Commodities face a number of headwinds this year as recession concerns cast a long shadow over much of the space. It’s an environment of opportunity for metal investors, given long-term demand forecasts for electrification metals that are likely to benefit prices.

Fossil fuel oversupply continues to contribute to price declines for crude oil and natural gas. Meanwhile, recession fears dampen the outlook for most commodities, including metals. The S&P GSCI nickel index is down 28.19% YTD, and the S&P GSCI aluminum index is down 6.84%. Copper has fared better and is relatively flat for the year, down just 0.99% YTD, while zinc is down 20.01% YTD (measured by respective S&P GSCI indexes).

Declining metal prices create opportunity for long-term investors, particularly within metals required for electrification. As the global economy reduces emissions to meet net-zero 2050 goals, forecasts call for strong demand within these metals.

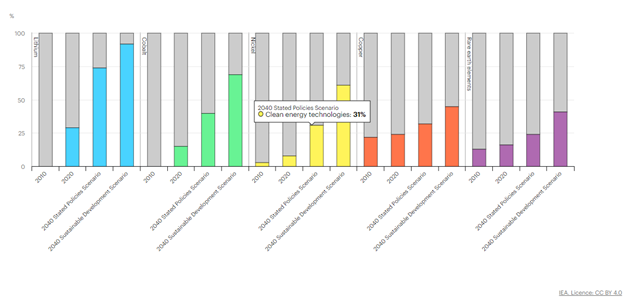

Image source: International Energy Agency

Demand for many key electrification metals will be driven from a variety of renewable energy technologies. Copper is critical for solar, wind, bioenergy, EVs and battery storage, and bioenergy renewables. Meanwhile, nickel demand is critical within geothermal, hydrogen, and EV and battery storage operations.

The International Energy Agency forecasts that by 2040, mineral demand from renewable energy technologies will double as a base case scenario. In an optimal scenario that successfully mitigates emissions by 2050, that demand will quadruple.

Capture Long-Term Support for Metal Prices With KMET

Given the long-term demand outlook for electrification metals, there is a strong buying opportunity now for investors. The KraneShares Electrification Metals ETF (KMET) offers targeted exposure to the metals necessary for electrification. The fund offers exposure to growing metal demand from the clean energy transition via the futures market.

The fund seeks to track the Bloomberg Electrification Metals Index. KMET carries futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure needed to meet 2050 net-zero goals.

KMET’s largest allocations currently include copper futures at 24.68% and a 24.62% allocation to nickel futures. The fund has an expense ratio of 0.79%.

For more news, information, and analysis, visit the Climate Insights Channel.