2023 was a year of surprises. These are five key sector themes illustrated in charts that dominated the ETF world this past year.

1. Consumer Discretionary Sector Stronger for Longer Than Expected

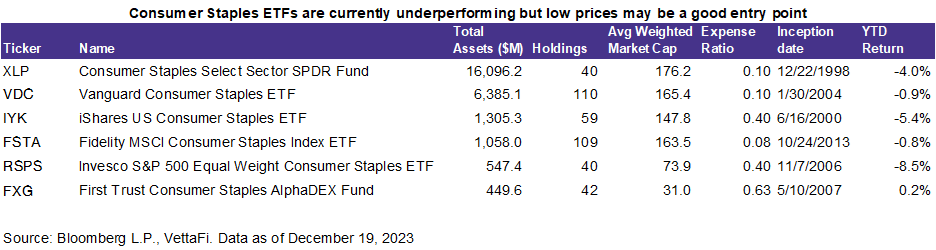

Consumer strength has been one of the most interesting stories since the start of the pandemic. When the consumer started losing steam, that translated into weakness in certain discretionary stocks like clothing and retail goods. But the consumer discretionary sector is broad. Overall high performance persisted due to spending on discretionary services. To maintain a high level of spending on services, consumers will likely continue to pull back on discretionary goods, while looking for discounts in consumer staples. Staples are typically more stable when the economy is weak; however, prices have stayed relatively lower than expected.

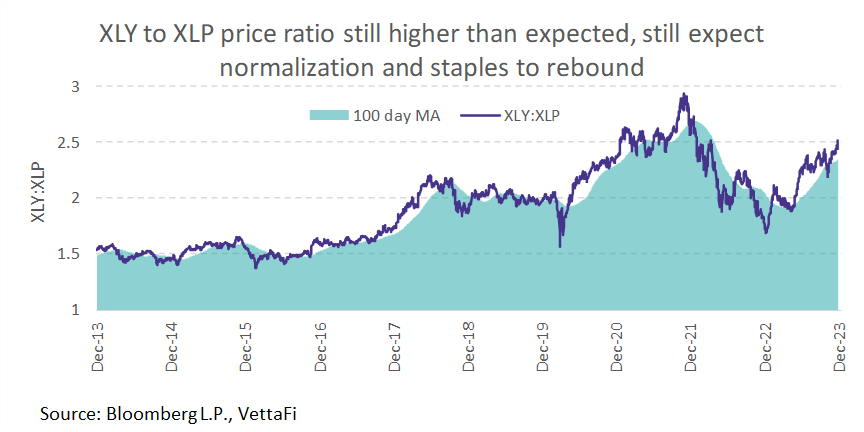

The chart above shows a ratio of the price of the consumer discretionary sector to the price of the consumer staples sector. This ratio tends to be higher when consumers are more confident. But because of the current economic environment and lower prices in consumer staples ETFs, the consumer staples sector could be undervalued compared to the consumer discretionary sector. The consumer staples sector could see some price normalization as consumers change their spending habit and investors grow more defensive. This means sector ETFs like the Consumer Staples Select Sector SPDR Fund (XLP), Vanguard Consumer Staples ETF (VDC), and iShares US Consumer Staples ETF (IYK) (along with other ETFs listed below) may show strength as the discretionary sector falls.

2. E-commerce Grows Its Market Share Even When Total Retail Sales Pulls Back

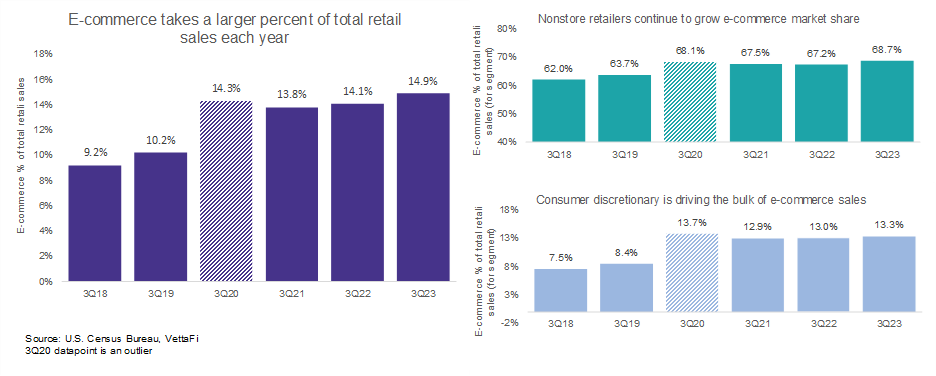

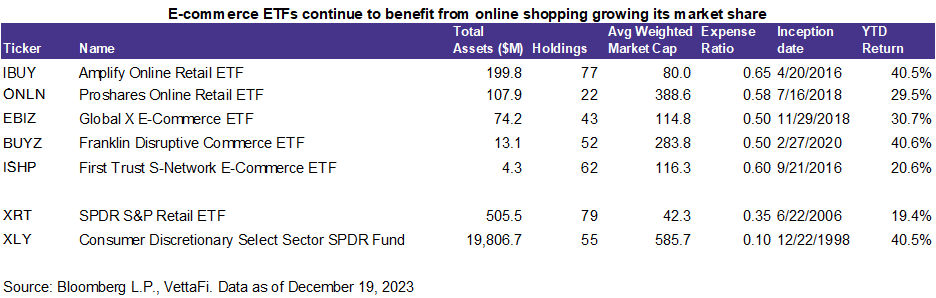

In the long term, I believe e-commerce is a further evolution of retail. It should be able to withstand market downturns as it takes share from traditional retail. Although e-commerce has been gaining share for several years (far before the pandemic occurred and independent of the current market environment due to increasing access to technology and a higher proportion of remote work), I believe market share will continue to grow as consumers look for ways to cut back on discretionary spending.

Online retail ETFs shown below like Amplify Online Retail ETF (IBUY), ProShares Online Retail ETF (ONLN), Global X E-Commerce ETF (EBIZ), Franklin Disruptive Commerce ETF (BUYZ), and First Trust S-Network E-Commerce ETF (ISHP) may show some weakness along with the broader retail sector. But they may be better able to withstand downturns as online shopping typically remains resilient in times when consumers are spending less.

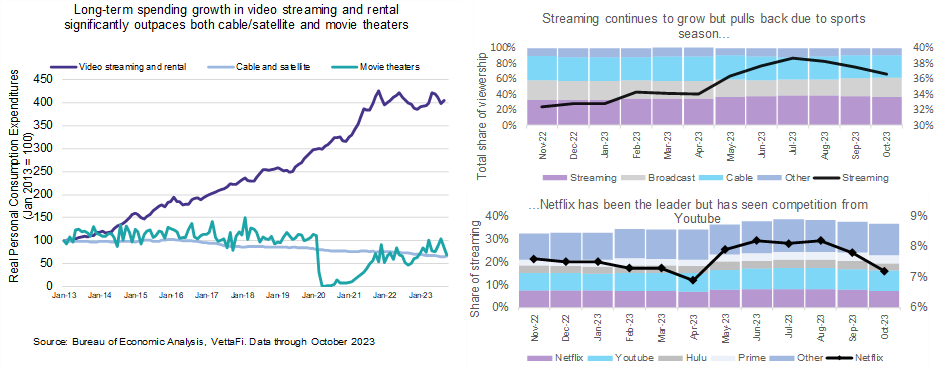

3. Consumers Value Freedom of Choice in Entertainment

Video streaming is a strong example of the consumer shift in media consumption that also applies to other forms of entertainment like audio streaming and online video gaming. Both have also become increasingly popular as consumers focus on less physical goods and opt for entertainment with on-demand, cloud-based storage options that can be enjoyed as a social experience.

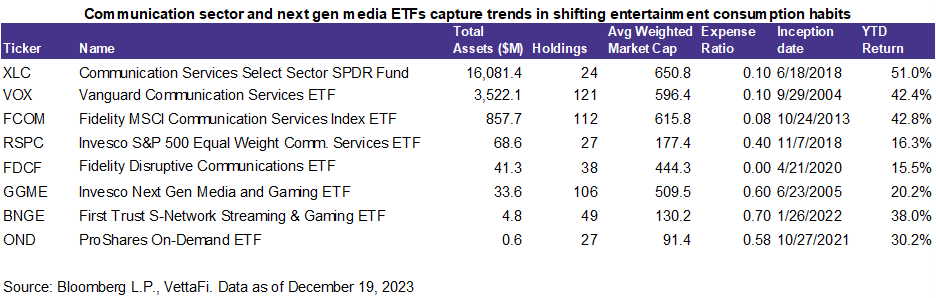

Broader communication ETFs capture this shift. Certain industry/thematic ETFs, which focus on streaming content or next-generation media delivery, better capture this. On a market-cap-weighted basis, the communications sector is currently the best-performing sector out of the Select Sector SPDR Funds (the Communication Services Select Sector SPDR Fund [XLC]) mainly due to large allocations to internet stocks like Meta Platforms (META) and Alphabet Inc. (GOOG/GOOGL). Streaming and media ETFs have had overall weaker performance, but certain ETFs like the First Trust S-Network Streaming & Gaming ETF (BNGE) and the ProShares On-Demand ETF (OND) have outperformed the broader S&P 500 market.

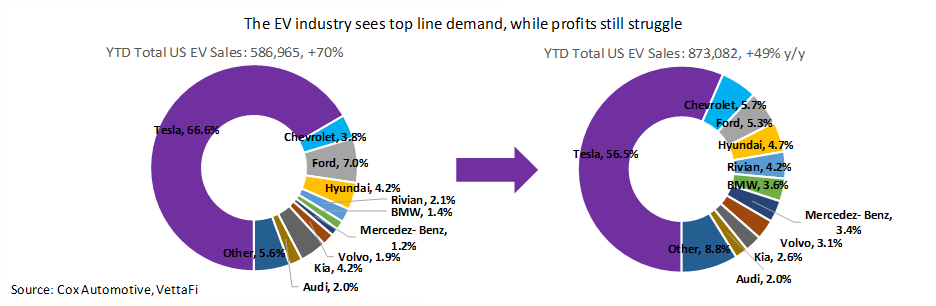

4. EV Transition Is Fragile, But Don’t Forget About Autonomous Technology

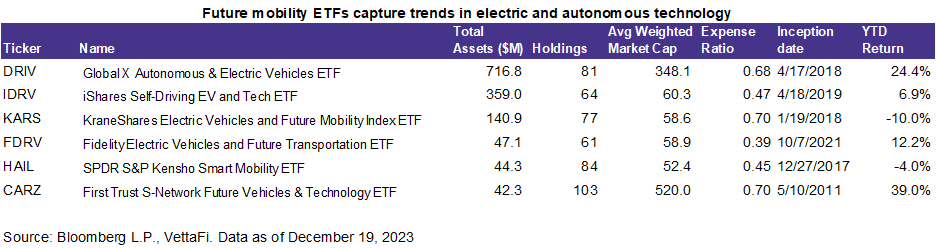

Demand is present, EV sales are growing, pandemic-related production delays are no longer keeping new entrants in their prerevenue phase. But one big issue remains — profitability. Besides Tesla (TSLA), electric vehicles are extremely unprofitable. Why? Several issues — lack of scale, design and engineering costs, and high battery costs. As result, many manufacturers are pulling back on their EV production targets while they wait for production to normalize. This does not mean that electric vehicles will always be unprofitable. It just indicates the EV transition needs to be more thought out. Fortunately, EV sales are only a small portion of auto manufacturers’ operations. And the industry is still growing through autonomous technology.

ETFs like the Global X Autonomous & Electric Vehicles ETF (DRIV), the iShares Self-Driving EV and Tech ETF (IDRV), and others listed below focus on both electric and autonomous technology. That’s in addition to capturing some of the earlier beneficiaries of the EV transition including semiconductors, battery manufacturers, and other EV infrastructure companies.

5. Crypto Is Back!

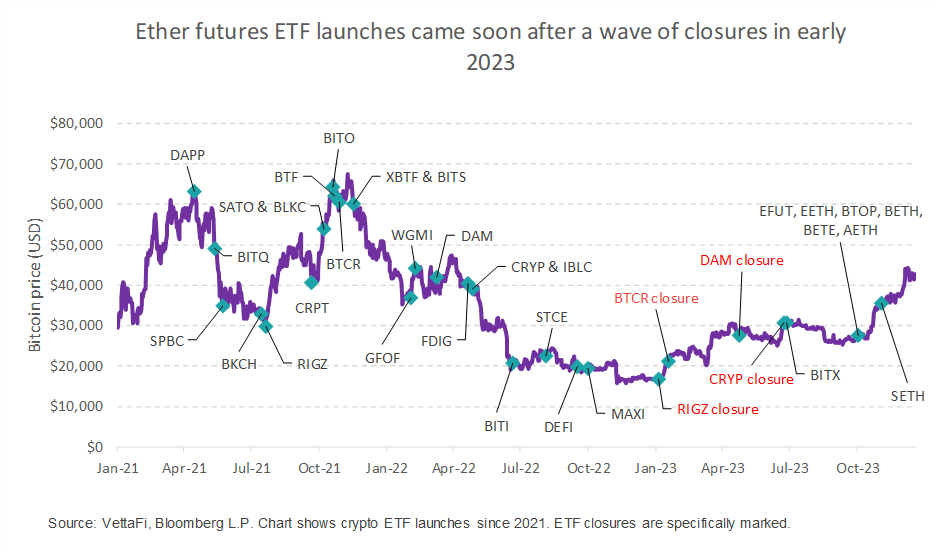

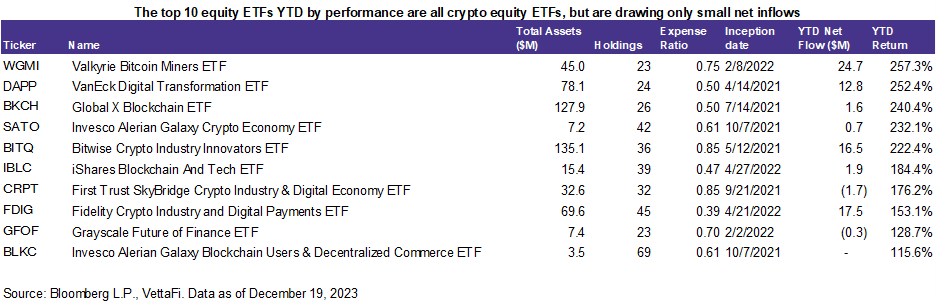

In early 2023, many mainstream investors were not interested in any crypto-related investments. That’s despite crypto and blockchain equity ETFs dominating the top 10 performing sector equity ETFs YTD. Several crypto ETFs were closed during this time, but interest was revitalized after the launch of ether futures ETFs and the (probable) launch of spot bitcoin ETFs in early January 2024. Now that bitcoin prices are hovering above $40,000, investors are eagerly watching for spot bitcoin news. And issuers are all competing for share in the crypto ETF world.

The Valkyrie Bitcoin Miners ETF (WGMI) has been a top performer, returning over 200% YTD. It has been followed closely behind by the VanEck Digital Transformation ETF (DAPP). These ETFs have been performing well since the beginning of the year due to lower prices at the end of 2022, particularly after the FTX fallout. Toward the end of 2023, these ETFs have seen even higher prices due to bitcoin prices rising on positive news from spot bitcoin ETFs.

For more news, information, and strategy, visit the Crypto Channel.