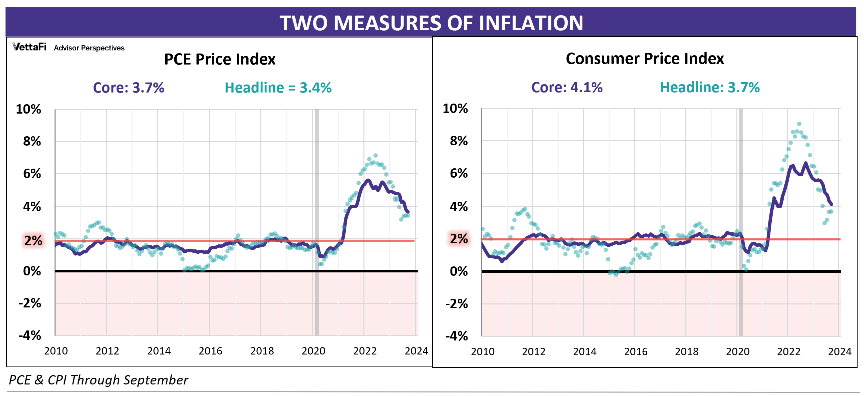

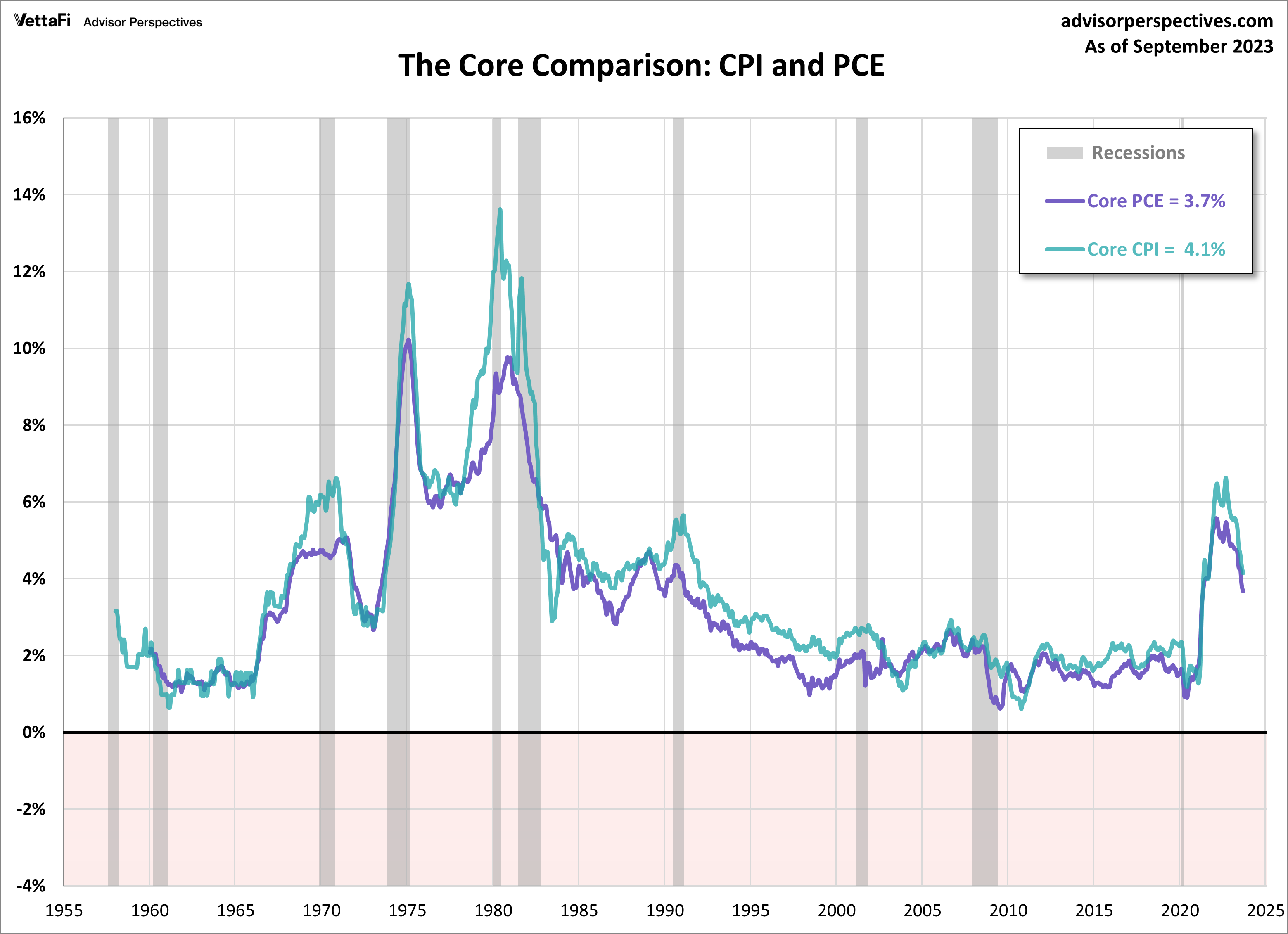

The BEA’s core PCE Price Index for September shows core inflation continues to be above the Federal Reserve’s 2% long-term target, at 3.7%. The September core Consumer Price Index (CPI) release was higher, at 4.1%. The For a closer look at each of those releases, check out our latest CPI and PCE Price Index releases.

Preferred Inflation Gauge

The Fed is on record as using core PCE data as its primary inflation gauge.

“The inflation rate over the longer run is primarily determined by monetary policy. Hence the Committee has the ability to specify a longer-run goal for inflation. The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. Communicating this inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored. This thereby fosters price stability and moderate long-term interest rates and enhances the Committee’s ability to promote maximum employment in the face of significant economic disturbances. [Source] Note: bolding added.”

Elsewhere, the Fed stressed the importance of longer-term inflation patterns. These are the likelihood of persistence, and the importance of “core” inflation (less food and energy). Why the emphasis on core inflation? Here is an excerpt from one of the Fed FAQs.

“Finally, policymakers examine a variety of “core” inflation measures to help identify inflation trends. The most common type of core inflation measures excludes items that tend to go up and down in price dramatically or often, like food and energy items. For those items, a large price change in one period does not necessarily tend to be followed by another large change in the same direction in the following period. Although food and energy make up an important part of the budget for most households — and policymakers ultimately seek to stabilize overall consumer prices — core inflation measures that leave out items with volatile prices can be useful in assessing inflation trends. [Source]”

PCE and CPI: A Side-by-Side Comparison

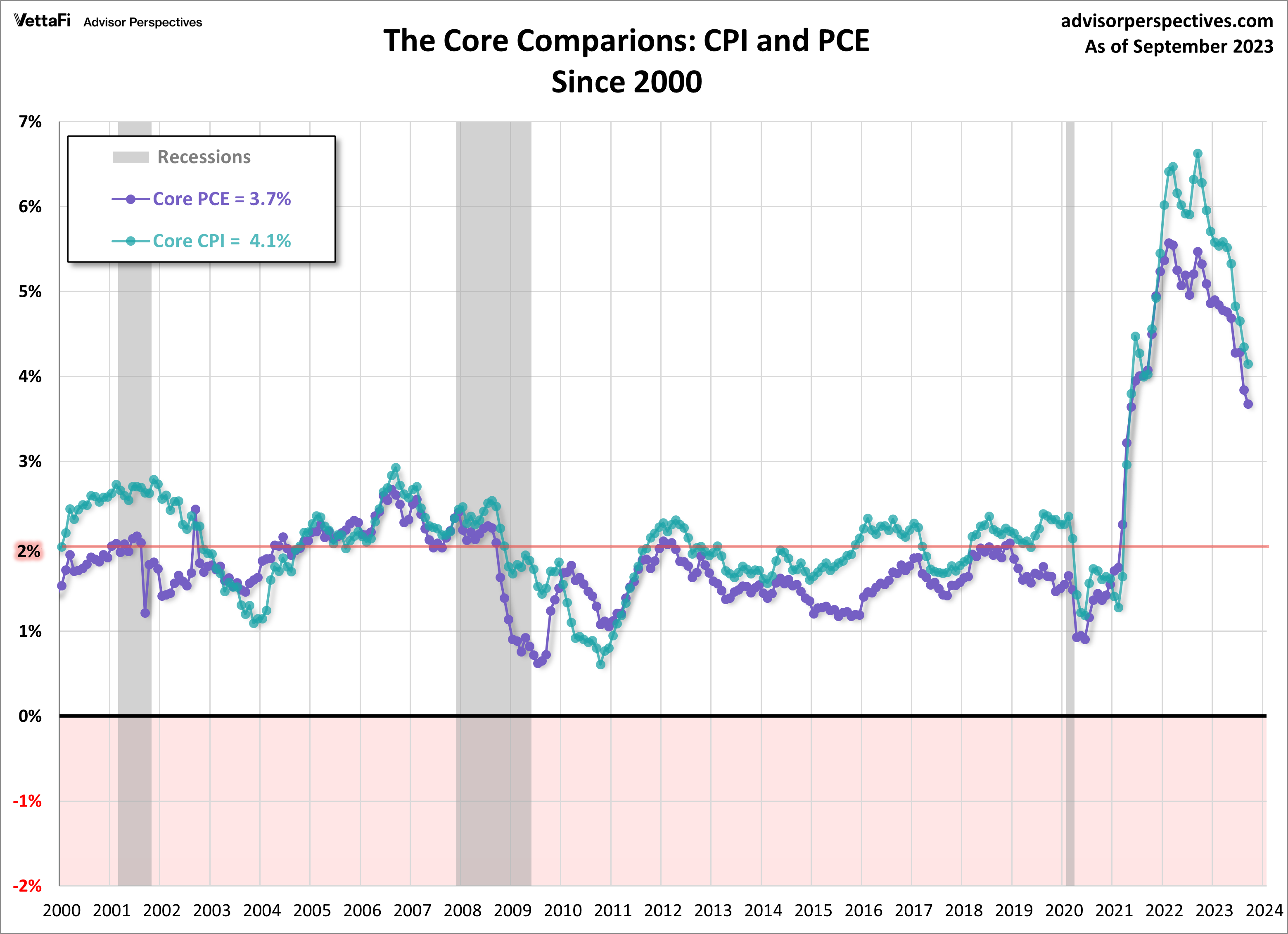

This close-up comparison gives us clues as to why the Fed prefers core PCE over core CPI as an indicator of its success in managing inflation. Core PCE is considerably less volatile than CPI. The Fed’s has twin mandates: price stability and maximizing employment. So it’s not surprising that, in the past, the less volatile core PCE has been its metric of choice. Yet the disinflationary trend in core PCE (prior to 2022) casts doubt on the effectiveness of the Fed’s monetary policy.

The BLS’s CPI and the BEA’s monthly Personal Income and Outlays report are the main indicators for price trends in the U.S. The chart below is an overlay of core CPI and core PCE since 2000.

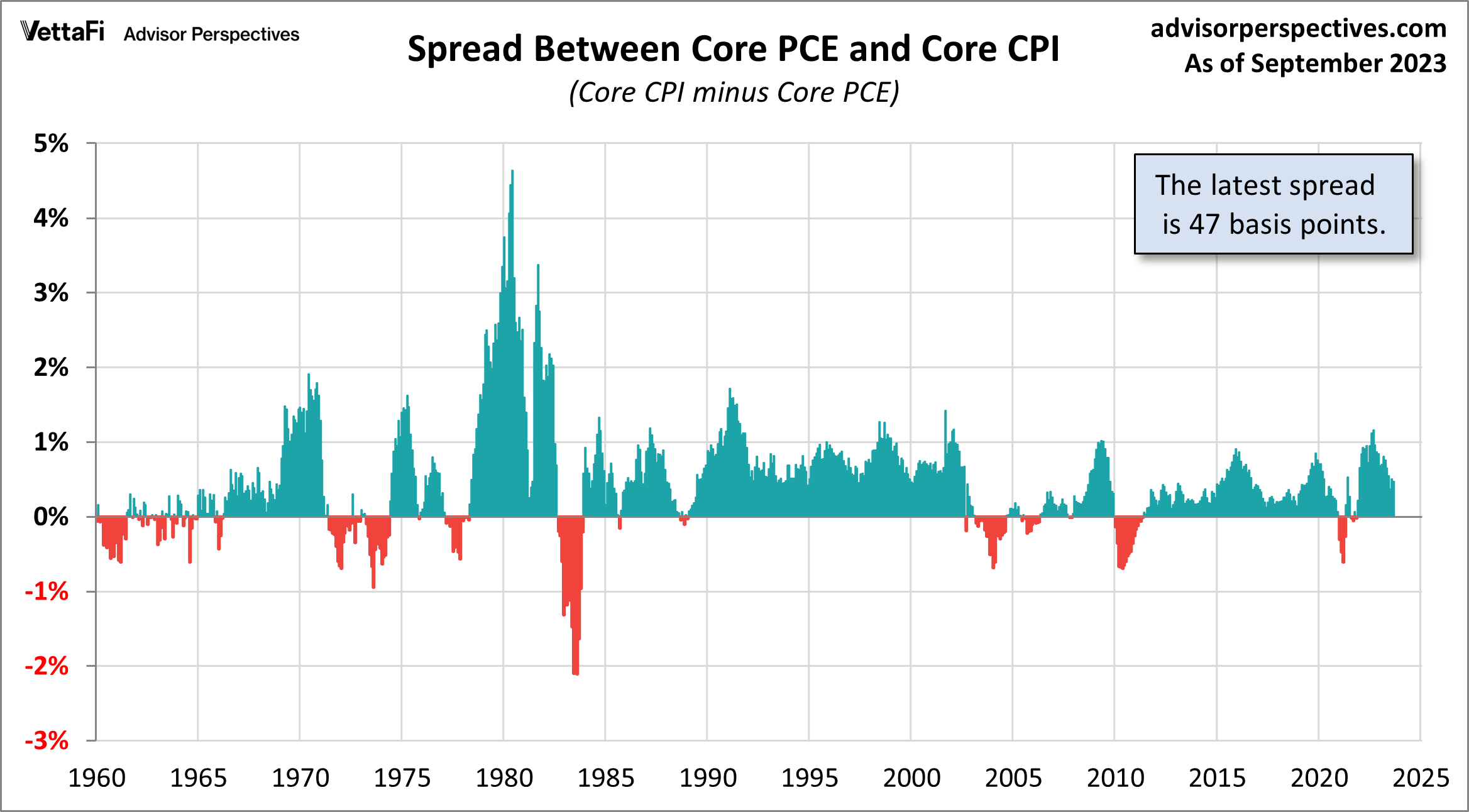

Here is an illustration of the spread between the two core metrics since 1960 through the latest month when both indicators have been published.

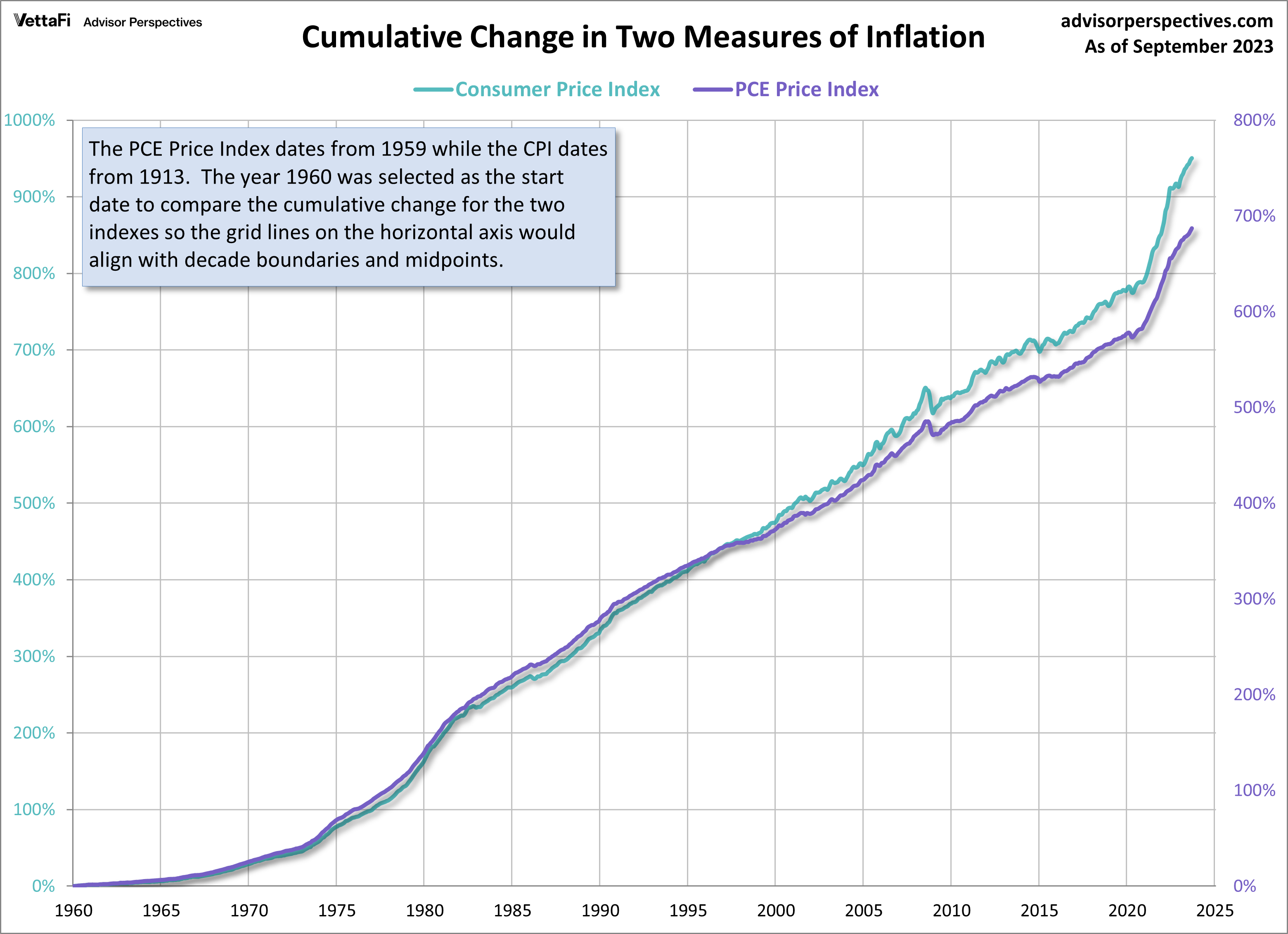

This is a long-term perspective from the actual beginnings of the two series.

Here is a chart that helps us compare the cumulative change in the two indexes since 1960. Over time, the PCE price index reflects significantly lower growth in inflation than does CPI.

For some technical data explaining the differences between the calculation of PCE and CPI, see this comparison article from the BEA.

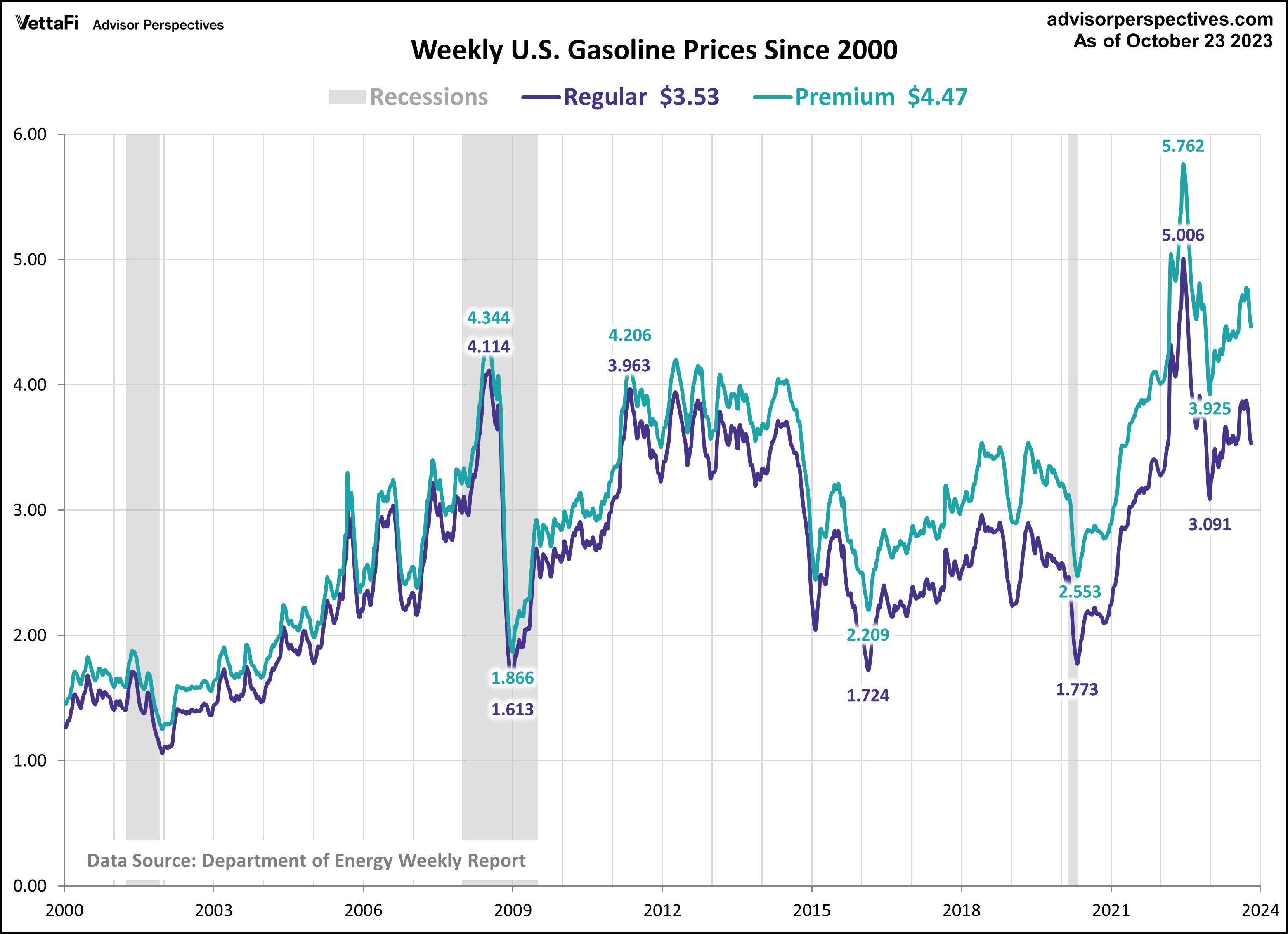

We can’t exclude food and energy from our monthly expenses. But the extreme volatility of these two expense categories, especially energy, often obscures the underlying trend. That is the focus of the chart above. For evidence of the volatility, see this overlay of headline and core CPI and this one of headline and core PCE.

Hostility Toward Government Inflation Analysis

The volatile price of gasoline explains why so many people are confused by the exclusion of food and energy from core measures of inflation. The chart of gasoline prices below is based on the latest weekly data from the Energy Information Administration.

During inflationary times, investors sometimes turn to agricultural commodity ETFs such as Teucrium Wheat Fund (WEAT) and Teucrium Corn Fund (CORN).

by Jennifer Nash of VettaFi | Advisor Perspectives, 10/30/23

Originally published on Advisor Perspectives.

For more news, information, and strategy, visit the Commodities Channel.