I’m a big fan of ETF product development, but sometimes the choices can be overwhelming. For example, on our ETF Database platform there are approximately 90 ETFs offering high yield bond exposure. However, as we recently wrote, there are cost and exposure differences between them that impact performance. Last week, nine new ETFs began trading offering direct exposure to spot bitcoin, while one firm turned a pre-existing product into an ETF. This ETF wave is unlike anything I’ve seen in my career.

VettaFi Crypto Symposium Insights

VettaFi hosted a timely virtual event last Friday. The Crypto Symposium featured experts from eight bitcoin ETFs. We talked about why this is a massive win for the advisor community after a multi-year journey. Yet we also covered some of the risks to be aware of when investing.

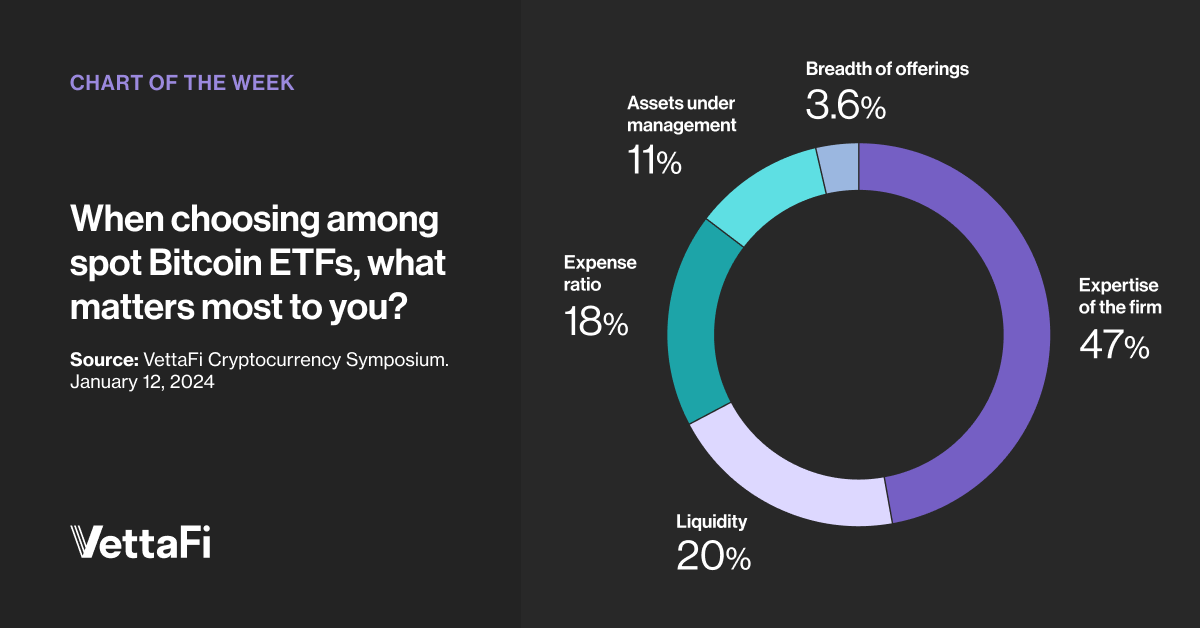

In addition, we heard from advisors and investors. For example, VettaFi asked, “When Choosing Among Spot Bitcoin ETFs, What Matters Most to You?”, The most popular selection by respondents was Expertise of the Firm with 47% of the total. Liquidity (20%) and Expense Ratio (18%) followed, with Assets Under Management (11%) and Breadth of Offerings (3.6%) further behind.

VettaFi has long advocated for ETF due diligence efforts to go beyond simply choosing the ETF with the lowest expense ratio. However, with spot bitcoin ETFs, the focus on exposure is largely irrelevant. The ten ETFs all own bitcoin, though the price they will buy it for daily might differ. We think this is unlikely to be noticeable to most investors.

ETF Fee Battle Started Early

The expense ratio difference will be more eye catching thanks to a pre-emptive fee battle. At present, seven of the ETFs were charging a 0.00% fee for at least the first three months or till the fund hits an assets threshold like $1 billion or $5 billion. Even when the fees are no longer waived, the expense ratios for many will be largely aligned. For example, the Franklin Bitcoin ETF (EZBC), the Bitwise Bitcoin ETF (BITB) and Fidelity Wise Origin Bitwise Fund (FBTC) would charge 0.19%, 0.20%, and 0.25%, respectively.

Meanwhile, the Grayscale Bitcoin Trust ETF (GBTC) had the overwhelming liquidity advantage out of the gate. GBTC was uplisted into an ETF, charging a 1.5% fee, and has $26 billion in assets. The ETF traded $2.3 billion on its first day. This made it the nineth most actively traded ETF in the U.S., regardless of investment style. GBTC had a two cents average bid-ask spread throughout the day. However, GBTC’s peers, led by the iShares Bitcoin Trust (IBIT), collectively traded more than $2 billion the first day according to Bloomberg. Volume for bitcoin ETFs in general remained strong in the subsequent days.

Advisors Told VettaFi They Plan to Add Crypto Exposure

We believe education about cryptocurrency remains paramount, given that access via ETFs is new. During the symposium, we learned that 58% of respondents expect to have between 1%-5% of their average client portfolio invested in crypto within three months. This compares favorably to the-just 34% that had similar low single-digit exposure last week.

Many advisors are looking for expertise to help them talk to clients about bitcoin, understand how to value the asset, and keep up with industry developments. Catching a replay of the VettaFi cryptocurrency symposium is a good start, as is visiting the Crypto Channel on this platform. From there, you can contact experts at the firm you most want to work with. One benefit for advisors coming to the Exchange Conference in February will be the ability to speak to those experts directly!

For more news, information, and analysis, visit the Crypto Channel.