Throughout the year, persistent inflation — including everyday costs like gasoline and groceries — has eaten into wage growth and created a broad impact across the labor market. Earlier this year we saw labor strikes for airline pilots, manufacturers, package delivery workers, and probably most famously, the Hollywood strike which has caused production issues across the media industry. The latest labor story has been the auto strikes, which could have a considerable impact on GDP and several auto stocks. This note looks at an overview of the impact on auto stocks and the extent to which auto ETFs are affected.

Cost of living increases have been the largest driver behind labor strikes.

The United Auto Workers (UAW) Strike began on September 15, 2023, and has continued throughout the end of September after several attempts to negotiate. Around 12,700 auto workers went on strike at the three large automakers Ford Motor Co (F), General Motors (GM), and Stellantis (STLA). Workers are asking for a mid-30% wage increase over four years (down from the initial ask of 40%). The strike was fueled by certain factors including higher CEO pay and controversy over the transition from traditional internal combustion engine (ICE) vehicles to electric vehicles. While the transition has the potential to create jobs, it will likely also take away some jobs from traditional auto workers. However, the main driver seems to be higher inflation and a higher cost of living relative to wage increases.

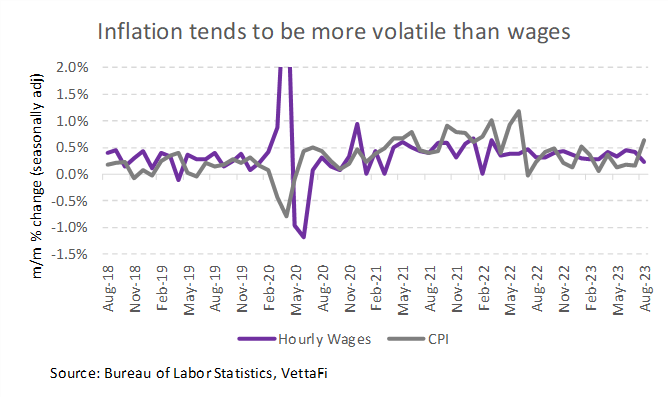

Over the past couple of years, many companies have continued to outperform in an inflationary environment by 1) growing their revenue by passing price increases onto consumers and 2) growing their bottom line by cutting costs. Labor costs are typically one of the largest expense items for a corporation (see last week’s note for more details on company margins). And while overall wages have been rising, they have not been keeping up with the cost of living. In August, inflation measured by the CPI was up 0.6% m/m while wages were up only 0.2%. Wages are also considerably less volatile than inflation month-to-month.

Impact of auto strikes not hitting all auto stocks equally.

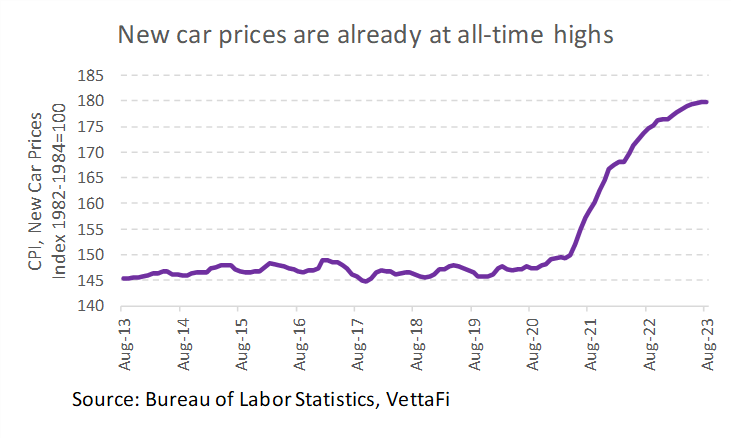

New car prices are already averaging at an all-time high (close to $48,000 at the beginning of 2023). It is possible that the strike could disrupt the supply of vehicles — which is still fragile from the pandemic — and cause even higher vehicle prices. In this case, because prices are already so high, higher automobile prices may not benefit these companies. But this may make other competitors more attractive. Honda Motor Co (7267 JP), for example, does not have a unionized labor force in the United States. Leading EV manufacturer Tesla (TSLA) also does not have unionized labor. Their prices may remain relatively more stable when compared to those companies affected by the auto strike.

Regarding EVs, Tesla has had to cut prices due to increased competition from legacy automakers. With several of these companies now faced with higher wage costs, they may have to cut back on investment in electric vehicles. Ford, which has already made some concessions to laborers, has reportedly paused work on its new $3.5 billion electric vehicle battery plant in Michigan.

ETFs that follow automotive trends typically lean toward electric and autonomous vehicle technology.

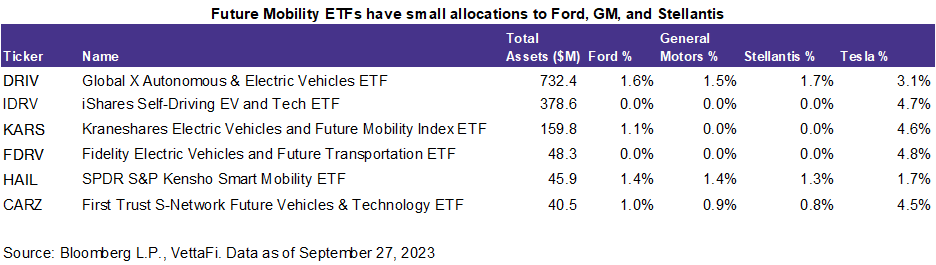

Cost issues are difficult to predict even when following research by experienced analysts. Stock price movements aren’t always predictable either. Ford, GM, and Stellantis, for example, haven’t demonstrated meaningful price movement since the beginning of the strikes. Long-term investors may prefer to hold an ETF that has diversified auto holdings instead of trying to decipher short-term price movements. There are currently not any ETFs that represent the traditional auto industry. Instead, several future mobility ETFs include legacy automakers like Ford, GM, and Stellantis in addition to EV manufacturers and other enabling technologies. While these three stocks are typically large holdings in future mobility ETFs, they are typically well-diversified among other holdings and have a much smaller weight than Tesla. If these three companies see a negative impact from the auto strike, likely, these future mobility ETFs won’t see a significant impact.

For more news, information, and analysis, visit the Climate Insights Channel.