Gold prices reached an all-time high earlier this month, and though prices retreated in the ensuing days, gold remains at a premium. For investors looking for bullish commodity opportunities beyond gold, electrification metals are worth consideration.

After a challenging start to the year, copper prices are now on the move. Prices popped today on news of the agreement by Chinese copper smelters to reduce production. The cuts come in the wake of raw material shortages, according to Reuters. Though no formal amounts were set for the cuts, it underscores the growing supply and demand imbalance.

The energy transition is forecast to create exponential demand growth within a number of key metals. These include copper, lithium, zinc, aluminum, cobalt, nickel, and others.

This demand growth is perhaps most apparent in China, where copper smelters aggressively expanded in the last year or so. That country is currently the global leader for the energy transition, and copper smelters sought to get ahead of the demand curve. Copper is a core component in many renewable energies, electric vehicles, power grids, and more.

However, the shutdown of multiple copper mines in the last 12 months due to protests and regulatory rulings created a supply shortage of copper concentrate. Chinese smelters purportedly cite this shortage as a primary reason for production cuts.

See also: “Don’t Miss the Rare Opportunity in Electrification Metals”

Electrification Metals Just Getting Started

As the global copper industry works to bring demand and supply into balance, investors have an opportunity to capture exposure at reduced but recovering prices.

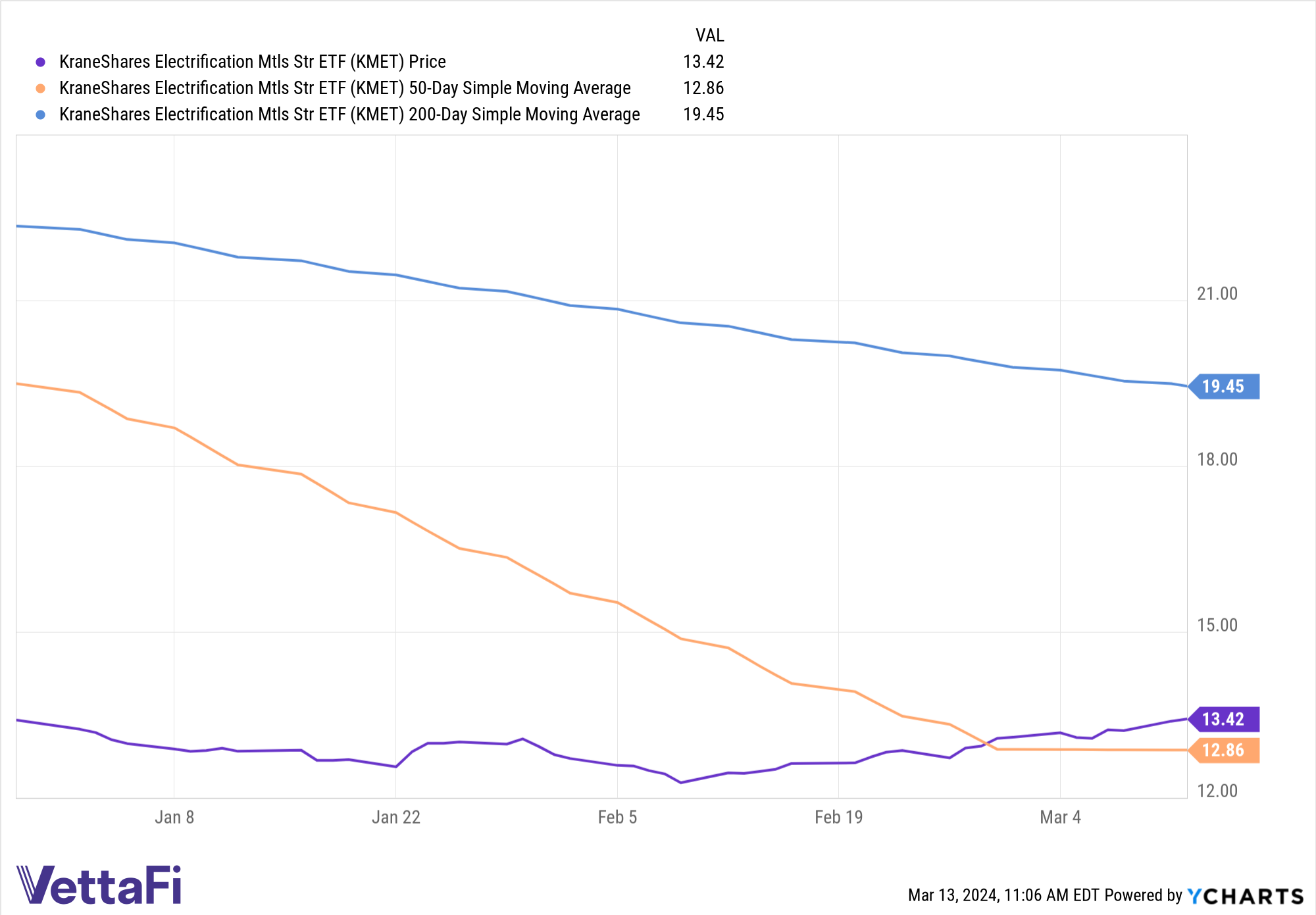

The KraneShares Electrification Metals ETF (KMET) offers exposure to electrification metals, like copper. The fund rose 7.83% on a price return basis in the last month, according to Y-chart data. After drawdowns in the first six weeks of the year, the ETF is on the move. KMET is up 0.15% YTD as of 03/12/24 and crossed above its 50-day simple moving average (SMA) on March 1.

Funds trending above their SMAs are considered ones to watch or buy. KMET currently sits below its 200-day SMA, providing investors with a chance to gain exposure to the long-term fundamentals at attractive prices.

Advisors and investors looking for opportunities in metals beyond gold should consider KMET. The ETF offers targeted exposure to the metals necessary for electrification, such as copper, lithium, and more. The strategy harnesses the growing metal demand from the clean energy transition via the futures market.

The fund seeks to track the Bloomberg Electrification Metals Index. KMET carries futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure needed to meet 2050 net-zero goals.

KMET’s largest allocations currently include copper futures at 29.28%, followed by nickel futures at 24.78%. The fund has an expense ratio of 0.80%.

For more news, information, and analysis, visit the Climate Insights Channel.