The past week has been all about economic data and what it means for the Fed’s ongoing campaign to whip inflation — and the numbers haven’t exactly shown the cooling off that the central bank is looking for amid a rapidly dwindling money supply. Jobs numbers are slowing down, yes, but openings are still well above pre-pandemic levels. As such, it may be worth considering how an active inflation equities ETF can navigate stubborn inflation and find sectors that outperform in a hot price environment.

Why active? Active ETFs have had a strong start to the year, and have really begun to come into their own as a part of the ETF landscape. Once relegated in large part to the world of thematics, active strategies that aim to replicate the performance of various indexes have been able to put up strong performances this year, with the added benefit of close attention from their management teams.

See more: “Chart of the Week: Advisors Plan to Use Active ETFs More in 2023”

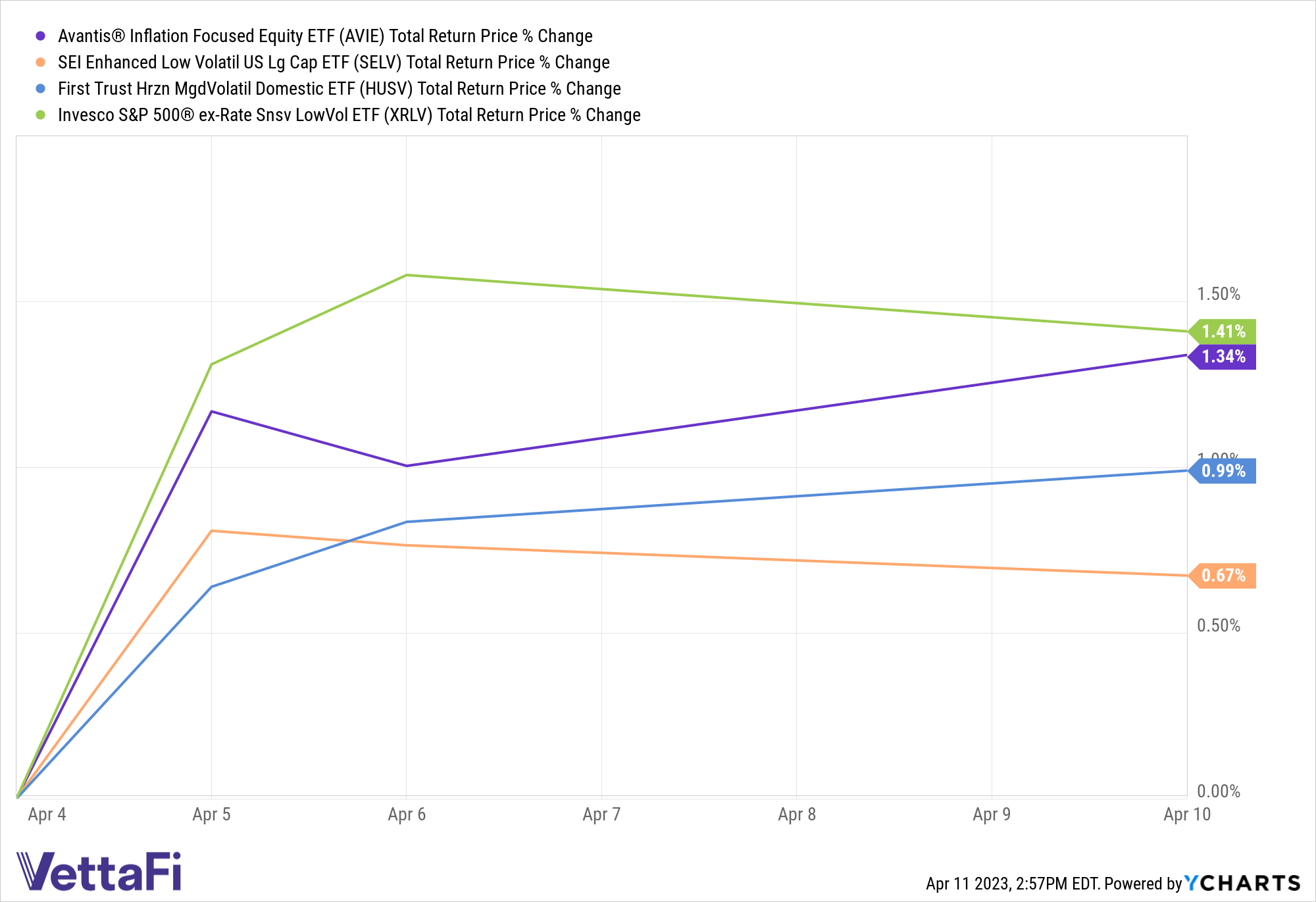

Certain sectors are better equipped for inflationary environments than others, and being able to move between them quickly is another benefit for an active inflation equities ETF like, for example, the Avantis Inflation Focused Equity ETF (AVIE). AVIE has returned 4.7% over the last month, and outperformed some of its competitor strategies over the last five days — with its active approach available for the same 25 basis point fee as some of its indexed peers.

Part of the Avantis brand suite of ETFs from American Century Investments, AVIE focuses on industries and sectors that outperform with a higher inflation rate, including firms of market caps that are evaluated on profitability and metrics like book value, outstanding shares, and cash flow from operations.

With markets seemingly more focused on when the Fed might cut rates this year to respond to a recession than with just how long this inflation fight is set to last, looking out for inflation-related equities may be an idea with some merit. AVIE comes from a family of active ETFs that have done well so far this year, and may be worth watching on its own terms in the weeks and months to come.

For more news, information, and analysis, visit the Core Strategies Channel.