Everyone knows that middle siblings tend to get overlooked, but is that happening to midcap stocks, too? Large-cap stocks like the past year’s “Magnificent Seven” dominate headlines, while stock pickers and analysts sift through countless small-cap firms to find the next big star. That leaves midcap stocks out in the cold somewhat, missing out on the benefits they offer.

See more: 3 Active ETFs for Midcap Investing’s Moment

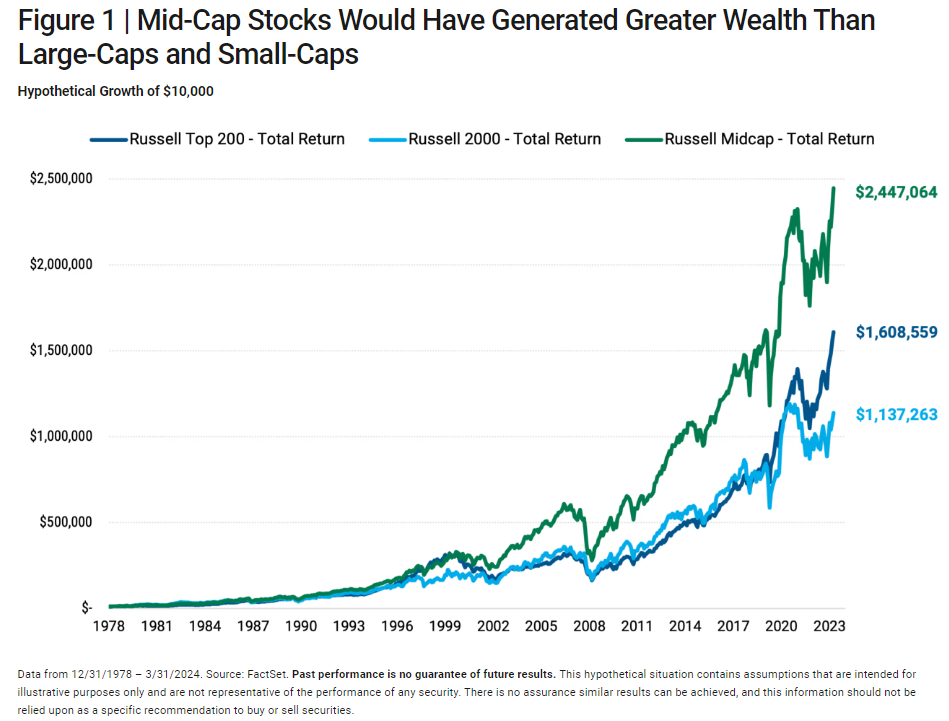

Take this graph from American Century Investments. The Russell Midcap Index, since its 1978 inception, has outperformed both the Russell Top 200 and the Russell 2000. While that doesn’t guarantee future performance, it’s the kind of data that may surprise investors.

American Century Investments graph on midcap stocks performance.

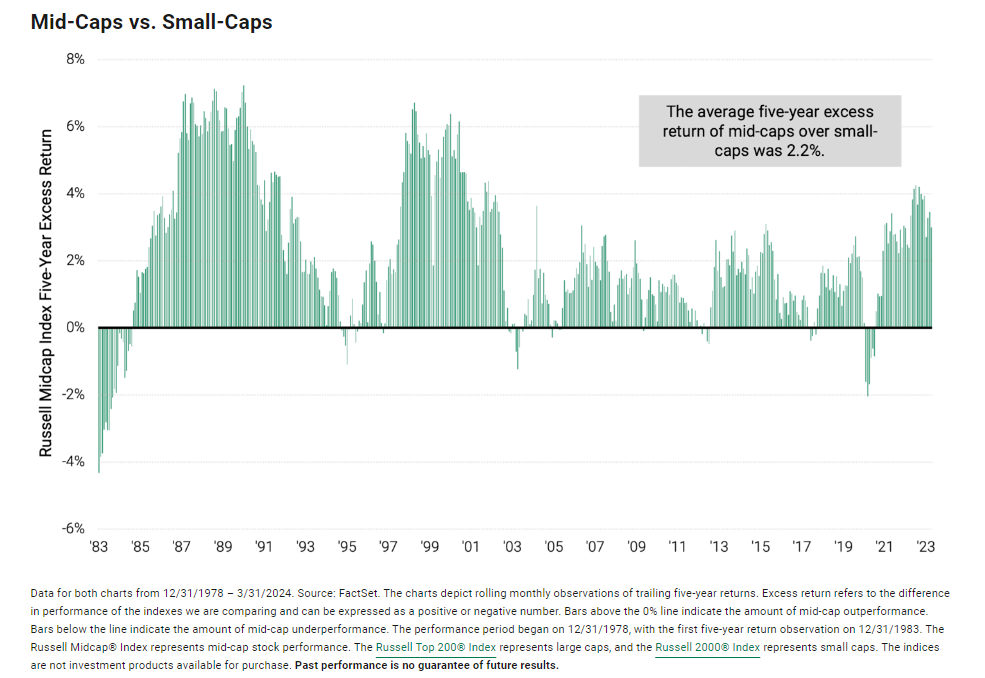

Further data emphasizes that outperformance. Midcap firms have outperformed large-caps in 55% of rolling five-year periods since 1983, while small-cap stocks have trailed midcaps in performance a staggering 89% of the time, as seen in the below graph.

Further American Century Investments graph on midcaps.

Despite those intriguing numbers, investors appear to be missing out on midcaps. While they make up nearly a fourth of domestic equities, midcap stocks constitute just 10% of domestic mutual fund assets, per Morningstar data.

That speaks to the current state of midcap stocks. So why might they appeal moving forward? For one, investors often like to diversify appropriately, and many may lack any midcap exposure. On their own, however, midcap stocks limit the risks seen in small-cap investing while also offering greater flexibility and adaptability than larger, more unwieldly firms.

Those two attributes could boost midcaps significantly this year. On the one hand, 2024 could still see some rate cuts that smart firms could ride to strong performance. On the other, if zero cuts arrive, or if big trends like AI come undone, midcaps may be less vulnerable than small peers.

The Avantis U.S. Mid Cap Value ETF (AVMV) could appeal as a route into the space. The strategy charges just 20 basis points to invest in midcap firms that meet value standards. It has returned 7.6% over the last three months per Avantis Investors data, beating its benchmark.

For more news, information, and strategy, visit the Core Strategies Channel.