Key Takeaways:

-

Multiple ways to access digital assets. As the space has grown, investors now have more ways to access digital assets.

-

ETFs provide an efficient way to invest. ETFs can provide investors with exposure to different aspects of the digital asset ecosystem, all through well-known vehicles that are efficient to own and trade.

- New ETFs available. We have launched two new digital assets ETFs in partnership with Galaxy Fund Management and Alerian.

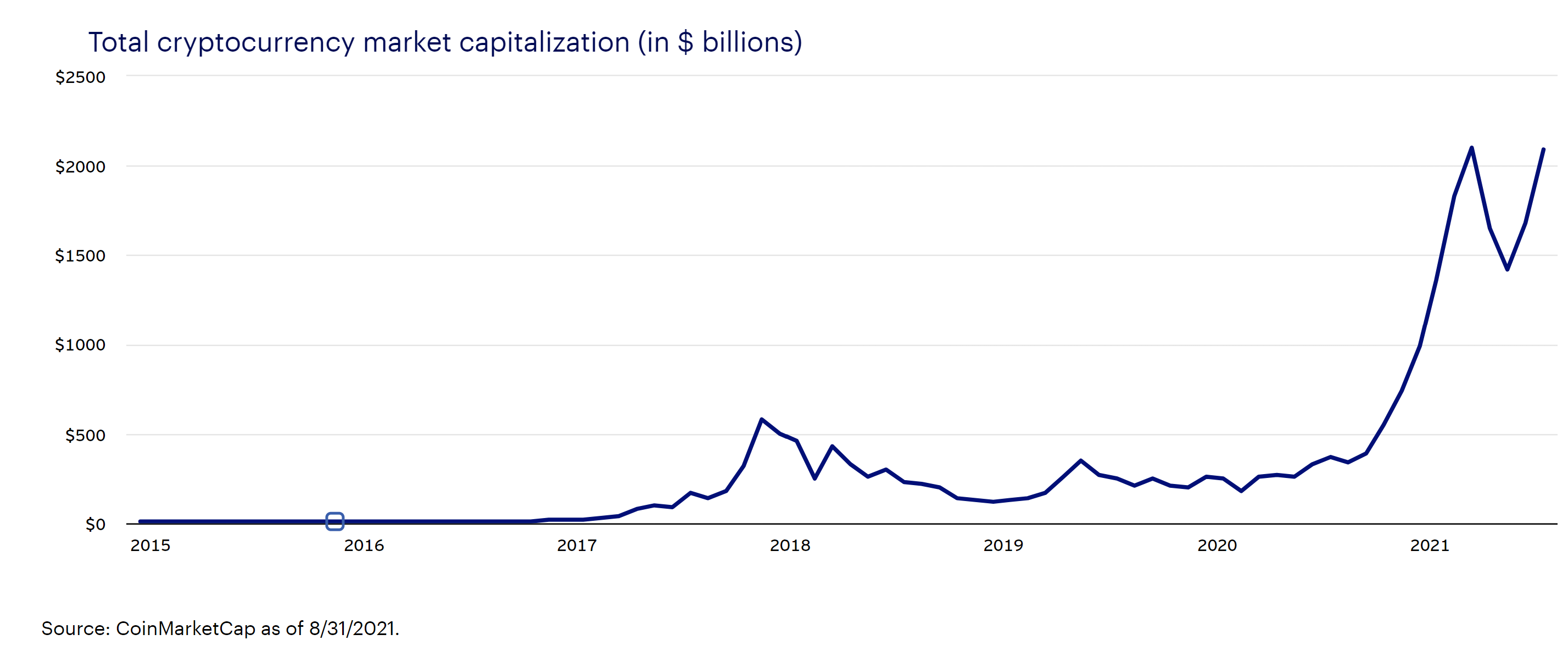

Headlined by cryptocurrencies (e.g. Bitcoin) and blockchain, digital assets are quickly becoming a major investable asset class. Cryptocurrencies alone have a collective market capitalization of $2.1 trillion—nearly equal to the amount of all U.S. dollars in circulation.1

So, it’s not surprising that many investors are exploring the value that digital assets may add to their portfolios. The idea of choosing from an ever-growing list of cryptocurrencies and navigating the potential risks associated with them may seem daunting. But the ways investors can access digital assets are expanding rapidly, and Invesco is at the forefront of this effort with the launch of our new Digital Asset ETFs, seeking to make it easier for investors to access this growing space.

Are you considering adding digital assets exposure to your portfolio? Keep exploring to learn about:

Investing in digital assets: Three key questions to guide your journey

Here are three of the most common questions we hear investors asking as they begin exploring digital assets:

1. Why are people interested in adding digital assets to their portfolios?

Potential opportunity: In addition to being a large, growing asset class, digital assets are a transformative force shaping economic activity. Well-known companies, such as Tesla and PayPal2, and governments throughout the world continue to explore the benefits of leveraging cryptocurrencies and blockchain technology to improve their operations. That’s one important way many investors believe that digital assets can play a role in diversified portfolios as adoption may grow. In fact, 90% of institutional investors surveyed recently believe that their own portfolios or their clients’ portfolios would include digital assets in the next five years, according to Fidelity.3

Cryptocurrencies have grown exponentially over the past five years

Potential hedge against inflation: Growing threats of inflation and market volatility could cause this interest to increase too. Many investors are attracted to Bitcoin, for example, because that cryptocurrency has a finite supply; only 21 million coins can ever be mined—governments can’t just print more of it, like they can with fiat currency. Because of this, digital assets with a finite supply in circulation may have the potential to hedge a portfolio against inflation, potentially like gold. Other cryptocurrencies on the other hand, such as Ethereum and Tether, have an uncapped supply, which may not be a potential hedge against inflation. It’s important for investors to understand the individual digital assets and do proper research before investing.

Potential diversification: Some people view digital assets as valuable sources of diversification. Since 2011, Bitcoin has exhibited low monthly correlations with other asset classes.4 We caution, however, against drawing firm conclusions based on the historical data of such a young, rapidly growing asset class.

2. Why are some investors hesitant to invest in digital assets?

Cryptocurrencies seem to make headlines nearly every day—both for positive and negative news. The volatile prices of Bitcoin and other digital coins often reflect the unpredictability of the asset class’s fast-evolving news cycles. Other common pitfalls of investing in cryptocurrency include forgotten passwords to digital asset accounts, lost wallets where digital assets are stored and expensive transactions of digital assets.

While these are certainly valid concerns, there are ways investors can better understand their options. As with any emerging asset class, researching the available options as well as the market and regulatory dynamics is critical to understanding the risks and potential upside of digital assets. Ways to invest in digital assets continues to grow, giving investors more choice in determining the right exposure for them. See the next question for ways to invest in digital assets.

3. What are the ways to invest in digital assets?

Targeted exposure through direct investment: Direct ownership of cryptocurrencies through a major crypto exchange

Indirect exposure via derivatives: Access to cryptocurrencies via derivative instruments (e.g. exchange-traded futures)

Broad exposure to the ecosystem: Access to companies that engage in cryptocurrencies and leverage blockchain technology

There are several approaches to add digital asset exposure to a portfolio. The most straightforward way is to simply buy an actual cryptocurrency and hold it as an asset. In addition to direct ownership of cryptocurrencies, investors can also own derivatives, which are financial instruments whose value is based on the price of an underlying cryptocurrency. For example, certain investors can buy futures contracts (a contract to buy the underlying asset at a pre-determined future price but can be traded before the contract ends) on Bitcoin, which gives them exposure to the underlying digital asset without having to physically own it.

Cryptocurrencies themselves, however, represent just one portion of the potential economic value created by digital assets. Investors can also invest in companies that provide technology or tools related to digital assets, as well as companies that could benefit, either directly or indirectly, from blockchain or the shift to decentralized finance. Decentralized finance (also known as DeFi) describes a system in which financial transactions are made directly between buyers and sellers without the need for banks or other centralized financial institutions.

Creating diversified exposure to digital assets and companies involved in that industry may seem challenging. To do this, investors would have to research and own individual stocks of companies that have varying exposure to digital assets, in addition to owning a collection of cryptocurrencies or derivatives. However, that’s where exchange-traded funds (ETFs) come in. ETFs can provide investors exposure to narrow or broad aspects of the digital asset ecosystem, all through well-known vehicles that are efficient to own and trade.

Invesco Digital Asset ETFs: Simplified access to unique opportunities

Blockchain, cryptocurrency and other digital assets have broad implications across the global economy. At Invesco, we believe that investors should have an array of tools to easily access and create a diversified exposure to digital assets—and that’s why we created the Invesco Digital Asset ETFs.

Invesco partnered with Galaxy Fund Management and Alerian to develop these innovative strategies for accessing the transformative, emerging asset class.

Galaxy Fund Management is a leading financial services innovator in the digital asset, cryptocurrency and blockchain technology sectors and provides leading-edge insights into the investible opportunities across the digital asset ecosystem.

Alerian is a pioneering index provider that has built innovative indexes that Invesco Digital Asset ETFs track.

Consider adding digital assets to your portfolio

Whether you’re looking for investment opportunities related to cryptocurrencies or exposure to the broader blockchain ecosystem, Invesco now offers ETFs that can give you simplified access and diversified exposure to digital assets in one fund.

| Invesco Alerian Galaxy Crypto Economy ETF (ticker: SATO) | Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (ticker: BLKC) |

|---|---|

| Targets key segments of the crypto economy—miners, enabling technologies, buyers and crypto trusts and exchange traded products (ETPs) | Access to the same key segments as the Invesco Alerian Galaxy Crypto Economy ETF (SATO), but adds exposure to companies that use blockchain technology. |

Footnotes

- Bloomberg and CoinMarketCap.com, as of 1 September 2021.

- As of list date of BLKC (10/7/2021), the weight to Tesla and PayPal is expected to be at or around 1.7% and 1.5%, respectively. As of list date of SATO (10/7/2021), the weight to Tesla and PayPal is expected to be at or around 1.4% and 1.2%, respectively. Source: Invesco as of 9/30/21, based on most recent underlying index data. Underlying indexes rebalance monthly.

- Fidelity Digital Assets, July 2021.

- Bloomberg and Invesco, as of 31 August 2021.

Originally published by Invesco on October 7, 2021.

For more news, information, and strategy, visit the Crypto Channel.