“We try and look at the whole asset class from a more strategic standpoint,” said Kiang. “There’s reasons to own commodities in a diversified portfolio.”

With U.S. equities being the prime focus during the extended bull run of 2018, Kiang could foresee a scenario where commodities gain the recognition it deserves from investors in 2019. At the current

“Commodities as an asset class is probably one of the most underbought asset classes,” said Kiang.

Alternative Safe Haven to Bonds

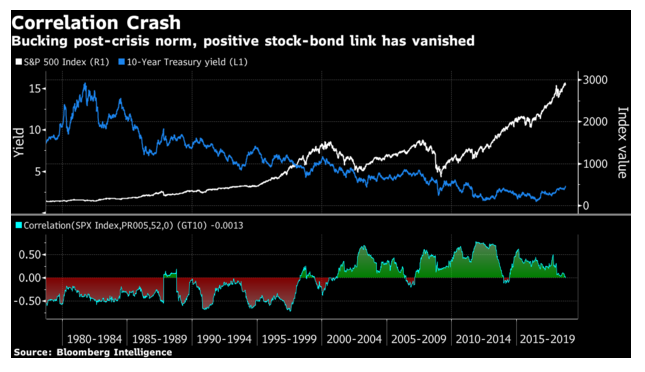

During the bout of volatility that took hold of the capital markets near of the end of 2018, stocks and bonds did something they don’t normally do–exhibit positive correlation. As equities were getting roiled with volatility, the tried and true safe haven of Treasuries were falling as yields were climbing.

This lockstep between stocks and bonds was not something typically seen within the capital markets as both are prone to marching to the beat of their own drum. However, the music they were making was something analysts were listening to closely, but something investors would like to ignore.

Commodities, however, lack correlation to both stocks and bonds–something investors will appreciate moving forward as a volatility protection measure.

“Commodities have a low to no correlation to any other asset class,” said Kiang.

For more trends in the ETF space, visit ETF Trends.