In 2024, inflation, interest rates, and the presidential election will likely be on top of ETF investors’ minds. Here are four other lesser-known trends and insights — both positive and negative — to consider in 2024.

1. Pricing power is needed to withstand short-term periods of weaker demand

It is not necessarily difficult to predict certain demand trends or themes that affect broader sector and industry revenue growth. A larger issue, however, has been balancing realistic and sustainable revenue growth and profitability with analyst and investor expectations. Analysts like to see growth. And higher revenue growth equals higher multiples equals higher stock prices.

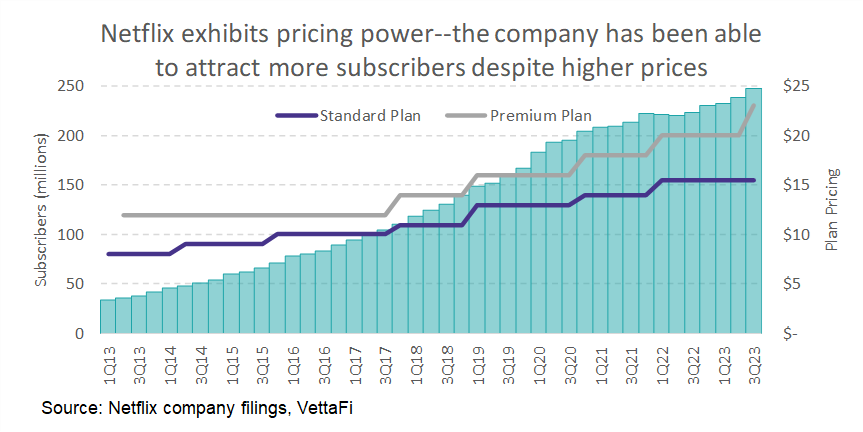

But when companies like Netflix (NFLX) and Tesla (TSLA) already have a large share of their respective markets, that growth rate eventually tapers off even in good markets. From there, they can raise prices — which Netflix has done several times over the past few years — to sustain a high level of revenue growth. This is referred to as pricing power. That means essentially raising prices while maintaining (or growing) demand. Companies with pricing power can increase revenue while demand moderates. They can also increase margins by passing on higher inflationary costs to customers. This becomes more important in our current environment, with higher inflationary costs on top of several years of consistently strong revenue growth.

Looking more broadly than the “Magnificent Seven” stocks, we’ll see companies with stronger pricing power in the consumer discretionary and consumer staples sectors. Companies with stronger pricing power typically sell goods and services that are difficult to replace; for example, staples products such as Coca-Cola (KO) or Costco (COST) or brand name products like Nike (NKE) and LVMH Moet Hennessy (MC FP) on the discretionary side.

These companies typically exhibit higher growth and stronger quality characteristics. And can withstand fluctuations in demand. ETFs that could benefit from this include consumer staples ETFs like the Consumer Staples Select Sector SPDR Fund (XLP) and luxury goods ETFs like the Tema Luxury ETF (LUX). (Bonus: There is an ETF that captures companies with strong pricing power. It’s the Invesco Bloomberg Pricing Power ETF (POWA).)

2. Labor issues continue to persist but are typically modest from an ETF perspective

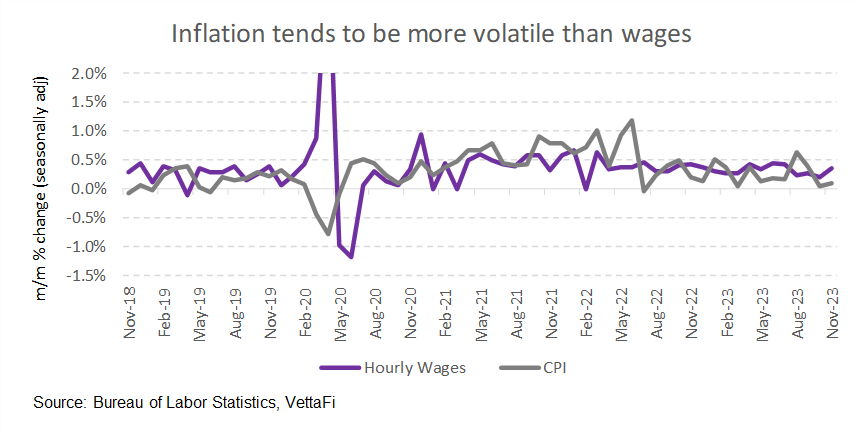

Last year, we saw labor strikes for airline pilots, manufacturers, and package delivery workers. But some of the highest-profile strikes included the auto strike and the Writers Guild of America and SAG-AFTRA strike. Both strikes significantly disrupted their respective industry, resulting in large earnings losses for certain companies. In 2024, labor issues could persist as inflation continues to push higher than wage increases. Industries that tend to have unions include manufacturing and service industries. They could see a twofold effect: lower revenues from supply disruptions and increased costs from higher employee wages.

The good news is that these effects are usually modest across ETFs. That’s because not all companies within an industry are unionized, and competitors may become more attractive. For example, last year, Ford Motor Co (F), General Motors (GM), and Stellantis (STLA) workers went on strike. But other automotive manufacturers like Honda Motor Co (7267 JP), for example, do not have a unionized labor force in the United States. Leading EV manufacturer Tesla (TSLA) also does not have unionized labor.

Their prices may remain relatively more stable when compared to those companies affected by the auto strike. These companies are also less likely to lose profits from unplanned wage increases. ETFs like the Global X Autonomous & Electric Vehicles ETF (DRIV) benefit from diversification among not only the auto manufacturers but along the value chain (semiconductors, materials, and charging infrastructure). DRIV was up around 24% in 2023, while individual stocks like Ford and GM were up only around 5% and 7%, respectively.

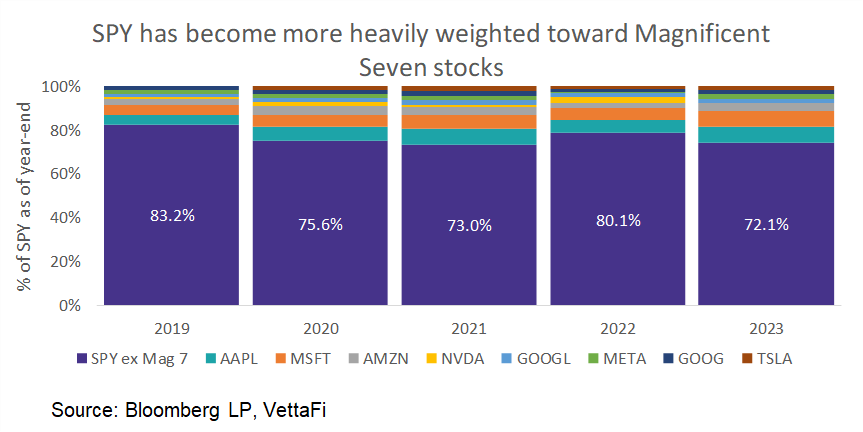

3. Small-caps provide diversification from an overallocation to Magnificent Seven stocks

For many investors, large-cap equities are typically a safer choice — objectively, based on the scale these companies have, and subjectively, based on the name recognition of the stocks/ETFs (particularly Magnificent Seven stocks). The S&P 500 has been up 24% last year. Much of that was driven by stocks like Apple (AAPL), Microsoft (MSFT), Tesla, Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META) and Alphabet (GOOGL/GOOG).

It is likely these stocks will continue to perform well in 2024. But small-cap stocks are currently undervalued and are regaining strength relative to their large-cap peers. The SPDR Portfolio S&P 600 Small Cap ETF (SPSM) was up 15.9% in 4Q23 versus the 11.2% for the SPDR S&P 500 ETF Trust (SPY). This doesn’t mean investors should abandon large-caps. But they should be cautious of overallocation to the same seven stocks. That’s because these stocks often have large allocations in broad domestic equity ETFs, technology industry ETFs, and many thematic ETFs.

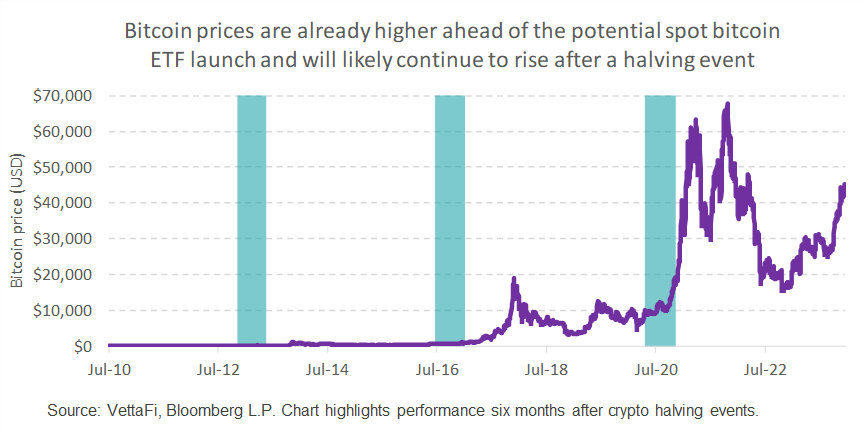

4. There’s more to crypto ETFs than the potential spot bitcoin ETF launch

Bitcoin is starting off strong in 2024, with prices reaching over $45,000 for the first time in almost two years. The rally in 2023 was partly due to a normalization from trough prices from 2022 and also partly due to excitement around crypto ETF launches (e.g., ether future ETFs and pending spot bitcoin ETF launches). The potential spot bitcoin ETF launch in January would not only increase access to different types of investors, but also would legitimize crypto beyond a niche investment idea or an internet craze.

But spot bitcoin ETFs aren’t the end of the road for bitcoin prices. I expect wider acceptance among both institutional and retail investors, which will lead to greater adoption, research, and ultimately a more mature cryptomarket. Additionally, a crypto halving event (which only happens every four years) is also expected around April of this year. A halving event cuts the amount of bitcoin awarded to miners in half, and bitcoin prices tend to move higher after a halving event.

Investors interested in owning crypto equity ETFs may see their prices appreciate along with bitcoin prices after the spot bitcoin ETF launch that is likely to occur next week. These ETFs were already the best-performing ETFs in 2023 out of all equity ETFs. The Valkyrie Bitcoin Miners ETF (WGMI) was up over 300% in 2023, followed closely by several others, including the VanEck Digital Transformation ETF (DAPP) and the Invesco Alerian Galaxy Crypto Economy ETF (SATO). And investors interested in buying a spot bitcoin ETF won’t miss out on all the gains. I expect these prices to drive higher as crypto interest increases in addition to a continued rally in bitcoin prices after the halving event.

VettaFi will be hosting its first Cryptocurrency Symposium webcast on January 12, 2024 at 11 a.m. ET. Click here to register.

For more news, information, and strategy, visit the Crypto Channel.