Rampant global inflation is hitting all commodities, including sugar. India is looking to keep sugar prices in check by limiting its exports for economic and political reasons, according to a Bloomberg report.

“India will restrict sugar exports as a precautionary measure to safeguard its own food supplies, another act of protectionism after banning wheat sales just over a week ago,” the report said.

Russia’s invasion of Ukraine provided geopolitical forces to sway India’s latest moves. Earlier in May, India also minimized exports of wheat thanks to a heatwave that sent prices of the commodity sky high.

“India took the world by surprise earlier this month when it curbed exports of wheat after a heatwave destroyed some crops, causing a jump in benchmark prices,” the report added. “Steps by governments to ban sales abroad, particularly in Asia, have ramped up in recent weeks since Russia’s invasion of Ukraine sparked a further surge in already-soaring global food prices.”

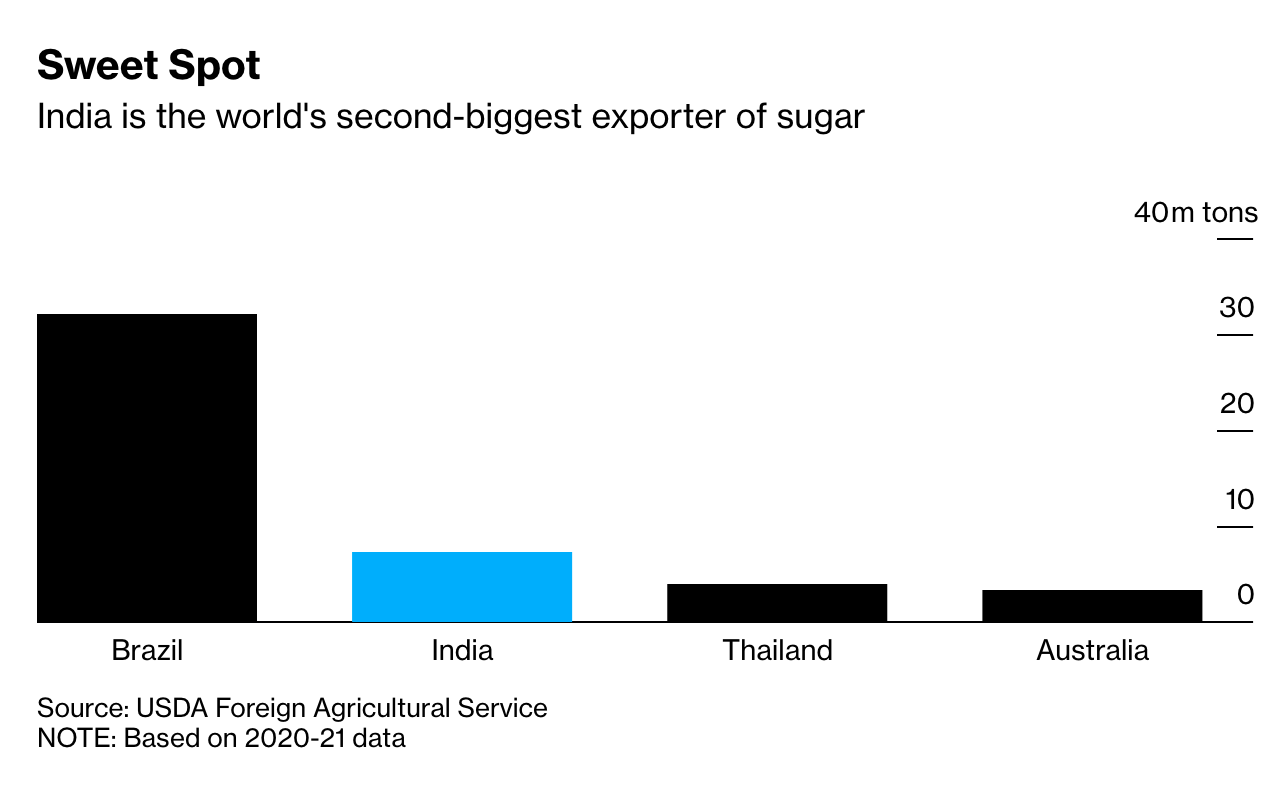

India’s position in terms of sugar exports is of notable importance. Behind Brazil, the country is the second-largest exporter of sugar.

“India was the world’s biggest sugar exporter after Brazil last year, and counts Bangladesh, Indonesia, Malaysia and Dubai among its top customers,” the Bloomberg report added.

Sugar Exposure in 1 ETF

Investors looking to get sugar exposure can do so via exchange traded funds (ETFs) that give dynamic exposure to commodities like sugar without having to open futures positions. In particular, investors can look at the Teucrium Sugar ETF (CANE).

The fund seeks to have the daily changes in the NAV of the fund’s shares reflect the daily changes in the sugar market for future delivery as measured by a weighted average of the closing settlement prices for three futures contracts for No. 11 Sugar that are traded on the ICE Futures US. The fund seeks to achieve its investment objective by investing under normal market conditions in Benchmark Component Futures Contracts.

Currently, the fund is outpacing a broader index — the S&P GSCI Sugar Index. CANE is up 6%, while the index is up 3% thus far in 2022.

For more news, information, and strategy, visit the Commodities Channel.