Last year saw electric vehicle sales grow by 40% year-over-year. It’s significant performance when many industries faltered or dragged. However, modest growth forecasts for this year weigh heavily on the industry, creating potential opportunities for long-term investors amidst a more subdued 2024 EV outlook.

“A consensus of reports estimates EV sales to grow by 20% in 2024,” explained Anthony Sassine, CFA, head of MENA and senior strategist at KraneShares in a recent report. It’s “still notable growth compared to established global industries.”

Plummeting prices on an excess of raw metals alongside reduced battery demand dragged on EV industry performance in 2023. Additionally, ongoing U.S. and China tensions and China’s economic challenges led to investor divestment in 2023.

The diversion of sentiment and performance proved pronounced last year. BYD, the largest EV manufacturer in China, beat out Tesla last year for top EV sales globally. Meanwhile, the company’s stock proved volatile, plummeting precipitously on numerous occasions last year.

EV Outlook for 2024 and Beyond

The EV industry faces several challenges this year as battery and metal prices fall and demand slows. However, many of the challenges of last year could drive innovation looking ahead.

Chief among the beneficiaries of reduced metal prices are battery manufacturers. More widely affordable electrification metals leads to greater access for innovators, which could benefit the industry in the long term.

Additionally, Lithium-Ion Phosphate (LFP) continues to grow in EV battery market share, accounting for 46% of EV batteries in 2023. It’s a noteworthy trend given that LFP batteries are the cheapest on the market currently. Reduced lithium prices this year further support this growth, which in turn will help drive EV costs for consumers down.

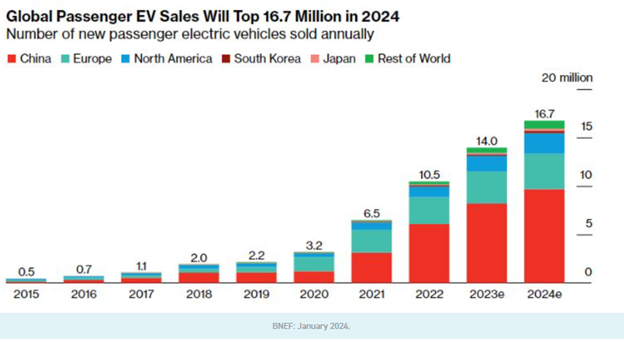

Looking beyond sentiment, it’s also important to understand the role of China in the EV ecosystem. China remains the hub of EV growth globally and is anticipated to dominate 2024 growth as well.

Image source: KraneShares

Given bearish investor sentiment this year, particularly for Chinese companies, and more subdued growth, many EV stocks currently trade at attractive valuations. “Many of these companies are trading at a price-to-sales (P/S) level between 1 and 2,” Sassine explained. It presents a window of opportunity for investors looking at the long-term potential of EV conversion.

Despite short-term challenges, the long-term demand remains significant for EVs as internal combustion engine vehicles are phased out. Last year, Bloomberg forecasted 1.3 billion EV cars replacing their ICE counterparts by 2040. For reference, less than 50 million EVs are currently in use globally.

“We have seen this story unfold before with many cornerstone technology companies, including Google, Facebook, Netflix, and now Tesla,” Sassine wrote. “While sales or subscriber growth may slow for a quarter or two, the long-term transformation story remains intact.”

Invest in the EV Ecosystem With KARS

The KraneShares Electric Vehicles and Future Mobility ETF (KARS) offers a good solution for investors looking to capture the potential long-term growth of major EV producers globally. The fund takes not just a global approach to EV exposure, but also invests along the entirety of the value chain.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically. This includes exposure to electric vehicle manufacturers, electric vehicle components, and batteries. It also includes hydrogen fuel cells and the raw materials utilized in the synthesis of producing parts for EVs.

The fund invests in many familiar car companies such as Tesla, Ford, and Mercedes-Benz, and major Chinese EV manufacturers such as BYD, Li Auto, and Nio. It also goes a step beyond and invests in the companies that contribute to the EV value chain. These include Samsung, Panasonic, and Albemarle, a major lithium manufacturer.

KARS carries an expense ratio of 0.72%.

For more news, information, and analysis, visit the Climate Insights Channel.