“The very first lesson the Gita teaches us is how to handle fear. In the moments before the battle starts, when Arjuna is overcome by fear, he doesn’t run from it or bury it; he faces it. In the text, Arjuna is a brave and skilled warrior, yet in this moment it is fear that causes him, for the first time, to reflect. It’s often said that when the fear of staying the same outweighs the fear of change, that is when we change. He asks for help in the form of insight and understanding. In that action, he has begun to shift from being controlled by his fear to understanding it.”

Jay Shetty, Think Like a Monk

The View from 30,000 feet

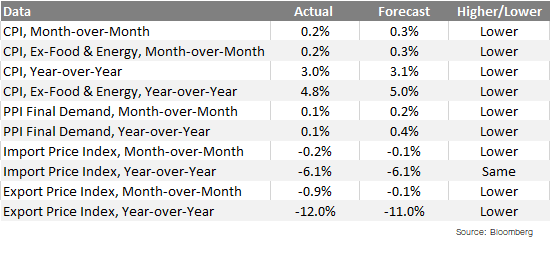

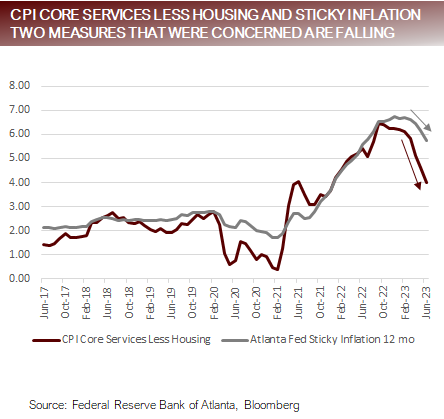

To keep the rally alive, the equity markets are looking for a continuation of the magic formula, what I’ve recently called the plotline – steadily declining inflation and a benign tightening of the labor market. If the plotline is in play, the Fed can take their foot off the brake pedal and the economy can ease into the fairytale ending from the Fed rate hiking rave party that so many, including myself, thought would end in tears. Last week’s data was a win for the plotline, with the latest readings on inflation coming in below expectations, the labor market holding in and consumer confidence picking up, adding to the bet for resilience in the economy and financial markets. Although the job market is a touch strong for Fed comfort, as long as inflation is behaving, the Fed can afford to be less aggressive.

- Two trends that have propelled higher equity markets in 2023 – Consistent underestimation of economic resilience and overestimation of inflationary pressures

- Last week was inflation week, and the big winner was the Fed

- Risks to the disinflationary story

- The most Frequently Asked Question from client’s this week: Could you provide more detail on why the Focus Point Leading Market Indicator shifted higher recently?

Consistent underestimation of economic resilience and overestimation of inflationary pressures

- Growth

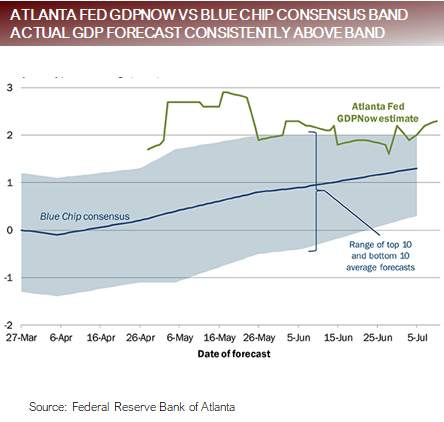

- The Atlanta Fed GDPNow model estimates annual GDP growth each week, compared with the Blue Chip consensus GDP Since its release in 2011 the Atlanta Fed GDPNow forecast has had an average error of 0.83. Perhaps the most interesting characteristic of 2023’s forecasts is that the Atlanta Fed GDPNow model has been above the entire range of Blue Chip estimates all year, suggesting that analysts, as a group, have been much too pessimistic about the economy’s growth trajectory.

- The Citigroup Economic Surprise Index’s latest reading was +75.10. To put this in context, only three times in the period between the end of the GFC and the beginning of the pandemic did the Citigroup Economic Surprise Index exceed this level. Another sign that economist and analysts have deeply underestimated economic resiliency in 2023.

- Inflation

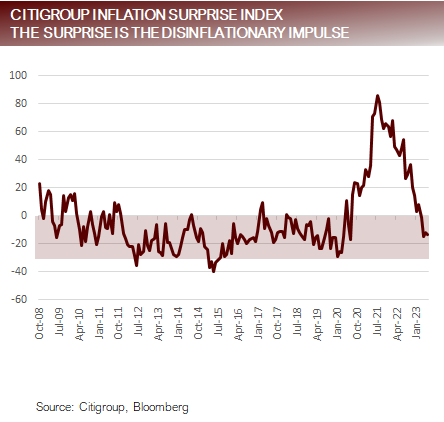

- The Citigroup Inflation Surprise Index’s latest reading was -13.69, which is below the average of -12.07 between 2010 and 2019. Importantly, the number is negative, which is a sign of a disinflationary impulse that is not reflected in analyst estimates.

Underestimating economic strength, overestimating inflation has been the 2023 trend

Last week was inflation week, and the big winner was the Fed

- There was nothing not to love about last week’s inflation data. The Fed was careful to comment that the news was encouraging, but market watchers should be careful to not to extrapolate one good month as anything other than that

- The implied Fed Funds Futures probabilities responded by taking the Fed at their word for the July meeting that they would raise rates one more time, then hold them steady through Q1 2024, followed by six 25 bps rate cuts by the end of 2024, ending the year at 400 bps, versus the most recent Fed Summary of Economic Projections which are forecasting 460 bps at the end of 2024.

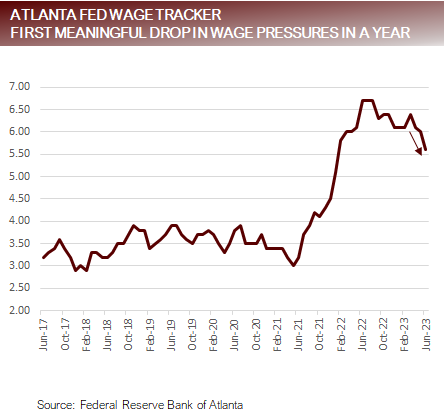

- Perhaps the best news was the Atlanta Fed Wage Tracker, which showed the first meaningful drop in wage pressures in almost a year.

Disinflationary pressures have begun to build

Risks to the disinflationary story

- Base Effects

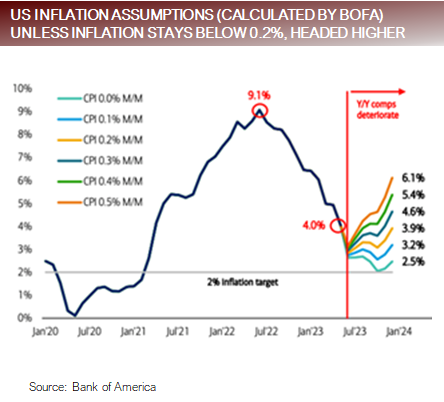

- The highest monthly inflation was posted in June of 2023 of 9.1%, at which point inflation started to trend lower. This good news for those who are feeling the effects of inflation but bad news when it comes to calculating inflation because of the base effect.

- A simple way to think of the base effect is to look at the rate of change of inflation 12 months ago, if it was rising it gets easier to push through disinflationary impacts, if it was falling it gets harder.

- As a result, even if inflation was flat every month for the remainder of the year, CPI, which ended last month at 3.0%, would only fall to 2.5%. However, if the monthly inflation rate trends at 0.2%, which would seem like a win, the year-over-year inflation rate would climb to 3.9% by the end of year.

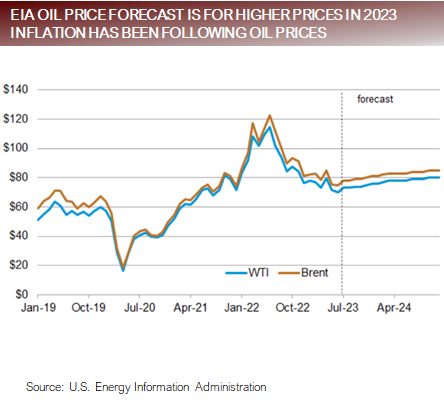

- Commodities

- Commodities are impacted by long-term and short-term supply/demand dynamics. For example, according to the Glencore CEO, the world will need to double copper production by the year 2050 to meet global This is an example of a statement that reflects the long-term supply/demand balances, often referred to as secular forces or super cycles.

- In the short-term, commodities respond to cyclical factors such as expectations of economic At the beginning of 2023, the expectation was for a recession in the US and real estate was expected to go in the toilet. Commodity prices fell in response. Fast forward six months and it looks like these assumptions may not be correct, so it’s also reasonable to expect commodity prices to begin to reflect the current cyclical forces soon.

- Based on this analysis, it should come as no surprise that copper broke out to a two-month high last week and oil is now trading at its highest level since April.

The easy gains for inflation have probably been made, from here it gets harder

FAQ: Provide more detail on why the Focus Point Leading Market Indicator shifted higher recently?

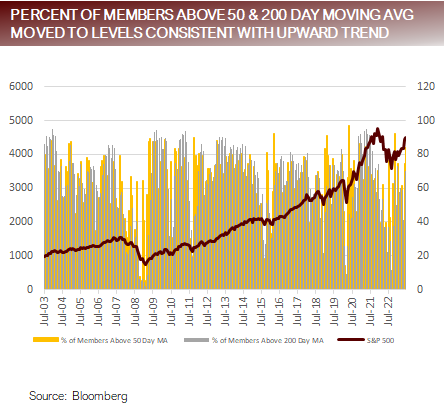

- Since the beginning of June, the markets and economic data began to exhibit characteristics that have historically been inconsistent with dramatic weakness in risk assets.

- The number of members of the S&P500 above the 50-day moving average and 200-day moving average are both above 60%.

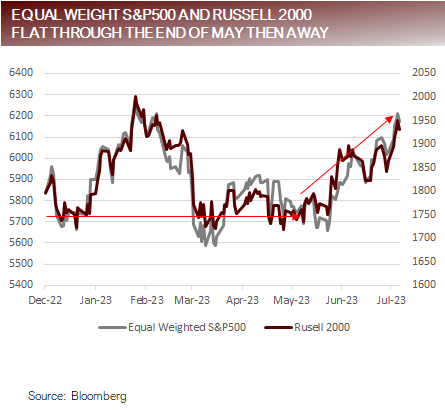

- The Russell 2000 and S&P500 were both flat to down at the end of May, but over the course of June, both staged strong rallies, indicating that breadth was improving in the S&P500 as well as across market capitalizations.

- Consumer confidence, which is heavily impacted by gasoline prices, food prices and housing began to improve.

- Credit spreads began trending lower have moved to levels hovering just above the average for the decade before the pandemic.

Market internals changed by the end of June to include larger market participation

Putting it all together

- In hindsight, the trends for the first half of 2023 were clear – better than expected growth and consistent disinflationary forces.

- Better than expected growth, supported by resilient consumers who were backed with pandemic savings and increased nominal spending from wage growth, trickled through to earnings, which easily surpassed gloomy expectations that had been polluted by recession forecasts.

- It’s unclear if these trends will continue in the second half because as nominal wage pressures ease and expectations around earnings increase, with inflation expectations falling, the markets are becoming primed for disappointments and a more challenging path.

- What matters most to the Fed is inflation, and what matters most to the consumer is the labor Right now, both the Fed and the consumer are seeing sunny days, however with restrictive interest rates levels and some of the major drivers of inflation getting less forceful in the second half of the year, there is risk that the sunny days turn stormy.

- With the breadth of the market expansion, increased confidence and surefooted credit conditions supporting the upward trend in risk asset prices, the markets look poised to follow a trend higher, but investors should not be complacent, Fed policy targeted at slowing the economy is still likely to take a pound of flesh out of the economy, and it’s hard to be precise when that bite will happen.

For more news, information, and analysis, visit the Commodities Channel.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.