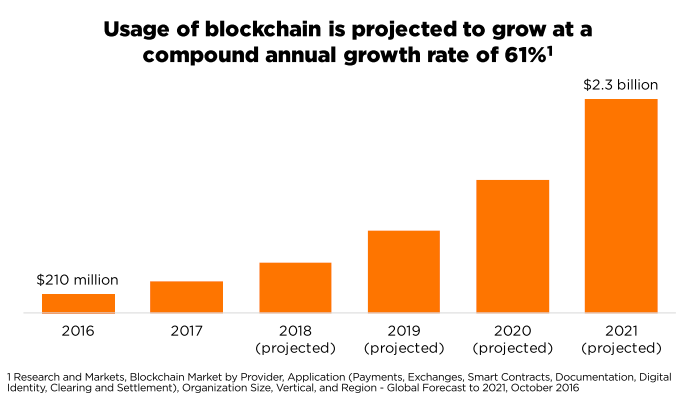

Blockchain is also affecting nearly every sector of the economy. Blockchain is among the latest technologies to carry the banner for disruption and is also an integral subtheme identified by Yewno and Nasdaq in the Nasdaq Yewno Disruptive Technology Benchmark. While many investors may be familiar with the term, very few understand exactly what it is, much less how to invest in it. The first thing that is important to understand is that blockchain is not the same thing as crytocurrency or bitcoin. There’s a lot of confusion out there on this—not only among investors, but across the industry in general. To put it simply, blockchain is the technology on which bitcoin was first developed. Think of it this way: blockchain is to bitcoin what the Internet was to email. When the Internet was first developed, it was an amazing technology, but nobody really understood how to use it. Then email was introduced, and it quickly became the first ‘killer app’ of the Internet. Bitcoin is, in essence, the fist ‘killer app’ of blockchain.

Most of us are just beginning to grasp blockchain’s potential, and its uses are far greater and far wider than anything we can currently imagine. Like the Internet (and robotics and AI) blockchain will impact every sector of the economy and every company—from the largest-cap companies down to the smallest-cap companies, and from the most hi-tech to the most low-tech manufacturing type businesses.

![]()

So if blockchain isn’t bitcoin, what is it?

Blockchain is a global database. But unlike traditional databases, with blockchain, everyone on the planet has a copy of his or her own. So unlike centralized or decentralized database structures, in blockchain, there’s no way to change previous entries in the database. If one person were to alter an entry and take assets from someone else, the change would be evident in every single copy of the ledger. As a result, blockchain is a 100% reliable and distributable ledger of ownership, reflecting all of the owners of all of the different assets along the system at any given point in time. And everyone has access to it, all the time.

Bitcoin represents the money that is traded using blockchain. Bitcoin makes the ideal ‘killer app’ because a distributed ledger makes an awful lot of sense for trading money. For example, two people can never have a physical copy of the exact same dollar bill. But in the case of real estate titles, land records, or items being manufactured and distributed by multiple parties, recording these items on the distributed ledger not only prevents duplication, but it also eliminates the need for a back-office. In the financial services world, blockchain is causing huge disruption by eliminating the need for back-office recordkeeping. Prior to blockchain, a full staff was required to process a single stock transaction. Using blockchain, that transaction is immediate and transparent on the distributed ledger.

In the food industry, IBM worked with Walmart, Nestle and others to apply blockchain to their global supply chain. Today they can know within seconds where a piece of contaminated food was sourced—down to the exact farm and crop—so they can isolate and recall only the affected items. Because they no longer need to take the entire product line off the shelves, they are using blockchain to save billions of dollars. For a company like Walmart that has 1.5% margins, if they can shave off any cost within their supply chain, it is meaningful in regard to their earnings growth.

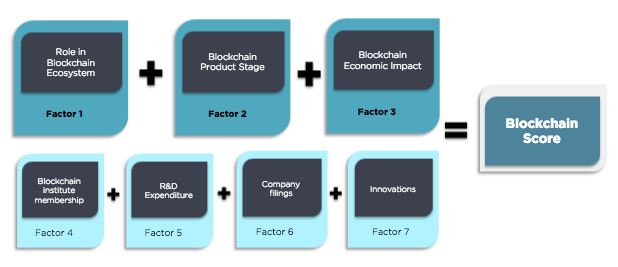

The Reality Shares Nasdaq NexGen Economy ETF helps investors capture the blockchain opportunity. The ETF tracks an index that is created in partnership with Reality Shares and Nasdaq. To start, the index uses the Reality Shares Blockchain Score methodology to identify companies that are most likely to be using blockchain in their businesses to become tomorrow’s disruptors—and to discern between companies who simply talking about blockchain and those who are really driving blockchain innovations. The process begins by evaluating the global universe of every publicly traded company on seven different factors.

The methodology looks at each company’s role in the blockchain ecosystem, stage of product development (are they just contemplating blockchain or actually in market with a revenue-producing item) and, if they are producing revenue with a blockchain solution, what kind of impact they are driving today. For example, IBM has invested heavily to become a major superpower in blockchain, but because of the size of the organization, the amount of blockchain impact required to move IBM’s stock price is huge. The methodology also looks at institute membership, and how much they are spending on R&D. How many filings have they made? How many blockchain patents have they applied for? How many have they received? All of those factors roll up to a score that is used to select the top companies that are added to the Reality Shares NASDAQ Blockchain Economy Index. The index is reevaluated and reallocated every six months.

The result is a well-diversified, global index that leans heavily toward technology, and includes some financials. 39% of holdings are in the US and the rest around the globe—a number that reflects the level of innovation outside our borders right now. Though as we’ve seen with other technologies, blockchain tends to cross these traditional boundaries to increase the potential value of the index for investors. The Reality Shares NASDAQ NexGen Economy ETF (NASDAQ: BLCN) that tracks the index was launched in January 2018.

Technology’s role in the 21st century portfolio

As you reposition your portfolios for the decades to come, there are many strategies to consider. In looking at your options, there is one thing that matters above all: performance. While it’s great to be able to go out to a client and talk about new, interesting stories, ultimately we are in a dollars and cents industry. So when you have a good story to tell and outstanding performance, you’ve found a homerun. Today, that homerun is emerging technologies.

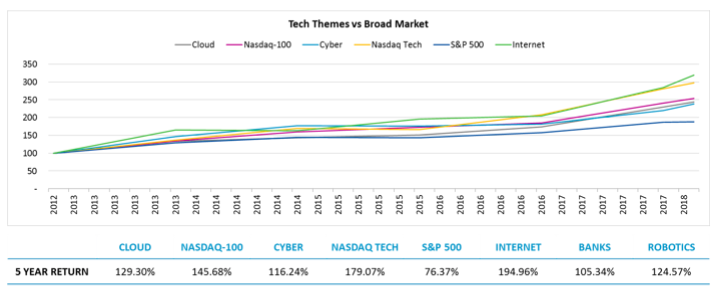

The following chart compares emerging technology themes with the broad market over the past five years. As you can see, technology is leading the way from a returns perspective:

Technology stocks are today’s modern day industrials. Looking at the data, it’s clear that technology stocks have moved well beyond ‘hype’ to become the new benchmark for growth. One hundred years ago, the market leaders were GE, Chicago Gas Company, American Sugar Company, and railroads. Today, the leaders are Amazon, Microsoft, Intel, Apple, Facebook, Alphabet, Tesla, and Starbucks. These are the names that are driving the economy forward on a daily basis and the aforementioned disruptive companies in addition to many others are all a part of the Nasdaq-100, an index comprised of the 100 largest non-financial companies listed on Nasdaq.

What does that mean from a performance perspective?

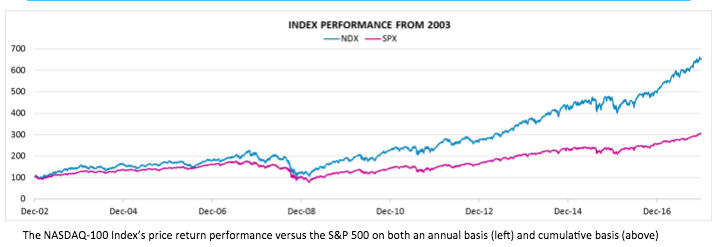

The Nasdaq-100’s phenomenal returns tell the story. The index has been marked by both the growth and maturation of the companies within it. In the years following the financial crisis, P/E has stabilized, and increases in market cap and earnings have been substantial, growing from $3.1T in 2012 to $6.5T in 2017 and $137B to $204B, respectively. When you compare the performance of the index since 2003, what you see is massive outperformance compared to the S&P 500:

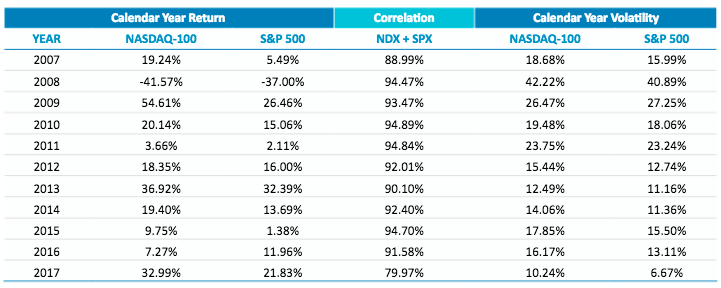

Even more, this performance was achieved without taking on excess risk. The volatility realized by the index during the intense growth period of 2013-2016 is right in line with the broad market. Note, also that during this period of outperformance, yield was also rising. The index’s ability to increase dividends in conjunction with very strong returns, and to continue to do that year over year, has resulted in a consistently increasing yield. The result: the Nasdaq-100 has outgained the S&P 500 by 150% cumulatively over the period, with only +1.3% risk—a slight increase that is more than offset by the excess returns that were generated:

Perhaps most impressive is the Nasdaq-100’s returns story. Since 2003, the Index has generated an incredible 2,000% growth in dividends on a cumulative basis since 2003. These dynamics make it a fascinating story for your clients, as well as a bona fide triple threat that includes:

- A strong fundamentals story on earnings,

- Revenue growth that far outpaces the broad market, and

- Dividend returns that outpace any other indices.

Clearly, technology has an important role in the 21st century portfolio. With the Nasdaq-100 leading the way for disruptive technology over the last 30 years since its launch in 1985, there are new and differentiated emerging technology indexes coming to market from Nasdaq that can work well when paired together. These new indexes are available to help investors capture this growth potential immediately. Though beware: because emerging technologies like robotics, AI, and blockchain are demonstrating such significant growth potential, many products that are coming to the market are thematic in name only and don’t really offer diverse exposure compared to the major indices. Nasdaq has attempted to solve that problem with the introduction of the Nasdaq Yewno Disruptive Technology Benchmark and its other assorted thematic indexes such as those mentioned here including the Nasdaq CTA Artificial Intelligence and Robotics Index and RealityShares Nasdaq Blockchain Economy Index. These indexes were designed so investors can operate with a more filled out picture of emerging technology across sectors and market capitalizations. Do your research. Identify products that are supported by methodologies that capture the technology exposure you are seeking. And, most of all, be sure you are taking action now to create a 21st century portfolio that is positioned to take full advantage of the exciting growth ahead in emerging technologies.

Nasdaq® is a registered trademark of Nasdaq, Inc. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED.

© 2018. Nasdaq, Inc. All Rights Reserved.