Semiconductors, AI, crypto — megatrend investing remains a popular option for all manner of advisors and investors. Megatrends remain ever changing but there’s an even larger super cycle in global markets that many investors may be missing. In fact, it’s the most substantial macro capital trend in modern history and it’s happening right now.

Decarbonization is “a trend that is bigger than any macro megatrend that we’ve seen to date,” explained Luke Oliver, head of climate investments at KraneShares, in a recent video.

“Regardless of your politics, regardless of your views on climate, on ESG, we are decarbonizing the global economy,” Oliver said. “The commitments are made, the money is in flow, and we are seeing the largest capital cycle in history.”

The shifting of economies and industries to decarbonize will take an enormous sum of money. Around $250 trillion will need to be invested to meet 2050 net zero goals according to McKinsey estimates. Of that, Oliver explains that $130 trillion funnels into the energy transition specifically. It’s a monumental shift that the KraneShares climate ETF suite is positioned to capture and capitalize on.

“The real capital moves towards real solutions with real economic return” Oliver explained. Those solutions present investors with a number of ways to capture the major economic shift towards net zero. This includes equity capture via transitioning companies or high-demand metals for electrification. It also includes investing in carbon allowances and carbon markets.

“Your portfolio is short this story,” Oliver cautioned. The majority of investors currently remain unhedged against decarbonization impacts or long transition solutions.

3 Pillars to Capture the Carbon Macro Trend

Carbon Markets

Image source: KraneShares

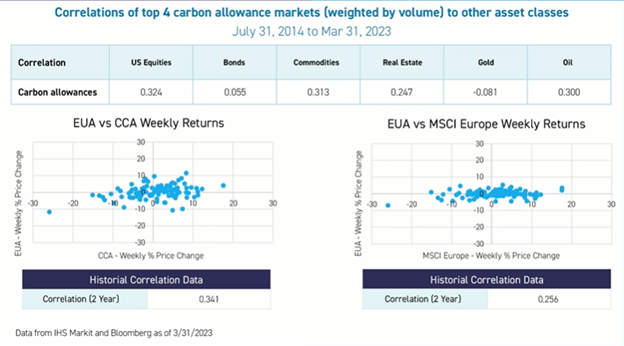

The carbon market is the place where investors can find both growth and diversification opportunities looking ahead. Global cap-and-trade, or carbon allowance markets, are regulated markets that governments use as mechanisms of change. Carbon markets put prices on emissions and pollution, and the major markets utilize tightening mechanisms to reduce supply and increase demand.

Despite economic slowing and challenges, it’s a space with upside potential in the coming years. Larger investors are already positioning to capture.

“We’re seeing the institutions, the ultra-high-net-worth family offices gravitating towards these carbon markets,” explained Oliver. “This is where the smart money is moving.”

KraneShares’ carbon allowances suite of funds includes the KraneShares Global Carbon Strategy ETF (KRBN). KRBN invests in carbon allowances futures globally from the EU, California, RGGI, and the U.K. More targeted options include the KraneShares European Carbon Allowance Strategy ETF (KEUA) and the KraneShares California Carbon Allowance Strategy ETF (KCCA).

See also: “Luke Oliver Talks Carbon Allowances and Innovation“

Barbell Opportunities in Equities

Equities present another opportunity to capture the decarbonization cycle. This includes a long position in what Oliver refers to as the “solutions”. This includes electric vehicle manufacturers and future mobility companies. These companies are already growth-oriented and most likely to propel decarbonization forward at a faster rate.

It also includes investing in companies currently considered dirty but those that are actively working to transition to renewables and net-zero emissions.

Companies that transition have an outsized impact during their transition, and after, Oliver explained. “They’re also being revalued as this old, traditional, industrial stock to a fast-growing, green energy or green tech firm.”

The KraneShares Electric Vehicles and Future Mobility ETF (KARS) invests across the EV ecosystem. KARS captures the growth in batteries, hydrogen fuel cell manufacturing, EV production, and more.

The New Economy Carries New Commodity Demands

Transitioning to net-zero emissions means an increase in electric vehicles and EV batteries. It also means increasing renewable energy sources such as solar panels and upgrading electrical grids. This in turn will create increased demand for several specific metals. These metals include lithium, cobalt, copper, aluminum, and more.

“There is going to be a huge demand for these particular commodities over the next five to 10 years,” said Oliver. This increased demand will meet supply constrictions and create a material repricing of electrification metals.

“These metals are going to be the driver of future energy and not fossil fuels,” Oliver explained.

The KraneShares Electrification Metals ETF (KMET) offers targeted exposure to the metals that will be necessary for electrification.

See also: “Luke Oliver Talks Climate: Making Money and Saving the Planet“

For more news, information, and analysis, visit the Climate Insights Channel.