Investors have increasingly moved away from mutual funds and towards ETFs in recent years. ETF investing offers a variety of benefits, whether active or passive. Of course, mutual fund AUM still looms large over ETF AUM, but that may not last forever. That’s because ETFs stand out when compared to the hidden cost of mutual funds.

See more: 9 Views on Adding Current Income in 2024

That cost? Taxes. Mutual funds struggle with how many taxable events they encounter as opposed to ETFs. That cost understood as the tax-cost ratio, can really hurt for the most tax-sensitive investors. Those nearing retirement, for example, need to limit tax burdens frequently.

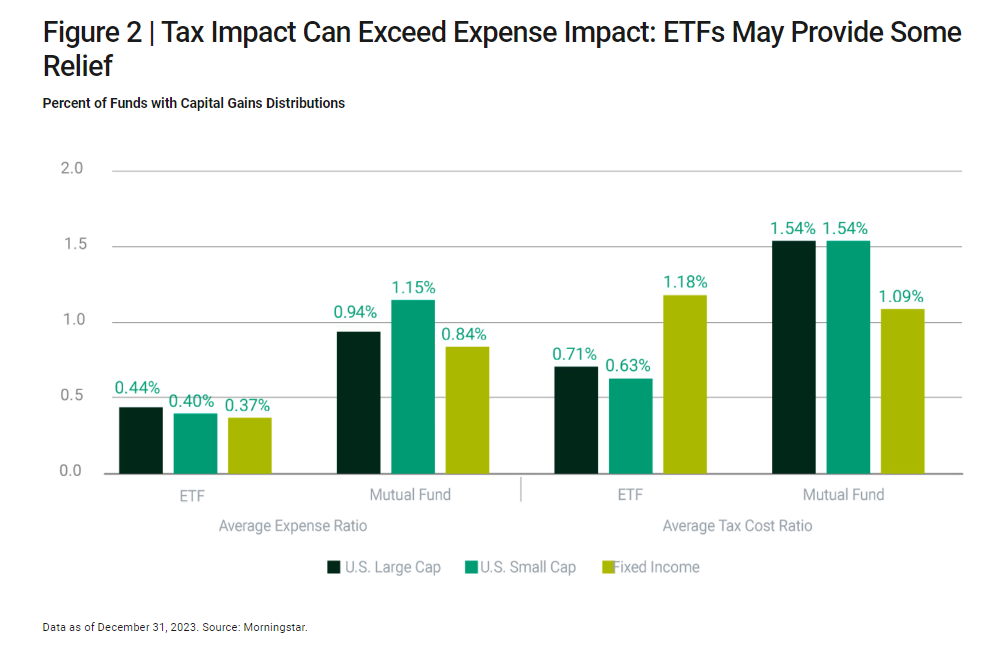

Mutual funds see more distributions than ETFs, which see more money lost to taxes. That hidden cost of mutual funds sees half of all U.S. equity mutual funds distributing capital gains, compared to just 2.5% of ETFs per American Century Investments. That already poses some challenges to investors, but what’s worse is that the average tax cost ratio of a mutual fund often outpaces its average expense ratio.

The cost of mutual funds in taxes vs. expenses, compared to ETFs.

For those investors who aren’t orbiting retirement, tax costs also limit reinvestment. Tax burden derailing that reinvestment can harm dividend strategies and other common investment approaches.

That’s why one strong option for addressing the hidden cost of mutual funds is ETFs. Active ETFs, particularly, offer flexibility, transparency, and tax mitigation.

For example, investors may want to consider a strategy like the American Century Focused Dynamic Growth ETF (FDG). FDG charges 45 basis points (bps) for its approach. It actively invests in large and mid-cap U.S. firms with potentially high profits and growth. The ETF has returned more than 40% over the last one-year period. On a YTD basis, it has returned more than 15%, per American Century Investments data.

FDG presents one strong option for mitigating tax issues. For investors concerned by taxable distributions, FDG and other ETFs may appeal.

For more news, information, and analysis, visit the Core Strategies Channel.