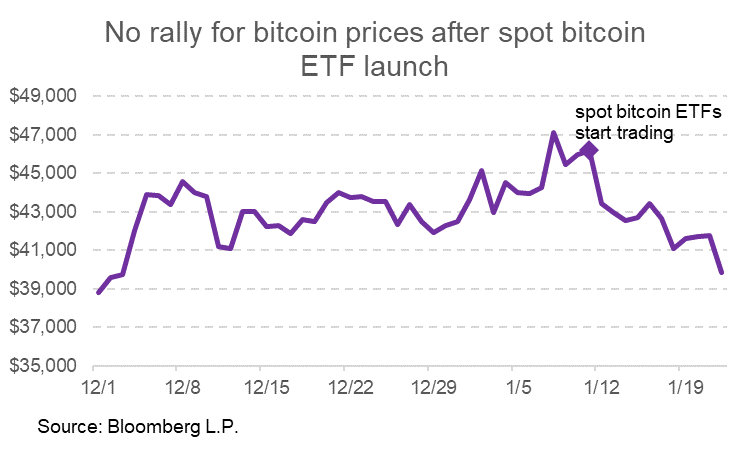

Bitcoin has fallen below $40,000 after rising to just under $50,000 before the spot bitcoin ETF launch. Many investors expected this to be the beginning of a price rally that would be extended later this year through the halving event and take us to prices seen in 2021. With excitement far below expected levels, bitcoin continues to be a divisive topic. But here is why it shouldn’t be.

Bitcoin is divisive because many don’t understand it.

When bitcoin was created in 2009, it was launched in the post-financial crisis era as an alternative to mainstream finance. Combining this asset with a mainstream financial instrument like an ETF has been a challenge. For example, the SEC was reluctant on approval. Then, JP Morgan’s CEO recently released negative comments on the cryptocurrency. Finally, Vanguard refused to let spot bitcoin ETFs trade on their platform.

Possibly one of the biggest barriers is that mainstream financial analysts who are accustomed to analyzing stocks and bonds don’t understand the cryptocurrency. It is more difficult to predict its prices and volumes, but arguably stocks can have and do have all the same risks. While earnings and EBITDA are based on some level of fact, multiples are an art, and stock prices are a best guess. Bitcoin has also been associated with bad actors, but the stock market hasn’t been immune from that issue (e.g., Theranos, Enron, etc.). Still, it has been given a bad reputation when many of the same issues exist for other disruptive technologies.

Its prices are more rational, which also means they are less exciting.

A couple of years ago, we wanted the bitcoin ecosystem to mature and we wanted prices to behave rationally. It was known for its volatility and that’s why it was seen as unfit for many investors. Now that they’re showing some rational behavior, it seems like the hype has died down. And many are no longer interested. After months of anticipation starting with Grayscale’s court win, the ether futures launch, and the SEC X hack, most of the excitement from the spot bitcoin ETF launch was already priced in. I think that explains the lack of price movement. Additionally, investors who had been waiting for prices to recover may have sold their bitcoin holdings on the brief rally near the ETF launch. And lastly, many investors are exiting Grayscale ($4.0 billion of outflows—discussed more below), which has added to that price pressure (another rational event).

Despite bitcoin prices falling, the launch was still significant for both crypto and ETFs.

Despite the lack of price movement, spot bitcoin ETFs were still a milestone in the crypto industry. It helped legitimize it and brought it to the mainstream. It was also a milestone in the ETF industry by setting a precedent similar to the gold ETF launch.

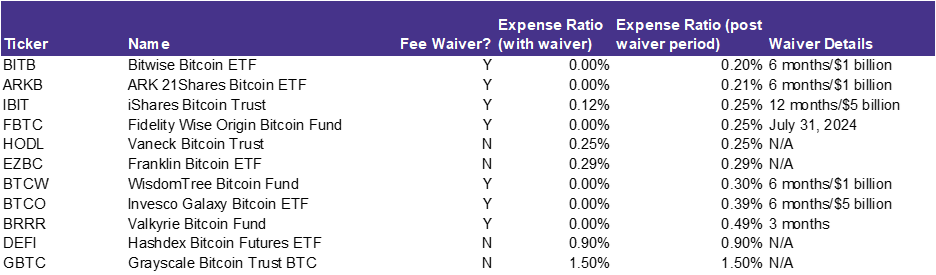

The iShares Bitcoin Trust (IBIT) saw $1.9 billion in flows, while the Fidelity Wise Origin Bitcoin Fund (FBTC) earned a close $1.6 billion. There is a large gap between these products and the Bitwise Bitcoin ETF (BITB) and the ARK 21Shares Bitcoin ETF (ARKB), which have around $500 million in inflows. A fee war drove fees down to 0.0% before launch. In turn, investors turned to big names that can provide the liquidity needed for institutional investors and the name recognition needed for new retail investors who are hesitant about investing in an emerging asset class. Together, the nine new spot bitcoin ETFs had $5.0 billion in net inflows this month. Meanwhile, Grayscale saw $4.0 billion of net outflows ($2.8 billion in the past week).

It seems that Grayscale had somewhat of a first-mover advantage with assets and experience. But its fee stands out sorely among its peers with its 1.5% expense ratio. We have to give Grayscale credit. If it were not for Grayscale’s victory in court over the SEC, spot bitcoin ETFs would probably not have been approved yet. Or maybe even ever. While they were a key player in this fight, investors logically may be moving to cheaper products. Many large institutional investors also exited Grayscale including ARK in December. ARK then invested those assets in their own spot bitcoin ETFs and FTX’s estate.

Bottom Line:

Spot bitcoin ETFs have played a large role in making crypto a more legitimate asset class. Flows ex-GBTC show that investors are interested in these products. But I expect not everyone will be a fan of Bitcoin. And that’s okay.

For more news, information, and analysis, visit the Crypto Channel.