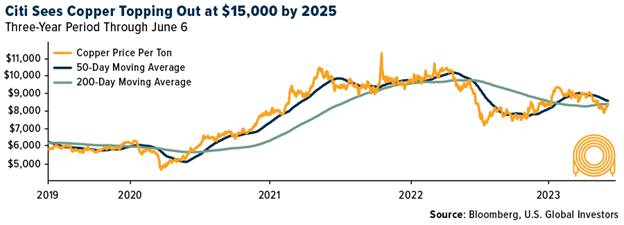

Copper prices continue to fall on concerns of recession and demand pullback in the second half of the year. Despite short-term challenges, copper prices have the potential to nearly double within the next two years, presenting a window of opportunity for investors to capture the next major commodity bull run.

The price of copper per ton averaged $8,243 in May, down 6.4% month-over-month and 12.3% year-over-year. China’s sluggish recovery led to lower-than-expected manufacturing demand in recent months, creating further headwinds for copper. China makes up approximately half of global copper demand.

Image source: Bloomberg

Citigroup’s managing director of commodities research, Max Layton, told Bloomberg that he estimates copper could reach as high as $15,000 per ton within the next two years. The potential for stunning gains could “make oil’s 2008 bull run look like child’s play,” Layton said.

Copper will likely fall a bit further this year, but Citigroup said it could have the potential to rally in the next six months to a year as the full scope of future global copper demand takes hold. The metal is one of several core components for electric vehicles. Demand for internal combustion engines is likely to peak within the next two years, according to Bloomberg. EVs could make up as much as 44% of the new vehicle market by 2030.

Meanwhile, discovery of new copper deposits slowed dramatically in recent years, according to S&P Global. Between 1990–2019, 224 new copper deposits were discovered with a collective 1.08 billion tons of copper in reserves. Only one of those was discovered after 2015, and only 16 were found between 2009–2019.

“While there is still an abundance of undeveloped discoveries, most are smaller or low grade, with relatively few high-quality assets available for development,” the authors wrote.

Collectively, the supply and demand imbalance is likely to tilt heavily in favor of copper price appreciation in the coming months and years.

See also: “Declining Metal Prices Create Window of Opportunity”

Capture the Commodity Bull Run Potential in Copper With KMET

Advisors and investors looking to gain exposure to copper ahead of price recovery and gains should consider the KraneShares Electrification Metals ETF (KMET). KMET offers targeted exposure to the metals necessary for electrification, such as copper. The fund offers exposure to growing metal demand from the clean energy transition via the futures market.

The fund seeks to track the Bloomberg Electrification Metals Index. KMET carries futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure needed to meet 2050 net-zero goals.

KMET’s largest allocations currently include copper futures at 24.38% and a 24.38% allocation to nickel futures. The fund has an expense ratio of 0.79%.

For more news, information, and analysis, visit the Climate Insights Channel.