2024 has not been a particularly kind year for European carbon allowance (EUA) prices.

Earlier this week, the European Commission noted that in 2023, Carbon emissions under the EU’s emissions trading system dropped by a record 15.5%. While this is a great indicator that Europe’s climate-friendly policies are working, the news does damper EUA prices in the short-term.

However, positive indicators remain for growth in the EUA market. Eurozone inflation dropped despite analyst expectations, providing hope for rate cuts on the horizon. Lowering inflation data could signal increased industry output, adding to EUA demand.

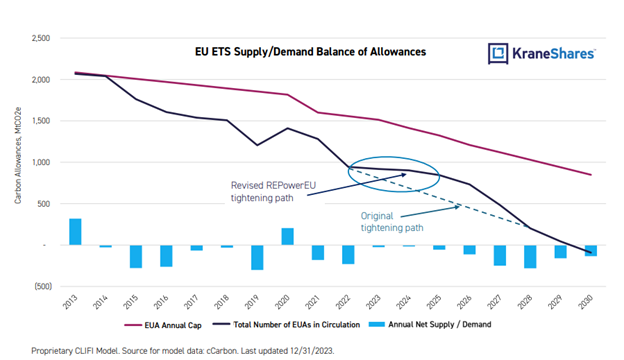

KraneShares asserts that Europe’s carbon allowances market is tightening. Their findings indicate that despite the additional EUAs brought to market, the tightening industry will keep allowances at the same 2030 projections.

Averaging Into EUAs

Luke Oliver, KraneShares managing director and head of climate investments, recently spoke to VettaFi about the EUA market. Oliver recommended averaging into EUAs this year, noting that some bullish pressures are growing among the bearish indicators.

“These markets are double the volatility of equities with higher expected returns, and so [the Sharpe ratio]is better. However, the diversification benefit of that volatility is actually lower overall portfolio volatility. You’ve got to weather this long, and it’s challenging, but this is absolutely a market you want to be long into 2030 and beyond,” Oliver adds.

See More: Luke Oliver Talks Carbon Market Investing in 2024

The KraneShares European Carbon Allowance Strategy ETF (NYSE Arca: KEUA) can provide investors with exposure to the EUA market’s growth potential. KEUA is benchmarked to the IHS Markit Carbon EUA Index and holds EUA futures. The fund has a net expense ratio of 0.79%.

As carbon allowances feature a lower correlation to other asset classes, investing in KEUA can provide traders with global portfolio diversification. While the fund has been in the red as EUA prices have sputtered, KEUA is currently up 3.18% over the last month, signaling possible momentum.

KraneShares features several climate-aligned ETFs in its fund library. One of the larger KraneShares funds, the KraneShares Global Carbon Strategy ETF (NYSE Arca: KRBN), oversees roughly $290 million in assets under management.

For more news, information, and analysis, visit the Climate Insights Channel.