Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides to debate controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Nick Peters-Golden debate whether now is the time for value ETFs.

Elle Caruso, staff writer, VettaFi: Hey, Nick. I look forward to discussing value ETFs today. They’ve fallen out of favor recently, but I think investors are seriously overlooking the benefits that value exposure adds to portfolios.

Nick Peters-Golden, staff writer, VettaFi: Listen, I have a ton of respect for value investing. Value has rewarded its investors at certain points in time. The great investing duo of Warren Buffet and Charlie Munger have been celebrated for finding undervalued firms and riding them to great success.

All that being said, now is not the time for value. There are too many reasons for investing in growth.

Value ETFs Are Critical for Diversification

Caruso: Value exposure is a critical component in a well-diversified portfolio. Most investors are overexposed to growth stocks — possibly without realizing it.

Flows remain heavily skewed toward tech at the sector level, with the sector seeing over $17.5 billion in inflows over the past year as of February 27, according to Strategas ETF Research. At the same time, all other sector-focused ETFs have net outflows totaling $17.5 billion, underscoring the unbalanced allocation and investors’ overweighting of the tech sector.

Additionally, as the market caps of tech companies continue to swell, broad benchmarks are increasingly adding a growth tilt to portfolios. Even though tech stocks have generated attractive returns recently, investors may be best positioned by maintaining an all-weather portfolio.

Value and growth tend to outperform during different economic environments, so maintaining an allocation to both can create an all-weather portfolio of sorts. History has repeatedly demonstrated that growth will win some years while value will win in others. Investors are typically unable to properly time the market and end up missing out on returns on both sides by trying to tactically move in and out of funds.

Investors can add long-term, cost-efficient exposure to large-cap value stocks with the iShares Russell 1000 Value ETF (IWD) and the Avantis U.S. Large Cap Value ETF (AVLV). Meanwhile, the iShares Russell 2000 Value ETF (IWN) offers exposure to the small-cap segment of the U.S. stock market, respectively.

Munger’s Wisdom

Peters-Golden: The late Charlie Munger, who passed away recently, shared his thoughts on value in the last few months of his life. Despite his great success with a value approach, he warned investors looking for deals to “get used to making less.” For someone so closely tied to an investing style, that indicates that something is not working in value land.

Most can agree that the post-Global Financial Crisis rate regime was an aberration. One would then look for the distortions that those rates left behind. Part of why they haven’t been as obvious could be due to the pandemic resetting the economy to some degree. Public spending may have helped the economy not fall out completely, it should be said.

Has that spending created its own distortions, however? It’s hard to say. The most obvious area that seems to be way ahead of its skis would be tech. However, it shows no sign of slowing down thanks to AI showing up. Many AI funds have had to stick with big tech names to keep up.

Those value ETFs that are sticking to their guns hold health and retail names, but even a strategy like the American Century U.S. Quality Value ETF (VALQ) still holds Apple (AAPL) in its top six weights per VettaFi data.

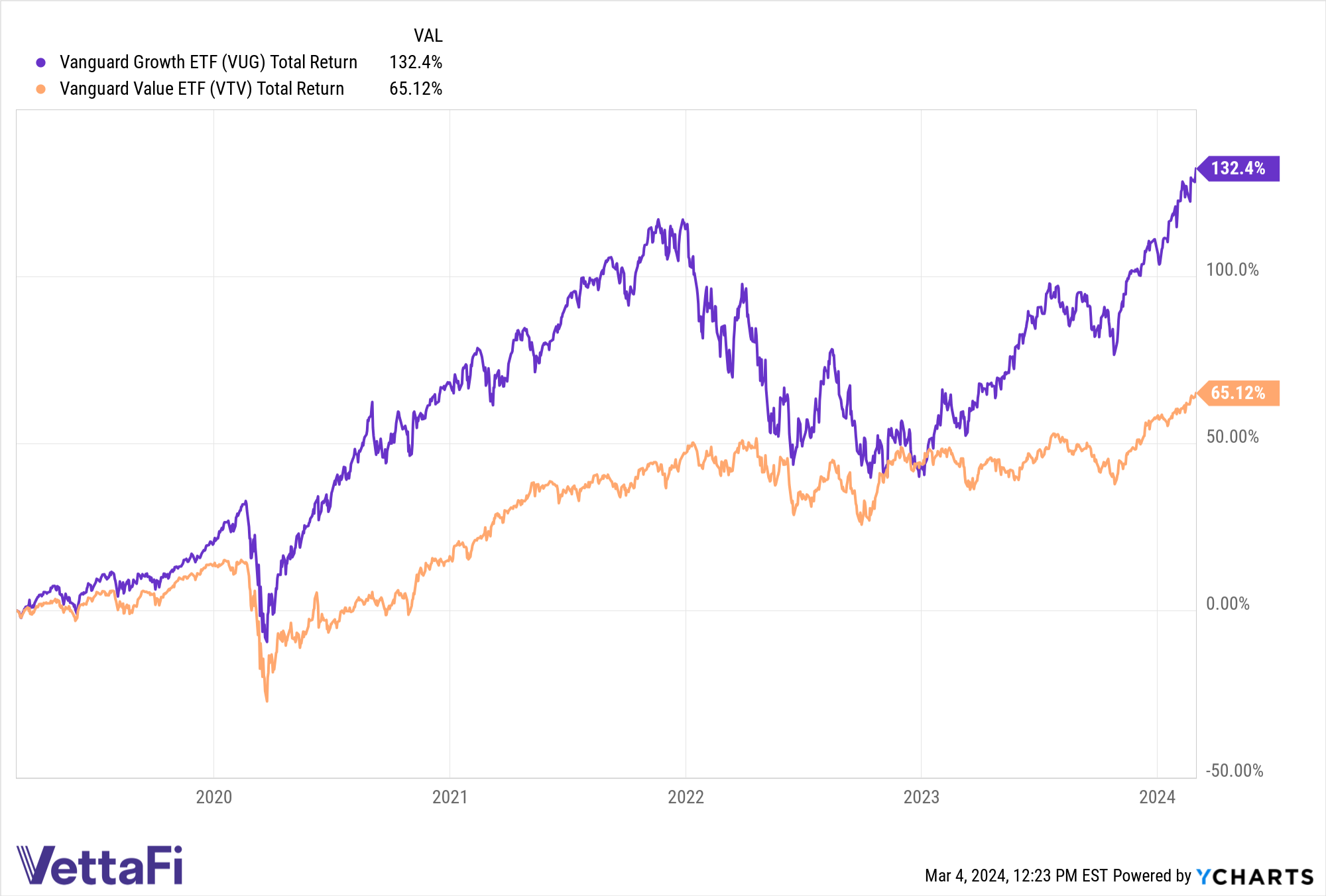

Taken together, if we look over the last five years at two pretty popular and straightforward growth and value representatives, the return gap is stark. This graph from YCharts doesn’t say it all, but it says a lot:

VUG has outperformed VTV.

Value may have had some brief windows where it has perhaps closed the gap on growth, but overall, growth remains the big brother here – at least between the Vanguard Growth ETF (VUG) and the Vanguard Value ETF (VTV).

Use Value ETFs to Position Defensively but Stay Invested

Caruso: In contrast to my prior point about the average investors being more heavily allocated to growth stocks than they realize, a lot of investors still have cash on the sidelines due to market uncertainty. High quality value ETFs can be a way for investors to participate in the market rally with less equity risk.

A defensive value ETF like the Hartford Multifactor US Equity ETF (ROUS) may be the right move in the current environment. ROUS allows investors to participate in the U.S. equity market, maintaining upside potential, while aiming to limit downside risk. The value ETF can enable investors to maintain target equity exposure more comfortably during choppy markets.

ROUS can do this through its multifactor approach to value investing. The Hartford Funds’ ETF seeks to target desired return-enhancing factors as well as to reduce exposure to unrewarded risk exposures.

To summarize, ROUS seeks to outperform traditional cap-weighted indexes and reduce volatility by 15% over a full market cycle. The multifactor ETF reduces concentration risk at the sector, market cap, and individual holding levels. This is particularly compelling for investors who are wary of getting back into the equity market due to concerns surrounding market uncertainty and volatility.

Value’s Closing Window?

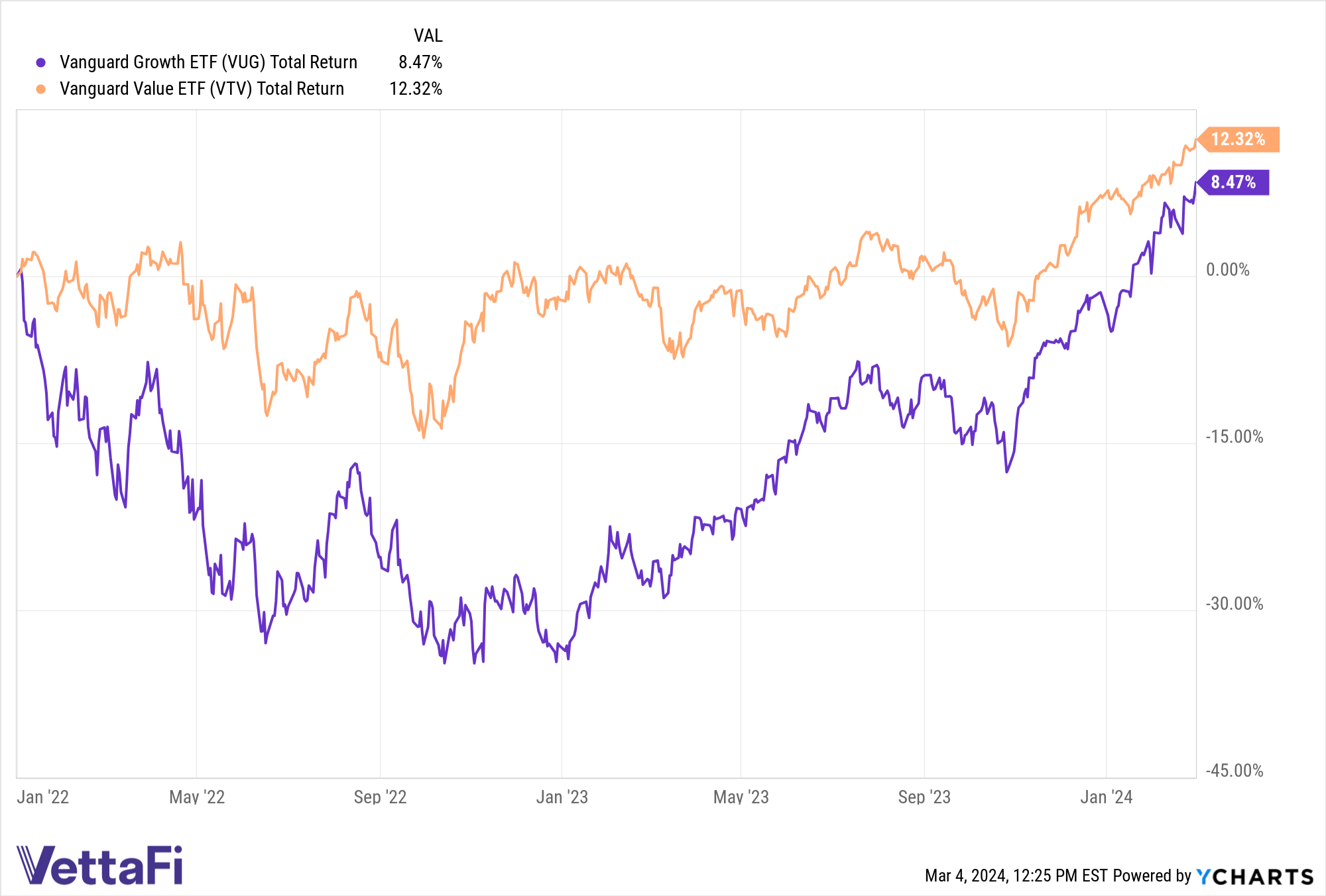

Peters-Golden: Looking back at VUG and VTV again, let’s consider the period when VTV did outperform VUG. Here’s another graph:

The recent period when VTV did outperform VUG.

That window between the start of January 2022 and the writing of this piece lets value show out. Of course, “showing out” in this case meant just about 4% between the two. That’s nothing to sneeze at, but just as quickly as it appeared, it disappeared. Per YCharts, VUG has outperformed VTV by more than 30% over the past year!

Past performance doesn’t indicate future returns, of course. However, one would have wanted more out of value for that window when it “did” do well, at least based on these ETFs. That’s because that moment for value may have passed if, or rather when, the Fed starts cutting rates this year.

Once rates start coming down, whether one likes AI or not, the AI party is going to really kick off. Like when the pizza arrives at a kid’s birthday party, markets may well go wild with the heady combination of AI utopianism and cheaper borrowing.

As I mentioned above, that could create a fever dream-level distortion around AI valuations in tech. That “may” is a load-bearing “may” however, and, for me, growth looks much the stronger bet. Value firms just aren’t positioned as well to benefit from rate-cut froth.

All this to say, value will return. AI, particularly, is promising a lot more than it may be able to deliver with just generative models. For now, however, value doesn’t look set to keep pace with the market.

High Valuations: Is It Time for Value to Shine?

Caruso: Value tends to rotate into favor after periods of ballooning or concerning high valuations. Mega caps are currently reaching record high valuations, suggesting value could outperform soon should valuations or concentration normalize.

Furthermore, large-cap growth performance can be particularly volatile during periods of high valuations. Historically, when investors get nervous about valuations, they tend to flock to companies with high free cash flow yields and low valuations.

Let’s look back at 2022 when U.S. large-cap growth ETFs significantly underperformed the market. During that period, the free cash flow yield segment performed exceptionally well. Large-cap growth ETFs and free cash flow ETFs tend to work in opposite directions, making them an ideal pair, effectively creating an all-weather portfolio.

Free cash flow ETFs to consider include the VictoryShares Free Cash Flow ETF (VFLO) and the Pacer US Cash Cows 100 ETF (COWZ).

Alternatives to Value ETFs

Peters-Golden: I know this is a value discussion, but taking the bear case, I want to offer some alternative options. While the obvious option would be to tout a growth ETF, a simple growth index may not be a great option either for a rate-cut environment this year.

That’s why a quality growth ETF could really appeal. The American Century U.S. Quality Growth ETF (QGRO) stands out here among potential options. QGRO tracks the American Century U.S. Quality Growth Index for a 29 basis point (bps) fee. That index looks for firms with high growth potential but also, crucially, strong fundamentals.

The index screens for stocks based on quality, income, and growth, based on factors like sales, cash flow, and return on assets and equity. The strategy looks to balance its high-growth stocks with a more stable growth firm roster. The latter group actually includes firms with appealing valuations and profitability, giving the ETF an intriguing inherent play on “value.”

The ETF ends up having a pretty mid-cap allocation, offering helpful diversification outside of the world of the so-called “Magnificent Seven.” QGRO has returned 35% over the last 12 months. It outperformed both its ETF Database Category and FactSet Segment averages. Finally, on a five-year basis, it has almost doubled the former average and well outpaced the latter, returning 16.5% in that time.

The old growth/value divide remains a helpful heuristic for investing, but it is not as clear-cut as it seems. Gray areas exist between the two, with all sorts of ETF flavors allowing intriguing ways to spin those ideas. That being said, for me, it’s clear that we’re in a growth moment. Value’s time will come, but the right growth strategy like QGRO can provide plenty of fundamental research to not get too caught up in froth when looking for alpha.

For more news, information, and analysis, visit the Core Strategies Channel.