Crude oil futures are gaining on Tuesday as crude pegged an 11-month high as tighter supply and projections for a decline in U.S. inventories offset fears over surging coronavirus cases.

Crude oil climbed to above $53 a barrel on Tuesday, for a gain of 1.63%, as the commodity approached the early March highs of near $57. Meanwhile, Brent crude was 80 cents, or 1.4%, higher at $56.44 a barrel and earlier hit $56.75, its highest level since last February.

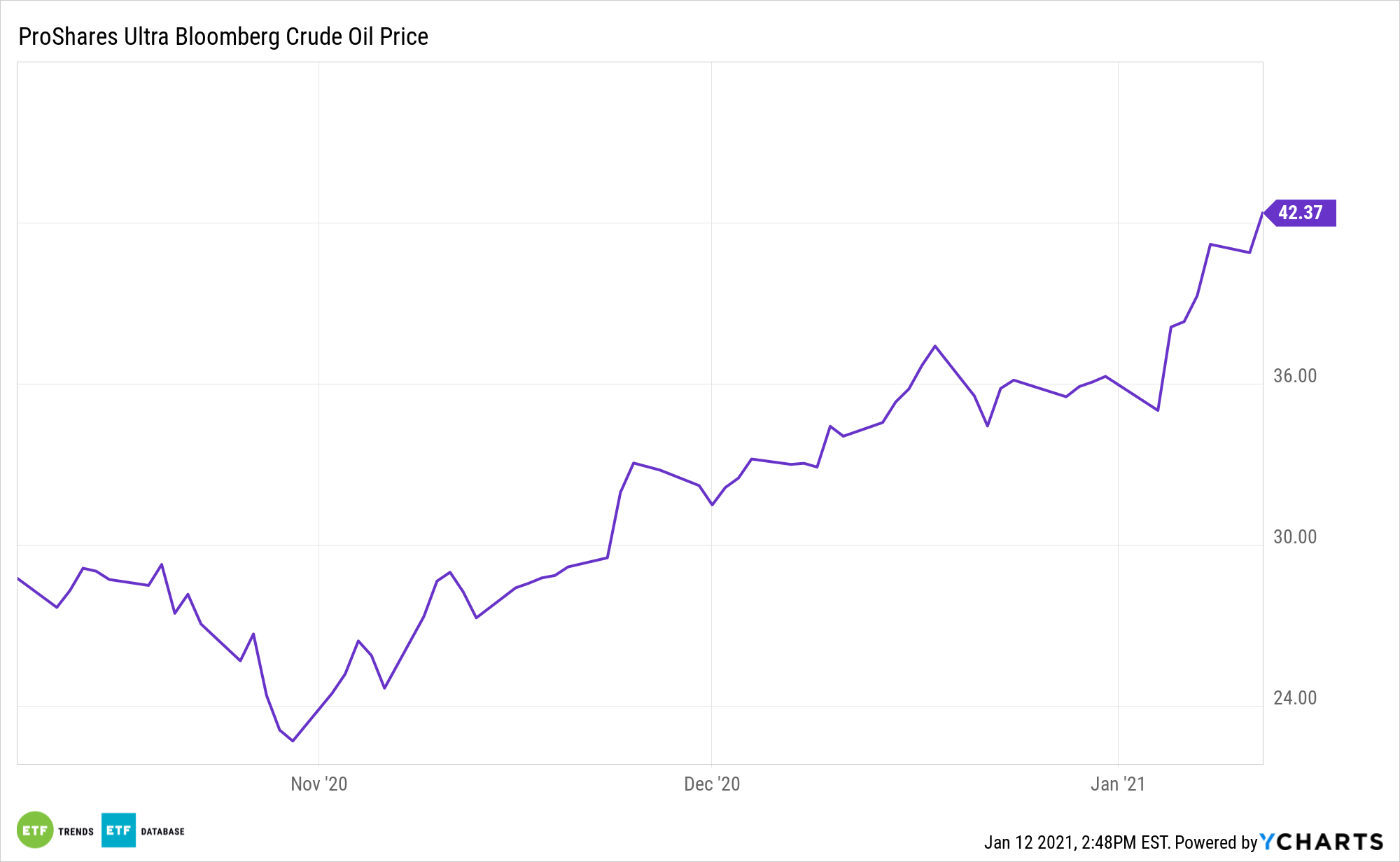

Crude ETFs gained amid the news, with the United States Oil Fund (USO) adding 1.73% and the ProShares Ultra Bloomberg Crude Oil (UCO) gaining more than 3.38%.

Saudi Arabia is set to slash output by an extra 1 million barrels per day (bpd) in February and March to curb inventories. The latest U.S. supply reports are predicted to reveal that crude stocks dropped for more than a month in a row.

“Saudi Arabia in particular is ensuring through its additional voluntary production cuts that the market is undersupplied if anything,” said Eugen Weinberg of Commerzbank.

With record cuts now occurring in crude, now some analysts see further gains as likely, and are warning investors to avoid short significant risk.

“We advise investors with a high risk tolerance to be long Brent or to sell its downside price risks,” said Giovanni Staunovo of UBS in a report on Tuesday.

Analyzing Future Oil Prices

Technical analysts are also suggesting a bullish increase.

“The price of oil may exhibit a bullish trend throughout the first quarter of 2021 as both the 50-Day SMA ($44.77) and 200-Day SMA( $37.43) start to track a positive slope, while the Relative Strength Index (RSI) registers another extreme reading in January to mimic the extreme behavior last seen in 2019,” writes David Song, a strategist from dailyfx.com.

The analyst did warn that a sell could result however, if certain technical conditions are met.

“With that said, the technical outlook for crude remains constructive as the price of oil trades above pre-pandemic, but the RSI may indicate a textbook sell signal over the coming days if the oscillator slips below 70,” Song added.

Crude also rallied on the expectation of a fall in U.S. crude stockpiles. Analysts anticipate that black gold inventories could drop by 2.7 million barrels for a fifth straight week of declines.

For investors looking for crude ETFs to play the run-up in oil, which has been fairly steady since November, the United States 12 Month Oil Fund (USL) and the iPath Pure Beta Crude Oil ETN (OIL) are two funds to consider.

For more market trends, visit ETF Trends.