Despite a rocky first quarter for the world’s two largest regulated carbon markets, the outlook for the year remains positive. Investors currently have a rare opportunity to gain exposure to carbon markets at reduced prices. These markets are set to benefit from global decarbonization efforts with strong fundamentals looking ahead.

EU Carbon Market

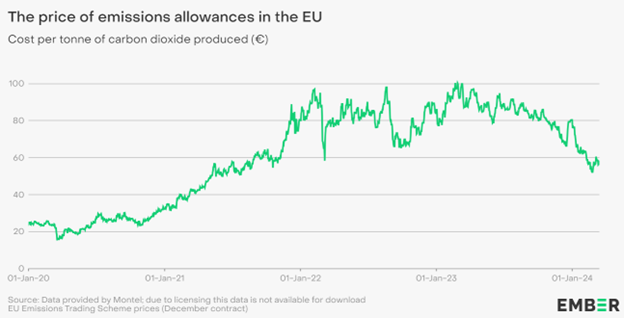

It’s been a rough start to the year for European Union Allowances (EUAs). Current declines are largely driven by a reduction in emissions from fossil fuels. Electricity derived from coal dropped 25% in 2023, while gas dropped 17% according to the KraneShares Climate Market Now blog. Alongside reduced emissions from fossil fuels were industrial output cutbacks due to soaring natural gas prices.

“But the peak in energy prices – specifically natural gas – is behind us now,” KraneShares wrote. This means “prices for fuel are at their lowest level in two years, dating back to before Russia’s invasion of Ukraine.”

Gas prices normalizing creates a constructive outlook for EUA prices, alongside an improving economic and macro outlook.

See also: “Luke Oliver Talks Carbon Market Investing in 2024”

In Europe’s carbon market specifically, the impact of REPowerEU continues to play a role in current prices. Enacted last year, the plan was Europe’s response to weaning itself from reliance on Russian fossil fuels.

The plan seeks to fund that transition by front-loading carbon allowances to auctions between 2023-2026. Beginning in 2027, auctions will reflect the shortened supply. Additionally, the existing “Fit for 55” plan increases annual cap reductions and continues to bring new industries into the market.

“This additional tightening of the market … could boost EUA prices back to the €100 level and even higher,” KraneShares said of analyst expectations.

EUAs traded at 56.04 euros/tonne as of March 12 compared to 99.79 euros/tonne one year ago.

Image source: Ember

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. The fund’s benchmark is the IHS Markit Carbon EUA Index. This benchmark tracks the most-traded EUA futures contracts, the oldest and most liquid carbon allowances market. Currently, the market covers roughly 40% of all EU emissions.

California Looks to Tighten Regulatory Trajectory

The California Air and Resources Board is currently in discussions with lawmakers regarding tightening. Current market expectations put emissions reductions at 48% by 2030, up from the current 40%.

The joint California and Quebec market continues its aggressive tightening policies. Further cap reductions will prove constructive for California Carbon Allowance (CCA) prices.

“With this comes a faster absorption of the market’s existing surplus,” KraneShares explained. This results in “turning the market net short of allowances after 10 years of annual excess supply.”

Thus far, most industries in California have yet to begin serious decarbonization efforts. Current CCA prices are mostly derived from changing from coal to gas for power sources. As coal power plants are decommissioned however, industrial plants will become the focus.

Meanwhile, the KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance markets. KCCA is a fund that offers exposure to the California cap-and-trade carbon allowance program, one of the fastest-growing carbon allowance programs worldwide. Its benchmark is the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

For more news, information, and analysis, visit the Climate Insights Channel.