The 2024 macro outlook in the U.S. remains muddled, with persistent inflation seemingly at odds with strong economic data. AI hype and Fed interest rates dominate headlines as well as markets this year. Meanwhile, decarbonization efforts ramp up in the background, creating opportunity for carbon market investors.

I recently sat down with Luke Oliver, managing director, head of climate investments, and head of strategy at KraneShares, to discuss the carbon market outlook for 2024.

Karrie Gordon, staff writer, VettaFi: Luke, thank you so much for taking the time to sit down with me today. Let’s start by looking at the broad outlook in a challenging and uncertain year for investors. What does the macro environment mean for carbon market investing this year?

Luke Oliver, managing director, head of climate investments, KraneShares: I want to start by making the important distinction that climate is not ESG. Climate is investing in the energy transition and the decarbonizing of the global economy. That’s always been our message.

It’s very clear and well-publicized what governments are doing in regard to policy and spending. For investors, it’s being on the right side of that. It’s not about ESG, it’s about real economic opportunities being produced. It’s tectonic in scale, but it’s moving way faster than that.

There are absolutely no signs of pullback on shifting policy or shifting spending. The economic opportunity is about winning the [intellectual property]and winning the race on buildable, scalable, low-carbon processes, mainly in the energy space. But it goes beyond that.

At KraneShares, we know we’re in the right place because we’ve seen lots of copycat and similar thesis ideas launched in spaces we occupy, like metals. We see that as proof that we’re on the right track. In the U.S., we were very early with the transition story in equities. We still believe very strongly in carbon, more than ever, because at these levels, there’s an incredible opportunity.

‘The Real Story for Us Is Europe and California’

Gordon: You’ve been first movers in a number of climate areas, such as carbon allowances, electrification metals, and carbon offset credits. The KraneShares Global Caron Strategy ETF (KRBN) was the first global fund to provide exposure to carbon allowances, and you’ve since expanded the suite to targeted exposures in Europe and California carbon markets. Where do you see opportunities in carbon markets this year?

Oliver: The carbon story for the last two years was that Europe has been priced appropriately. It’s had its price discovery, we’ve seen the big returns, and now it’s somewhat normalized. Those normalized returns are still beating market returns though. They’re inflation-busting returns — we’re still talking about 20 plus percent a year expected returns, whereas California has not had its price discovery moment.

As a result, [California] has quite an explosive upside, and when it normalizes, it still has a very strong structural story. UK and RGGI [Regional Greenhouse Gas Initiative] are somewhat junior versions of the same two stories, but the real story for us is Europe and California.

Now, how that’s changed recently is we’ve started to see California’s price moving. It was up 34% last year, and we are nowhere near the top of where this is going. We can net the present value of the price of carbon today with two simple models and one slightly more complicated one to tell you what the current value of California is. You do that by modeling when we think the surplus [of allowances] runs out, which is 2029.

California’s Carbon Market

Gordon: Talk to me about how you forecast prices and your models. Can you explain why you’re so constructive on California specifically?

Oliver: If there’s no surplus, that means companies will have to purchase from the first liquidity tier in the program. It’s easy to model that price because it’s inflation plus 5%. That’s currently adjusted to $56. Then we can assume inflation starts to come down — maybe it does, maybe it doesn’t — but we can forecast that to 2029. The third model is discounting that back to today, using a risk-free rate. What you end up with is about $66 a ton, and we’re trading at $42 a ton.

Don’t forget there is a liquidity tier that isn’t at $66 yet. Our present value has to be wherever the liquidity tier is, which is $56. From $42 to $56 is a lot; it’s incredible. Why isn’t the price there yet? Because the market is pricing the bid like a commodity and where the demand/supply is today.

They’re thinking about oil or power or gas; they’re not thinking about a financial asset. A carbon allowance is a financial asset — it doesn’t need to be transported, refined, and doesn’t go bad.

Average Into the European Market

Gordon: You highlighted Europe as the other area of opportunity this year. Would you expand on that?

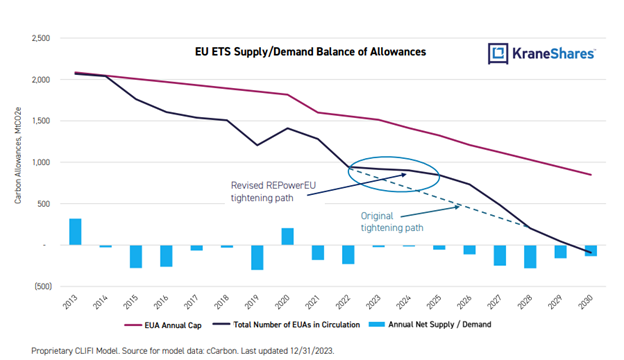

Oliver: What’s exciting is that the European carbon market has had a massive price correction back to its 80 to 100 euro range. There’s no reason it’s not trading out. The REPowerEU means they front-loaded auctions. Our model originally was declining surplus, but since they auctioned more now, they’ll auction less in the three subsequent years. In either model, you end up mathematically in the same place by 2029.

Image source: KraneShares

However, if you’re a commodity trader in gas, oil, or power, there’s always pressure to sell and clear at the clearing price today. It’s incredibly expensive to store it, and you either use it or lose it. When the curve is flat, there are a lot of market participants that will short it and then go really long when it starts to roll over.

As a buy-and-hold strategic investor, you just want to be long, and you can get long right now at depressed prices. If we’re trading at 55 euros and it’s going back to 90 euros — which isn’t even the forecast of 140 euros minimum — that’s an almost 60% rally. That’s incredible.

Gordon: Luke, this has been both educational and incredibly insightful. One last question for you: What advice do you have for carbon investors in 2024?

Oliver: For us, there is a great buying opportunity this year. I would be acquiring California and Europe over the next six months. In California, you’d be buying on the way up, and there might be a pullback, so you want to average in and pick some of that up. If it keeps going up, you’ve missed out on some downside but you’ve managed your risk a little bit. In Europe, you just want to average in, because it might go lower than this. That’s OK, because when the market turns, all the shorts have to come out.

These markets are double the volatility of equities with higher expected returns, and so [the Sharpe ratio]is better. However, the diversification benefit of that volatility is actually lower overall portfolio volatility. You’ve got to weather this long, and it’s challenging, but this is absolutely a market you want to be long into 2030 and beyond.

For more news, information, and analysis, visit the Climate Insights Channel.