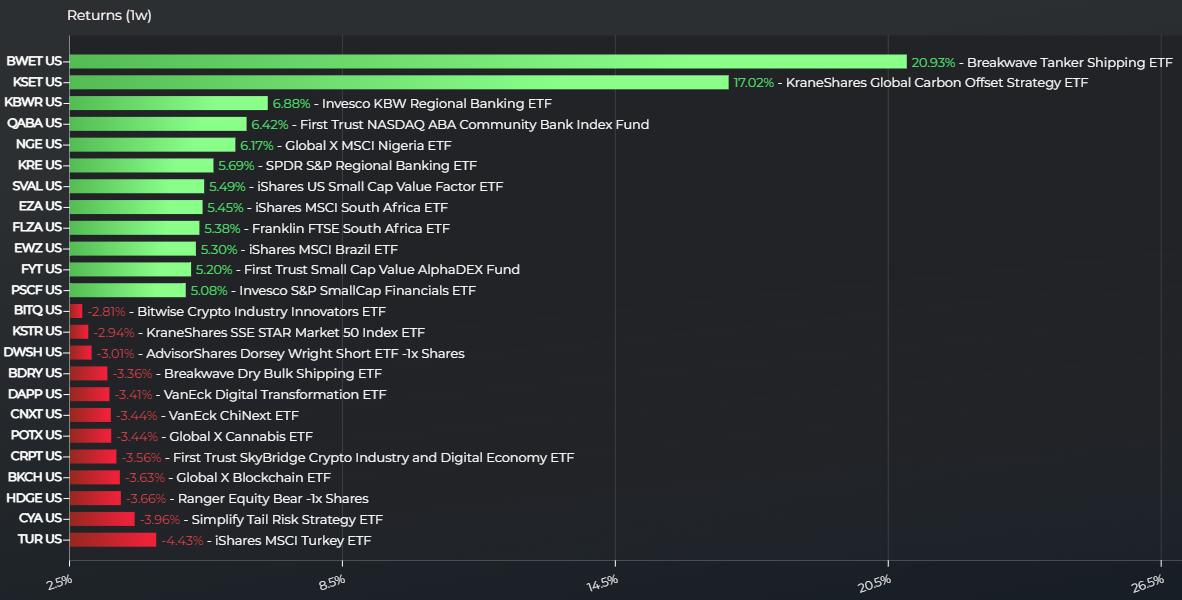

In this edition of the top weekly ETF performers, KraneShares stood out with carbon offset ETF KSET. The KraneShares Global Carbon Offset Strategy ETF (KSET) returned 17% for the week, only outperformed by the Breakwave Tanker Shipping ETF (BWET). KSET’s performance arrives as ESG strategies have struggled, but also as climate change-related wildfire smoke choked the northeast United States.

See more: “European Carbon Allowances Up 10%: A Summer Guide”

KSET tracks the S&P GSCI Global Voluntary Carbon Liquidity Weighted Index, which holds futures contracts on voluntary carbon offset credits. The ETF stands out as the first U.S.-listed global carbon offset ETF, offering exposure to both CME-traded Global Emissions Offsets (GEOs) and Nature-Based Global Emission Offsets (N-GEOs). KSET charges 79 basis points and launched just last April.

Intriguingly, KSET stands out as the lone environmentally-focused ETF in the top twelve performers of the last week. Most ETFs for the week focused on foreign equities and financials, instead.

For example, the Invesco KBW Regional Banking ETF (KBWR) returned 6.9% for the week, adding $3 million in net inflows over the last month. It has also turned around -18.4% YTD returns into 15.2% returns over the last month. The SPDR S&P Regional Banking ETF (KRE) also made the list, returning 5.7%.

In foreign equities ETFs, African economies led for the week, with two South Africa ETFs joined by one Nigeria-focused fund. The iShares MSCI South Africa ETF (EZA) and the Franklin FTSE South Africa ETF (FLZA) ETF returned 5.5% and 5.4% respectively. The Global X MSCI Nigeria ETF (NGE), meanwhile, returned 6.2%.

Those returns could relate to the same forces that are boosting BWET, commodities. BWET only launched last month but has returned 23.6% over the last three months, charging 350 basis points. The ETF provides long-only exposure to the crude oil tanker shipping market via near-dated wet freight futures contracts.

Carbon offset ETF KSET took a leading position in one-week returns per LOGICLY.

For more news, information, and analysis, visit the Climate Insights Channel.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.