The end of 2018 may have burned an image of volatility in investors’ minds that would drive their decisions when reassessing their portfolios for 2019. As such, alternatives to diversify and counteract volatility would be on the investment agenda, making exchange-traded funds (ETFs) like the Aberdeen Standard Bloomberg All Commodity Strategy K-1 Free ETF (NYSEArca: BCI) a prime alternative.

Commodity Diversification

BCi seeks to provide a total return designed to exceed the performance of the Bloomberg Commodity IndexSM, which is calculated on an excess return basis—-the first of its kind since its inception in the first quarter of 2017. BCI is actively managed and seeks to provide a total return designed to exceed the performance of the index.

“At that time when we had launched it, we were the first ETF based on this index benchmark so up until that point, there had not been an ETF that was covering this institutional benchmark,” said Stan Kiang, Director of Strategic Accounts at Aberdeen Standard Investments.

With BCI offered at 25 basis points, it also offers a cost-effective solution to providing investors with exposure to commodities. Additionally, there are no K-1 tax documents issued, which is a requirement for investments in partnership interests.

“We were also the first to offer this exposure without the traditional shortcomings of what we used to see in traditional ETF commodity products, such as high fees,” said Kiang.

“The new benchmark exposure, the low cost and the tax efficiency were three big hurdles we addressed with that product (BCI),” added Kiang.

BCI will generally seek to hold similar interests to those included in the index and will seek exposure to many of the commodities included in the index under the same futures rolling schedule as the index. Additionally, BCI will also hold short-term fixed-income securities.

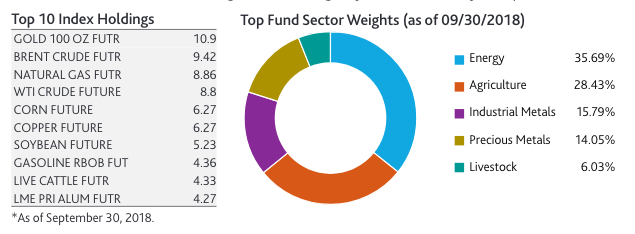

With allocations in precious metals, agriculture and energy, BCI gives investors core exposure to a wide range of commodities.