Energy ETFs took center stage over the last week in performance, with oil ETFs stepping up. That represents a notable change compared to the trend of crypto ETFs leading top performers this year. Crypto ETFs did retain some rankings, but oil ETFs and oil industry investing spiked in the top 12 ranking. Whether in oil or crypto, commodities-oriented ETFs once again proved to be the top strategies of the week.

That may be due to crude oil futures rising to their highest level since May. The Crude Oil Continuous Contract Overview (CL00) hit around $73.50 as of July 10. While oil has fallen somewhat due to the prospect of a U.S. recession, the possibility of OPEC cuts has maintained a price floor.

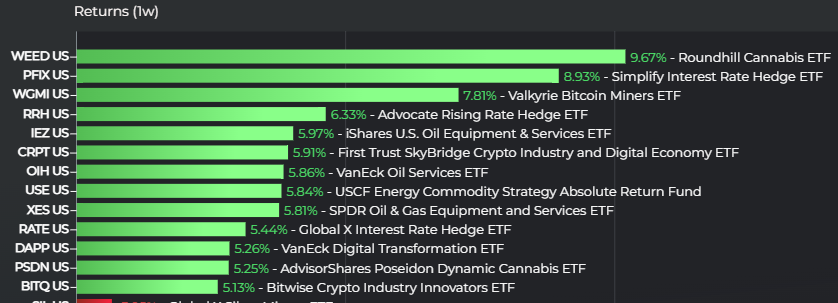

Those factors helped the iShares U.S. Oil Equipment & Services ETF (IEZ) return 6% over the last week, per LOGICLY. The VanEck Oil Services ETF (OIH) returned 5.9%, while the SPDR Oil & Gas Equipment and Services ETF (XES) returned 5.8%. The USCF Energy Commodity Strategy Absolute Return Fund (USE) returned 5.8%, meanwhile.

Oil ETFs may have done well to join the ranks of top-performing weekly ETFs, but crypto ETFs also showed well. Once again, bitcoin strategies like the Valkyrie Bitcoin Miners ETF (WGMI) did well, with WGMI returning 7.8%. The VanEck Digital Transformation ETF (DAPP) returned 5.3%. The Bitwise Crypto Industry Innovators ETF (BITQ) returned 5.1%, meanwhile.

The top ETF for the week, however, focused on the surprising theme of cannabis. The Roundhill Cannabis ETF (WEED) returned 9.7% in that time, according to LOGICLY. Interestingly, WEED relies on investing in real estate investment trusts (REITs). Those REITS must derive at least half their revenue from the legal cannabis and hemp industry. WEED also uses total return swaps to help provide exposure to U.S. multi-state operators (MSOs).