After a year when advisors were relatively cautious about taking on credit risk, sentiment seems to be shifting. In 2023, the most popular fixed income ETF was the iShares 20+ Year Treasury ETF (TLT). TLT, which rose 2.8% thanks to a 13% rally in the fourth quarter, gathered a whopping $25 billion. Meanwhile, the iShares iBoxx $ High Yield Bond ETF (HYG) pulled in $2.6 billion of new money. This is despite HYG posting an impressive 11.5% total return.

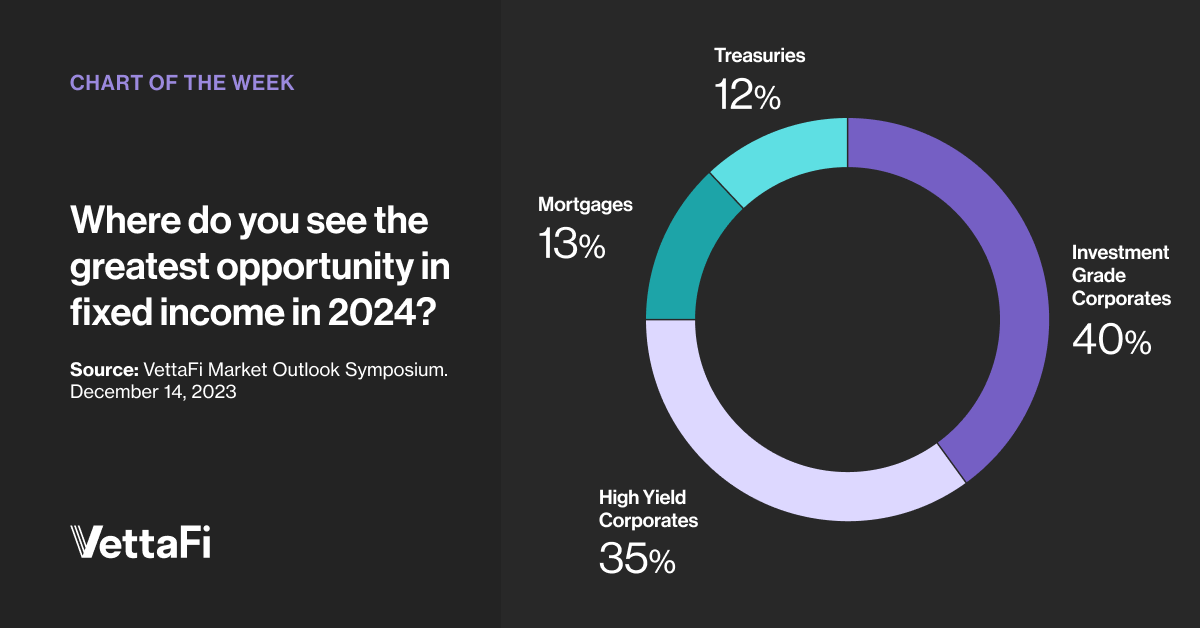

In mid-December, VettaFi hosted a Market Outlook Symposium for advisors in partnership with fixed income focused asset managers like abrdn, Goldman Sachs, F/m Investments, Invesco, and Pimco. During the event, we asked attendees: Where do you see the greatest opportunity in fixed income in 2024?

The most popular choice was investment-grade corporates (40%), but this was closely followed by high yield corporates (35%). Mortgages (13%) and Treasuries (12%) were far less popular. We have asked a version of this question in the past, and investment-grade corporates have remained popular. But this time, high yield seems to be gaining some traction.

Low-Cost, High Yield ETFs to Consider

Recently it has become both cheaper and easier to be more precise in high yield using ETFs. In July 2023, the Schwab High Yield Bond ETF (SCYB) began trading. While the ETF has just $83 million in assets, its minuscule fee of 0.03% makes it likely to garner more attention as it ages. However, it has competition as a low-cost alternative to HYG. Some more established products had fee reductions in recent months.

The SPDR Portfolio High Yield Bond ETF (SPHY) and the Xtrackers USD High Yield Corporate Bond ETF (HYLB) both manage approximately $3.4 billion in assets and now charge a modest 0.05% fee. Despite the similarities, SPHY outperformed HYLB by 79 basis points in 2023. This is due to the unique exposures of these index-based products. In 2023, SPHY pulled in $2.4 billion of new money, while HYLB had net outflows.

The largest of the low-cost high yield ETFs is the iShares Broad USD High Yield Corporate Bond ETF (USHY). The $12 billion fund benefited from $2.1 billion of new money in 2023 and a 12.8% total return. USHY has a 0.08% fee that is notably less expensive than its sibling HYG. However, the cost is not the only thing that makes USHY different. The fund has slightly more CCC-rated and slightly less BB-rated bonds inside as of year-end. We encourage advisors to not select any ETF based solely on its fee.

Managing Credit Risk With ETFs

BondBloxx has a suite of ETFs for advisors wanting to target their client’s credit risk. For example, there is the BondBloxx BB-Rated USD High Yield Corporate Bond ETF (XBB). This fund could be paired with one of the above low cost ETFs to reduce the credit risk taken. Most broad high yield ETFs have less than 50% of assets in BB bonds.

The firm also offers sector-specific high yield ETFs focused on energy, financials, REITs, and industrials, to name a few. In September 2023, the BondBloxx USD High Yield Bond Sector Rotation ETF (HYSA) launched. The ETF, subadvised by Macquarie Asset Management, uses these ETFs in an effort to outperform index-based approaches like HYG.

For more news, information, and strategy, visit the Institutional Income Strategies Channel.