Commodities ran hot in 2022, and despite a more muted second half, fared well in a tough year that saw both stocks and bonds falter. Today, the VettaFi voices huddle around the hydration station to discuss their outlook for commodities as an asset class in 2023, including the possibilities of a repeat performance and which specific commodities they are keeping an eye on.

Lara Crigger, editor-in-chief: Ah, commodities. My favorite topic! (You know what they say: Once a commodities reporter, always a commodities reporter.) (Yes, I know nobody actually says that.) The run-up we saw last year, especially in agricultural commodities ETFs like the Teucrium Corn Fund (CORN) and the Teucrium Wheat Fund (WEAT), was giving me flashbacks to 2007, when every day-trader with a few hundred bucks and a dream plowed into an asset class newly opened up by the launch of a slew of broad-based commodities ETFs.

Of course, the difference between now and then is that commodities, and commodities ETFs, aren’t such a new phenomenon anymore. There are more options beyond just broad-based GSCI-tracking exposures, including the single-commodity futures ETFs I mentioned above, single-commodity producers ETFs beyond just gold miners (junior uranium miners, anyone?), and even “future of food” tech stock ETFs, like the VanEck Future of Food ETF (YUMY) or the Global X AgTech & Food Innovation ETF (KROP).

Still, I think the investor enthusiasm we saw for commodities has popped for the time being. Despite billions in inflows earlier in the year, commodities ETFs mostly ended 2022 flat in terms of new assets, and in January they only took in about $436 million in net flows. Research-wise, we’ve seen “commodities” as a research topic fall to its lowest point in 12 months. (I talked about that and other research trends in my talk on advisor engagement data at Exchange.)

That’s not to say that there aren’t fundamental, supply-issue supports for higher commodity prices ahead, of course. Prices in grains markets, for example, could remain elevated throughout 2023, due to extreme weather in South America and continued geopolitical upheaval’s impact on distribution.

Stacey, you follow the energy markets closely. What are you seeing on the horizon for 2023?

Stacey Morris, head of energy research: Oil and natural gas are always top of mind for me. In terms of 2022 performance, U.S. oil and natural gas benchmarks both hit highs not seen in more than a decade, but ultimately they ended the year with more modest gains, especially when compared to energy stocks.

More recently, the weakness in natural gas has been particularly notable. U.S. benchmark natural gas prices were north of $6/MMBtu in mid-December and closed at a relative low of $2.07/MMBtu earlier this week. Too much supply has quickly overwhelmed demand, which was hampered by a warm winter and delays to the restart of the Freeport LNG export facility. With weaker prices, producers are talking about dropping rigs, and the U.S. natural gas rig count is down four rigs from early December to last Friday. For 2023, I think natural gas prices can improve from where they are today as growth moderates, but by all indications, natural gas is not going to see the strength in 2023 that it saw in 2022.

Shifting to oil, West Texas Intermediate (WTI) prices have been mostly rangebound between $75 and $80 per barrel this year. Prices are relatively strong in the context of the last several years (i.e., since 2014), but they are well below the $123 high seen in March 2022. For oil prices, I think markets will tighten as the year goes on driven by improving demand from China’s reopening and supply issues from Russia. This was something Samuel Rines and I discussed in our session at Exchange, and I think his estimates for Russian production declines were particularly notable. My expectation is that oil prices improve over the course of the year as the supply-demand balance tightens over time.

With a weaker commodity price picture near-term and cost inflation weighing on producers, I think investors need to be more selective with their energy allocations this year. The default options of Exxon (XOM), Chevron (CVX), and the Energy Select Sector SPDR Fund (XLE) worked extremely well last year, but I don’t think that is going to be the case for 2023. (I will expand upon this in my note for this Tuesday.) Year-to-date, the Alerian MLP Infrastructure Index (AMZI), which underlies the Alerian MLP ETF (AMLP), is up 5.3% on a total return basis, while the index tracked by the XLE is down -4.5%. If you’re worried about energy commodity price weakness or downside volatility, it would make sense to shift your energy exposure towards energy infrastructure MLPs and corporations, which largely earn fees for providing services and are less sensitive to commodity prices.

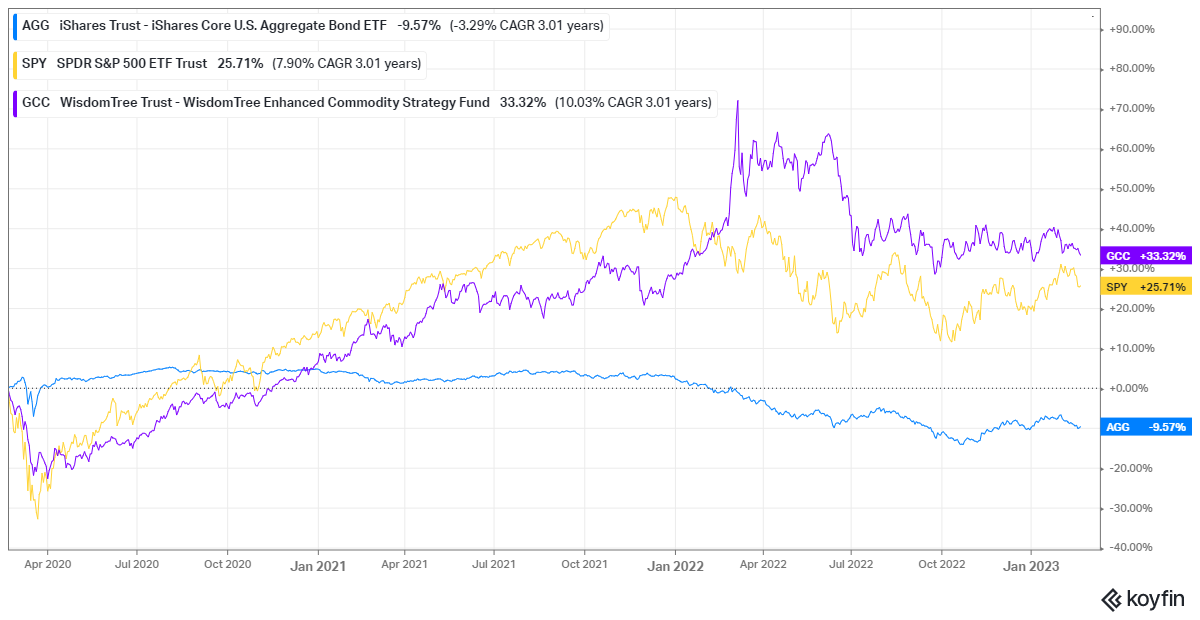

Dave Nadig, financial futurist: I think the case for advisors on commodities remains what it always is: a critical diversifier that shouldn’t be timed. Here’s the last two years:

Is there any world in which you didn’t want a small percentage allocated to broad commodities? (I’ve represented it above by the WisdomTree Enhanced Commodity Strategy Fund (GCC), which I like because it limits the energy swings a bit.)

Right now, there are arguments for the positive case (potentially resurgent China, energy below its peak) and the negative case (global recession), but really the point of any alternatives allocation is to act as a long-cycle diversifier, not to be a quick hit. Whether you choose to go for a more pure-play strategy focused on raw materials, a no-K-1 commodities ETF, or you go with a pure managed futures exposure (which is more of a total return strategy), the point should be diversification, not chasing headlines.

Roxanna Islam, associate director of research: As Lara hinted at, most commodities depend on supply/demand dynamics, and there are a couple of recent situations that led to some of the high price appreciation we saw across commodities.

During the pandemic, lumber prices were driven much higher because people were buying new homes, making home improvements, or just ordering more furniture. So demand was extremely high. But on top of this, supply was low, due to supply chain issues. If you also think about wood in terms of paper products, we had a demand for paper and packaging when people were staying at home and buying more physical goods delivered in cardboard boxes. Now that the situation has normalized, lumber prices have come back down and are now near pre-pandemic levels. There are a couple of ETFs that can be used to invest in lumber: the iShares Global Timber & Forestry ETF (WOOD) and the Invesco MSCI Global Timber ETF (CUT). Neither directly track commodity prices, but both hold stocks and REITs of lumber-related companies including those in timberland, forest products, paper, and packaging.

If you look at agricultural commodities like corn, wheat, and soybeans, we saw volatility in the supply/demand dynamics during the Russia/Ukraine event. Some of those economic effects have calmed down toward the end of 2022 and 2023, so we may not continue to see the extreme price appreciation that we saw in recent years. But overall, pricing is still higher than it was pre-pandemic — corn and soybean commodity prices, for example, are around double of what they were pre-pandemic. Pricing may remain elevated in 2023, but probably not at the same levels seen throughout recent years.

Let’s also talk about gold. I think a lot of investors are still bullish on it, because of the Fed and the current rate environment. But gold is an interesting commodity because it has fewer industrial uses than other metals, like copper and aluminum. Much of its pricing is driven by investor sentiment and interest rate expectations, so this is a different situation that what we discussed with lumber, ags, or energy. Another thing I find interesting about investing in gold is that investors can hold physical gold — something that can’t be done with many other commodities. For example, you can’t (easily) hold a barrel of oil or store a bushel of corn long-term without it rotting. Most gold ETFs are actually backed by physical gold, including some of the largest gold funds like the SPDR Gold Shares (GLD) and the iShares Gold Trust (IAU). (I could segue into a spot bitcoin ETF debate, but I’m not going to go there!)

I got long-winded, but to summarize: I personally think commodity prices may still remain high this year, but there’s probably less supply/demand factors compared to previous years that will drive pricing up for commodities. Fortunately, ETFs make it a lot easier to invest in commodities for those looking to enter the space. I also will echo what Dave said — commodities are best used as a long-cycle diversifier, and it’s extremely difficult to time the market!

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of AMLP.

For more news, information, and analysis, visit the Commodities Channel.