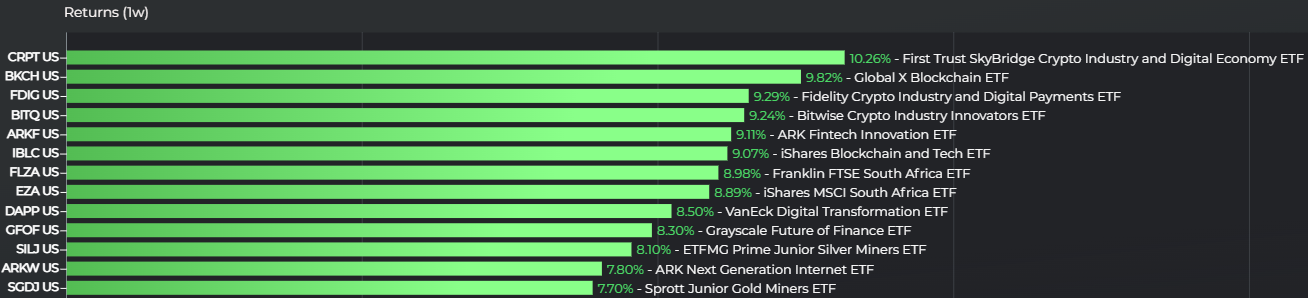

In this week’s review of the top ETFs of the last week, crypto ETFs dominated once again. The so-called 2022 crypto winter has long since thawed in a year marked by SEC and spot bitcoin ETF drama. That has boosted the increasingly diverse field of crypto ETFs to frequently dominate in returns. This past week, that’s specifically helped drive returns for crypto strategies at firms including Fidelity and Global X.

The Fidelity Crypto Industry and Digital Payments ETF (FDIG) earned a third-place finish among the top 12 weekly ETFs. FDIG returned 9.3% in that time, according to data from LOGICLY, charging 39 basis points (bps). FDIG tracks the Fidelity Crypto Industry and Digital Payments Index, including firms tied to crypto, the blockchain, and digital payments. After launching just last year, the strategy has returned 52.7% over the last month and holds $54.8 million in AUM.

Eight total ETFs of the top 12 for the week relate in some way to cryptocurrency and digital assets. Alongside Fidelity’s crypto ETF is the First Trust SkyBridge Crypto Industry & Digital Economy ETF (CRPT), which invests actively. CRPT has returned 67% over the last month and 10.3% for the week for an 85 bps charge. Rounding out the top three is the Global X Blockchain ETF (BKCH), which has returned 9.8% for the week.

Crypto ETFs dominated the weekly return charts but were not the only focus for ETF returns overall. The other trend to dominate the performance charts was gold and silver investing. South Africa benefitted too, likely from the number of gold mines in the country lifting gold ETFs as well. The Franklin FTSE South Africa ETF (FLZA) returned about 9% for the week, with gold companies included in the ETF’s top-weighted firms.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.

For more news, information, and analysis, visit VettaFi | ETF Trends.