Ethereum could be eyeing the $5,000 price level as the second-largest cryptocurrency in terms of market cap continues its hot streak that began in October.

So far this year, ethereum is up over 500%, which is over 400% more than bitcoin. This comes after bitcoin drew its all-time high in October following the introduction of a U.S. bitcoin futures ETF.

“Ether has been the only coin to consistently note an increase throughout October, including during the last week when most of the altcoins besides Bitcoin consolidated,” an AMB Crypto article says. “As a result, on 29 October it finally breached the $4200 resistance and marked a new all-time high.”

“Further, on 2 November, it rose again by 6.28% and marked another all-time high of $4595,” the article adds. “Registering two all-time highs in a single week is not common for Ethereum or any other top coin.”

Ethereum’s strong performance continues to spark speculation on whether an ethereum-based ETF could also hit the U.S. markets. Canada already has ethereum ETFs, such as the CI Galaxy Ethereum ETF (ETHX), which has been a beneficiary of ether’s bull run.

“Crypto’s becoming an asset class, not just an asset,” says Galaxy global asset management head Steve Kurz. “From a market infrastructure and development of the asset class perspective, Ether is picking up steam, probably the way Bitcoin did a year-and-a-half ago.”

A Diversified Crypto Option

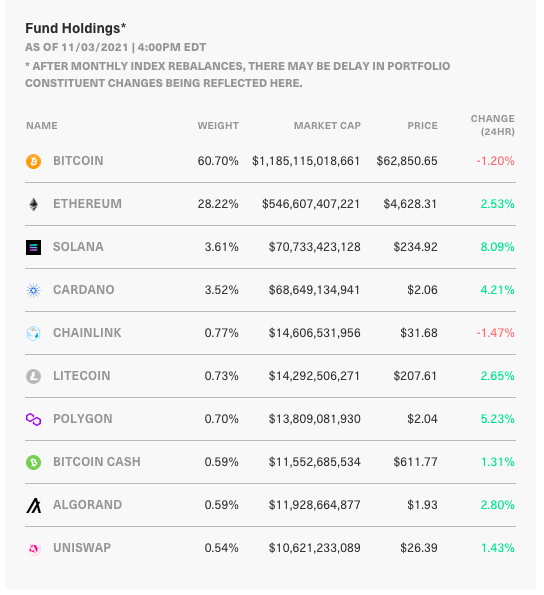

As ether, bitcoin, and alt coins continue to rally, investors can get diversified exposure with a fund like Bitwise’s Bitwise 10 Crypto Index Fund (BITW). The fund seeks to track an index comprised of the 10 most highly valued cryptocurrencies, screened and monitored for certain risks, weighted by market capitalization, and rebalanced monthly.

The fund provides the security and simplicity of a traditional investment vehicle, with shares tradable in brokerage accounts using ticker “BITW.” Features of the fund mentioned on its website include the following:

- Diversification: A rules-based methodology provides unbiased exposure to the cryptoasset markets. The index is reconstituted monthly to quickly reflect market changes in this fast-moving asset class.

- Methodology: BITW provides investors with a one-stop solution for gaining exposure to approximately 70% of the crypto market. Different cryptoassets target different markets and have historically provided different returns.

- Security: Custody is a critical component of cryptoasset management. The fund’s assets are held securely with one of the world’s leading cryptoasset custodians, and Bitwise continuously evaluates security developments to stay up-to-date with industry best practices.

For more news, information, and strategy, visit the Crypto Channel.