The reduction in global demand as economies struggle with inflation and recession continues to weigh heavily on several asset classes. Electrification metals suffered from supply and demand misalignments in the economic pullback of the last year. It creates a window of opportunity for investors wanting access to metals with strong demand forecasts looking ahead.

Lithium: Too Much of a Good Thing

Lithium is a metal central to the energy transition, used in a range of rechargeable batteries. Lithium-ion batteries for electric vehicles are perhaps the most commonly known, but lithium is a core component in a variety of EV battery types.

The electrification metal garnered attention for its meteoric price capitulation in 2023. Prices hit a historic $80,000 per ton in December 2022 after a record run and surging demand. By the end of December 2023, lithium carbonate sold for approximately $16,000 a ton. Battery-grade lithium carbonate prices currently hover around $14,000 per ton as of 02/23/2024 according to ChemAnalyst News.

After lithium prices surged in 2022, 2023 brought about an abrupt collapse as oversupply drove prices down. The oversupply resulted in part from a number of new projects coming online as well as slowing demand during economic downturn. China’s slow economic recovery muted EV demand last year. However, despite reduced demand, it’s worth noting that EV sales still grew year-over-year in China and globally. They’re also forecast for further growth this year as well.

See also: “2024 EV Outlook: Short-Term Challenges, Long Runway”

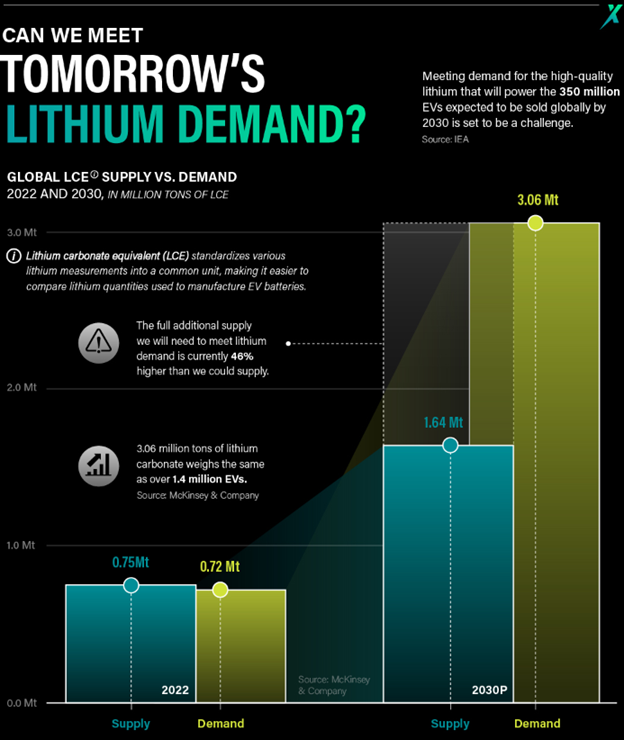

While mines in Africa, particularly Zimbabwe, continue to ramp up output, the majority of the industry has cut production. Easing surpluses are forecast to shift to deficits beginning next year, with exponentially increasing demand through 2030.

Image source: Visual Capitalist

“2023 saw the market shift into an oversupply; we now need to wait for demand to absorb that extra supply,” William Adams, head of battery and base metals research at Fastmarkets, told Investing News Network. “We expect the market to remain in a surplus in 2024, although some supply restraint and ongoing good demand should ensure the surplus is manageable.”

Gain Entry at Reduced Lithium Prices Ahead of Demand Surge

Advisors and investors looking to add exposure to energy transition metals at reduced prices should consider the KraneShares Electrification Metals ETF (KMET). KMET offers targeted exposure to the metals necessary for electrification, such as lithium. The strategy harnesses the growing metal demand from the clean energy transition via the futures market.

The fund seeks to track the Bloomberg Electrification Metals Index. KMET carries futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure needed to meet 2050 net-zero goals.

KMET’s largest allocations currently include copper futures at 30.1% and nickel futures at 24.23%. Lithium futures make up 8.72% of the fund’s investments. KMET has an expense ratio of 0.80%.

For more news, information, and analysis, visit the Climate Insights Channel.