Investing in physical gold can be a challenging way for investors to access the asset class. Once purchased investors would have to consider several different factors including finding secure storage to safeguard against theft. Luckily, gold ETFs exist for investors who want in on this asset class, but do not want to deal with the demands of physically owning it.

Investors can use gold as part of a short-term strategy to hedge against volatility, inflation and weakness in the dollar. Over the long term, it can serve as a portfolio diversifier, providing uncorrelated returns.

There are 10 ETFs that invest in physical gold, and even though they essentially all hold the exact same asset, there are some key differences among the available funds, even the three largest. Data from the analytics platform LOGICLY allows an apples-to-apples comparison of all three.

See more: “Interest in Commodity ETFs Continues to Drop“

Largest Physical Gold ETFs

The SPDR Gold Shares ETF (GLD) is the largest fund in this asset class with $56.0 billion in AUM. It was the first physical gold ETF to trade in the U.S., launching in November 2004. It has an expense ratio of 0.40%.

For investors looking for similar characteristics of GLD, but at a much lower price, they should look to the SPDR Gold MiniShares Trust (GLDM). This fund has an expense ratio of 0.10% which is significantly cheaper than GLD. Each share of GLDM represents a fraction of what a share of GLD holds, and the lower price makes it more accessible to retail investors. The fund has more than $6 billion in assets under management.

The iShares Gold Trust ETF (IAU) is another one of the major players in the gold ETF space. Much like GLD, IAU has been around for a long time, launching a few months after GLD in January 2005. The fund has nearly $28 billion in AUM and an affordable expense ratio of 0.25%.

All three funds track the price of gold as determined by the London Bullion Market Association (LBMA).

Performance of Gold ETFs

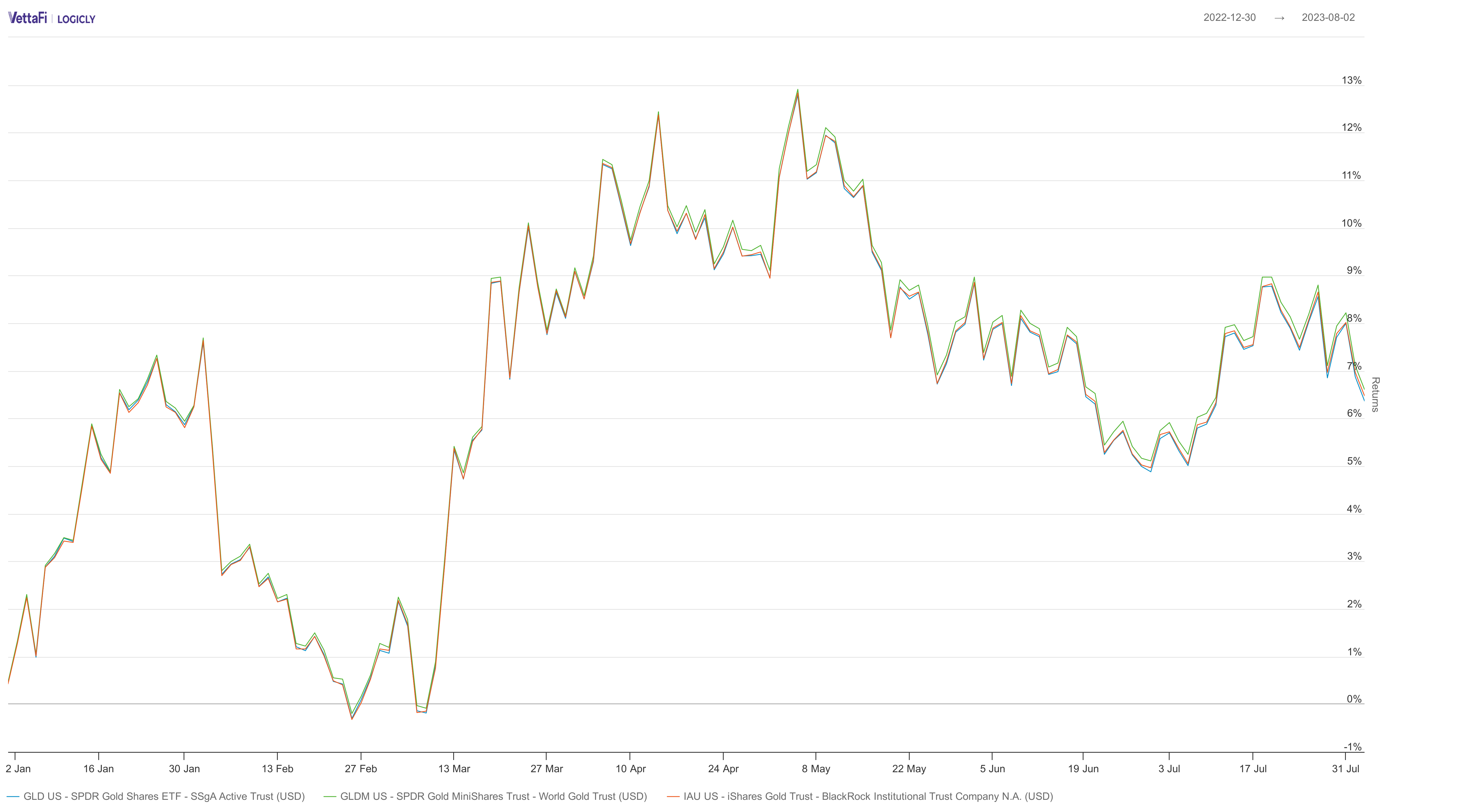

GLD, GLDM, and IAU YTD Performance per LOGICLY.

Given all three of the funds track the same asset, it’s not surprising that their performance is virtually identical. GLDM has led the pack with a YTD return of 6.11% and a 9.81% return in the last year. IAU has had the second-highest performance among the funds mentioned with a 6.01% YTD date return, and a 9.72% return in the last year. GLD ranks third among the funds with a 5.87% YTD return. In the last year, GLD posted a return of 9.48%.

For more news, information, and strategy, visit the Commodities Channel.