“Instead of competing to be the best, companies can—and should—compete to be unique. This concept is all about value. It’s about uniqueness in the value you create and how you create it.”

– Joan Magretta, Understanding Michael Porter

The View from 30,000 feet

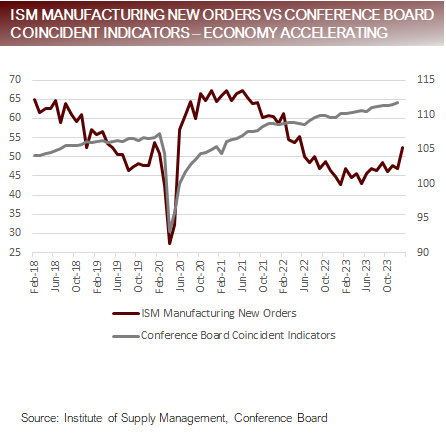

Last week was action packed. Three events dominated headlines: The Fed Meeting, Magnificent 7 Earnings and the Escalation of American Military Action in the Middle East. In addition to these headlines, there was a steady stream of economic data indicating that the U.S. economy is, yet again, growing faster that almost anyone expected. To put this in context, Bloomberg surveyed 77 economists for estimates of changes in Nonfarm Payroll reported on Friday. The highest estimate was 300k. The actual reported growth in Nonfarm Payrolls was 353k. In addition, last week the Atlanta Fed GDPNow estimate for Q1 GDP skyrocketed to 4.2%, exactly double the average estimate of the 60 economists surveyed by Bloomberg. Those two numbers tell you everything you need to know about what people are expecting versus what’s actually happening. I’ll end with the comment that we’ve concluded our last three Macro Thoughts with, which sums up not only what we’ve been seeing in the data, but the dangers lurking around corners:

The larger picture is that inflation continues to fall at a faster pace than expected, the labor market remains strong, which is causing resiliency in demand and corporate profits. It’s hard to be pessimistic with this as the backdrop, but with expectations for S&P500 earnings to grow at 11.2% in 2024, well above historical averages, and six rate cuts priced in versus a Fed that’s broadcasting three cuts, it’s also hard to feel like the markets aren’t priced for perfection.

- Powell guides away from a cut in March, but pressor Q&A highlights to expect more cuts than previous SEP forecasted

- Magnificent 7 Q4 2023 earnings performance (deleting TSLA and AAPL), in one word – AWESOME

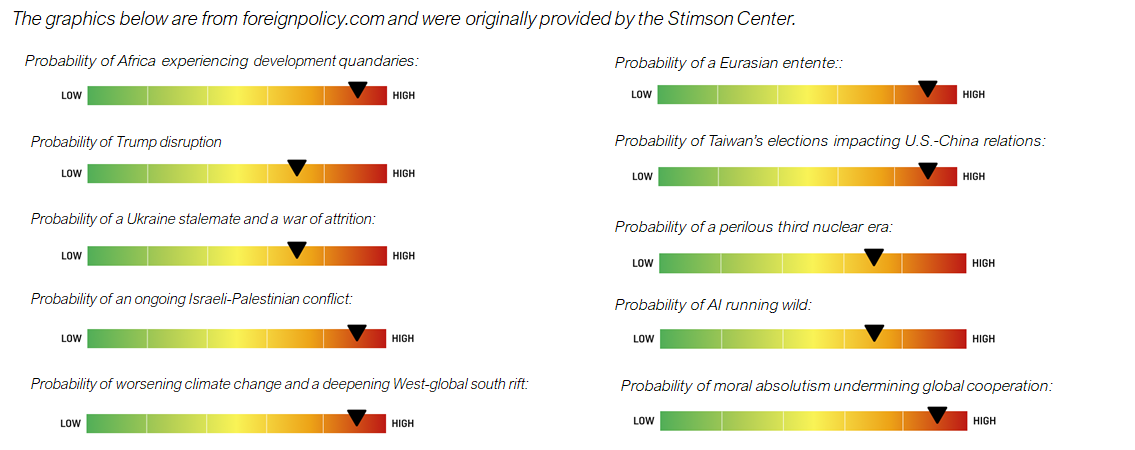

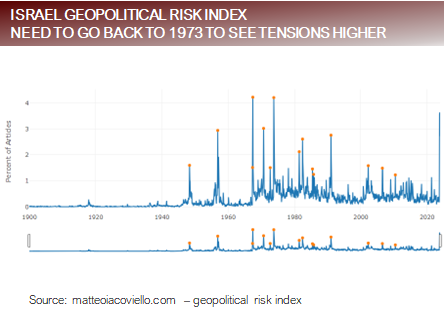

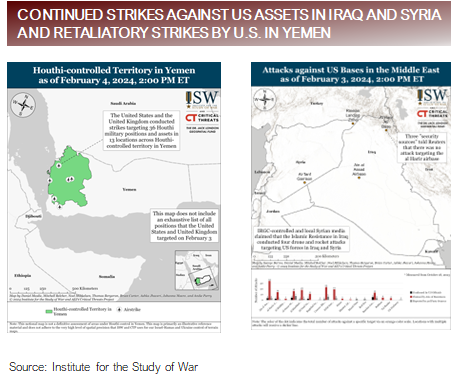

- The markets are ignoring geopolitical risk, which have escalated significantly in the last four weeks

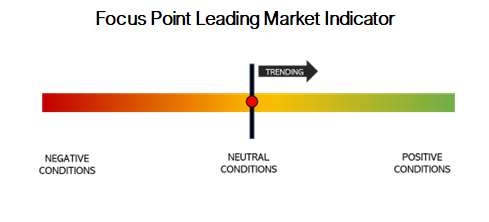

- Focus Point Leading Market Indicator continues in Neutral Conditions, notching slightly higher at month end

- Focus Point Sector Rotation Update: Avoiding interest rate sensitive sectors of the economy

Powell guides away from a cut in March, pressor Q&A highlights to expect more cuts

- The big news headline from the Q&A portion of the Fed press conference was when Powell veered out of his way to deliberately make the following statement, highlighting the point he, and virtually every other Fed President, have been making over the last four weeks:

- “Based on the meeting today, I would tell you that I don’t think it’s likely that the Committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that. But that’s to be seen. So, I wouldn’t call — you know, when you ask me about in the near term, I’m hearing that as March. I would say that’s probably not the most likely case or what we would call the base case.”

- That last sentence ignited an immediate equity and Treasury market selloff causing expectations for Fed Funds Futures to push out the probability of a rates cut from March to Interestingly, it did not change the expectations about the number of rate cuts in 2024, which remains six, twice that of the last Summary of Economic Projections (SEP).

- Perhaps the most interesting question that didn’t receive much post-pressor converge was by Jennifer Schonberger of Yahoo Finance, who ask Powell how he squared the circle with core PCE running at a 9% rate over the last six months versus the SEP projection of 2.4% by the end of 2024, noting that the Fed is projecting three rate cuts to get to 2.4%. To that Powell answered, the following statement, implying more than three cuts to come in 2024 if the trend persists:

- “We’ll update our inflation forecasts at the next meeting. You referred to the December meeting. That’s three months old, so it might be lower now given the data we’ve gotten. Look, as I mentioned, we’re going to be reacting to the data. If we get very strong inflation data and it kicks back up, then we’ll go slower or later or both. If we got really good inflation data soon, that would tell us that we could go sooner and perhaps go faster.”

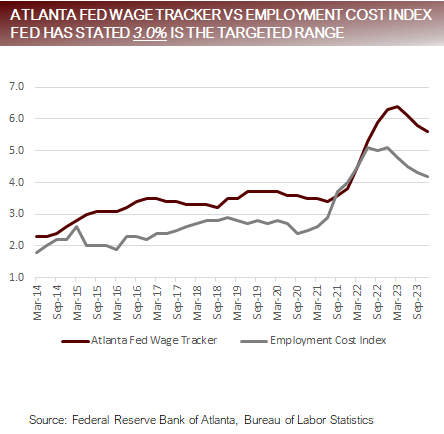

Wages and signs of a resurgence in economic momentum are a thorn in the side of rates cut hopes

Magnificent 7 Q4 2023 earnings performance (deleting TSLA and AAPL), in one word – AWESOME

- Reports from META and AMZN last week sent the stocks into orbit.

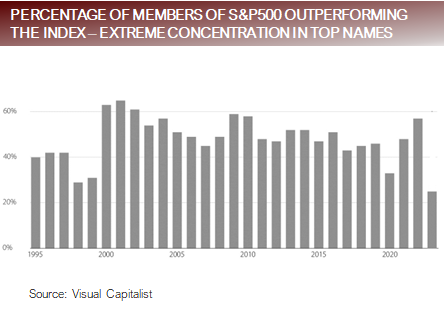

- MSFT, NVDA, META, AMZN and GOOG collectively represent 87% of the return of the S&P500, with MSFT, NVDA and META alonE making up 86% of the return of the S&P 500.

- Actual Q4 2023 earnings growth:

- MSFT 21%

- META 203%

- AMZN 115%

- GOOG 56%

- Although, it would be easy to get despondent that 496 names in the S&P500 might be considered dead weight on the index right Take solace, there are 140 (28%) names in the S&P500 trading above the YTD return of the overall index. At first glance this might seem good, until you consider that for the 10-years prior to the pandemic the average number of constituents of the S&P500 that outperformed the index every year was 49.5%. In fact, the only two comparable years where the percentage of companies were close to 30% was 1998 (29%) and 1999 (31%).

- With the bulk of earnings gains coming from the top companies weighted in the index, it’s not surprising to find that’s where the gains are concentrated as It might or might not be unhealthy, but it’s certainly unusual.

Concentration of performance from top weighted names because that’s where the growth has been

The markets are ignoring geopolitical risk, which have escalated significantly in the last four weeks

The graphics below are from foreignpolicy.com and were originally provided by the Stimson Center.

Regional tensions escalated and U.S. inching closer to direct engagement against Iran

Focus Point Leading Market Indicator continues in Neutral Conditions, notching slightly higher

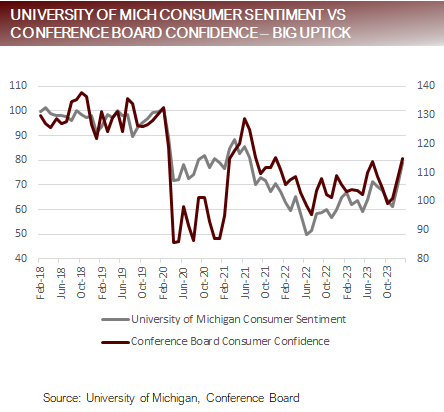

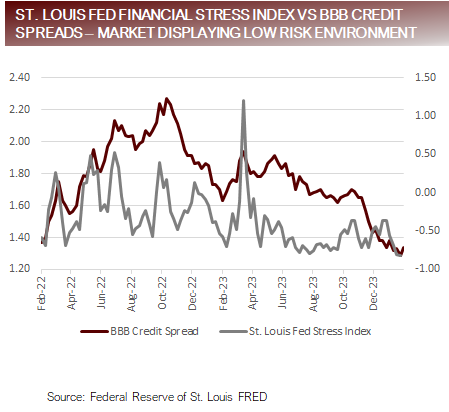

- The Focus Point Leading Market Indicator nudged slightly higher at the end of January, propelled by increased consumer confidence and the continued easing of financial conditions.

- The S. economy continues to be the engine of growth for developed markets, powered by the high margin Tech sector, a resilient job market and an insatiable U.S. consumer.

- Japan remains a close second behind the S., as the weak JPY benefits the export sector.

- Emerging markets are being weighed down by China, who is struggling with a deflationary bust in their property sector, while the government struggles to right size programs to breath life back into the economy.

Improving consumer confidence and loosening financial conditions help nudge the FPLMI higher

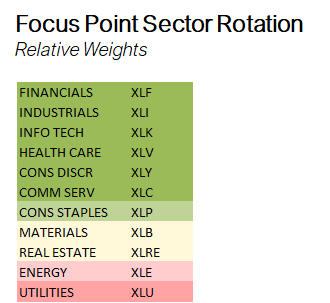

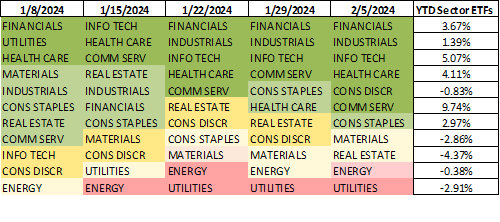

Focus Point Sector Rotation Update: Avoiding interest rate sensitive sectors of the economy

- The Focus Point Sector Rotation Model is a combined trend following and mean reversion model that utilizes seven factors to analyze daily price data on sectors to determine the strength of upward trends.

- Rally broadening, led by cyclicals with sectors exposed to pressure from higher rates lagging most.

- Evolution of sector exposures since the beginning of 2024

Putting it all together

- Friday afternoon after the blowout in the jobs report showing more job gains in any month since January 2023, these headlines appeared on my Apple New feed.

- These headlines accompanied another headline on Bloomberg that, Mike Wilson, Morgan Stanley’s famed 2023 perma- bear, is stepping down (forced down) from their Investment Committee, in a sign that the firm is throwing in the towel on the 2023 Wall Street “Obsession with Recession”

- Dan Ives, Wedbush’s outspokenly bullish superstar tech analyst, jokingly said last week after the META, AMZN, GOOG earnings beats, that if you’re looking for a recession, you’d better have a telescope.

- We should all be reminded by these three bullet points, there are perma-bulls and perma-bears and biased media Each can look like oracles in the right environment, but that doesn’t make them impervious. They still get carried out on stretchers or hidden in the background like the rest of us mortals when they aren’t right for long enough.

- Things In September 2008, annualized GDP printed at 3.7, and then proceeded to freefall to -0.5 by June of 2009. What this tells us is that the market environment changes. Some, like us, think you need to be prepared to change with it.

For more news, information, and analysis, visit the Commodities Channel.