In the race to net-zero emissions by 2050, an increasingly sizeable piece of the emissions reduction puzzle falls to carbon capture and removal technologies. Understanding where carbon abatement technologies currently stand and their impact on the world’s most established carbon allowances market gives advisors and investors a window into the future of carbon allowance investing and emissions reductions.

Carbon capture technologies receive noteworthy funding from carbon allowances markets and will impact carbon allowance prices in the long term. Oktay Kurbanov, partner at Climate Finance Partners (CLIFI), took a look at where abatement technologies stand now and how far out the inflection point is for impact on EU allowance prices in a recent paper.

“In the discussions of carbon allowance future price trajectories, the cost of abatement technologies often comes up as a fundamental factor that may set a “ceiling” on European Union allowance (EUA) prices,” Kurbanov wrote.

Rising carbon allowance prices at some point in the future will cross the threshold at which carbon abatement technologies exist. At this point, it holds that most companies will opt for the abatement technologies that reduce or eliminate emissions. Funding for the transition would come from selling unused allowances or savings from not purchasing them in the first place.

The long-term goal of any allowance market is to drive meaningful emissions reductions across industries. In theory, widespread CCS adoption creates a potential headwind for EUA prices, but the reality is still a long way off.

Barriers to Widespread Carbon Capture and Storage Adoption

The price threshold at which carbon capture and storage (CCS) technology becomes a viable emissions solution remains out of reach in the mid term.

Image source: KraneShares

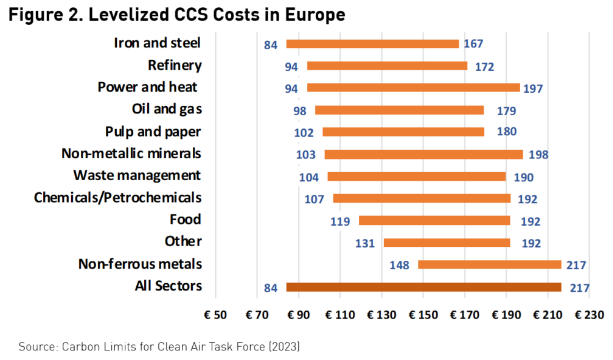

“The target level of EUA prices to incentivize mass adoption of the CCS abatement technology in Europe is estimated to be €165 [$216 USD], which is 80% higher than current EUA prices,” Kurbanov explained. EUA prices currently sit around €90 ($118 USD).

Current regulations estimate that by 2030, carbon capture and storage technologies will account for just 3%–4% of the current emissions cap. This target remains well beyond current capabilities and requires 26 times the capture of today’s CCS.

CCS technologies also remain cost prohibitive on any large scale in their current iteration.

“Given high capital intensity, scaling CCS technologies will require attracting private capital,” Kurbanov wrote. That capital means that carbon allowance prices will need to offer a “return premium” for EUAs substantially above CCS costs.

What’s more, to scale existing carbon capture technologies requires a significant buildout of infrastructure and regulatory support. Kurbanov noted the notoriously slow process of EU legislation as a hurdle to transition.

“Many EU countries with high emissions do not have the required geological capacity for CO2 storage,” Kurbanov explained. Captured emissions will need both the regulatory channels and the infrastructure to transport cross-border to countries with capacity for storage. The beginnings of this process can be seen in individual agreements between Germany, the Netherlands, and Norway. However, continent-wide capabilities and support remain years away.

See also: “How to Invest in the Biggest Macro Trend in History“

Investing in the Long-Term Outlook for EUA Prices

A more definitive picture exists now for long-term emissions reductions and the role of CCS in that process. The picture remains fairly out of focus for now, given the number of hurdles to widespread CCS adoption and current EUA prices.

“Based on current project economics and risk factors, EUAs have a long way to go,” according to Kurbanov.

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. The EU carbon market covers over 12,000 participants and a variety of industries. Participation is mandatory for companies within predetermined industries such as power, agriculture, industrial, and aviation.

The fund’s benchmark is the IHS Markit Carbon EUA Index. This benchmark tracks the most-traded EUA futures contracts, the oldest and most liquid carbon allowances market. Currently, the market covers roughly 40% of all EU emissions, including 27 member states and Norway, Iceland, and Liechtenstein.

KEUA has an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.