Some investment trends seem obvious — people are watching more streaming movies, consumers like shopping online, and more people are buying electric cars. So why don’t these ETFs always work?

ETFs serve as wrappers, so performance of an ETF will depend on its holdings. In many cases, ETFs hold stocks, so the key to understanding your ETF behavior is having a basic understanding of how stocks work. This note discusses how analysts look at stocks and why an ETF may not always immediately reflect the behavior you would think.

Analysis Often Starts With a Broader Set of Assumptions.

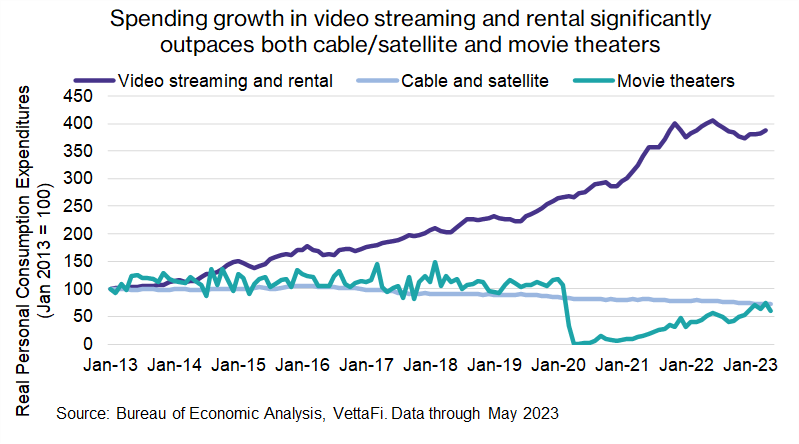

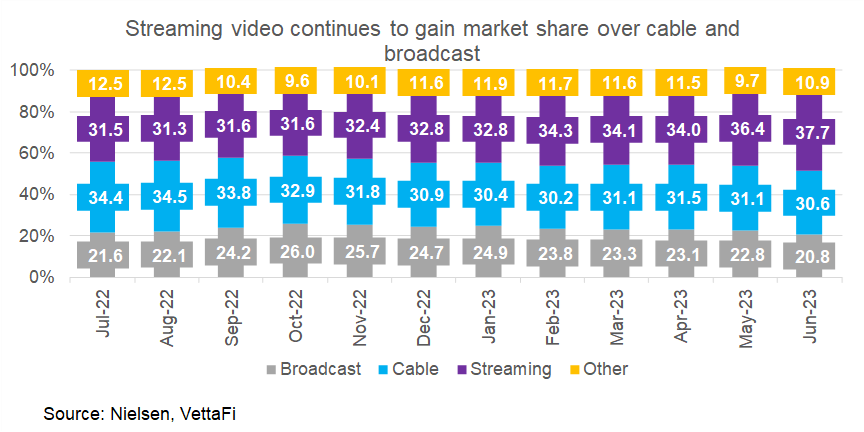

Typically, analysts start with broader assumptions that drives demand which ultimately drives revenue or top-line growth. For example, for streaming stocks we can assume that streaming demand is growing for several reasons: 1) more connected devices, faster internet with wider reach, 2) shift away from cable/satellite and shorter theatrical windows, and 3) rise in original content that makes streaming services more appealing. We can look at broader macro data e.g., consumer spending on streaming and video rental from the Bureau of Economic Analysis or streaming services market share from Nielsen.

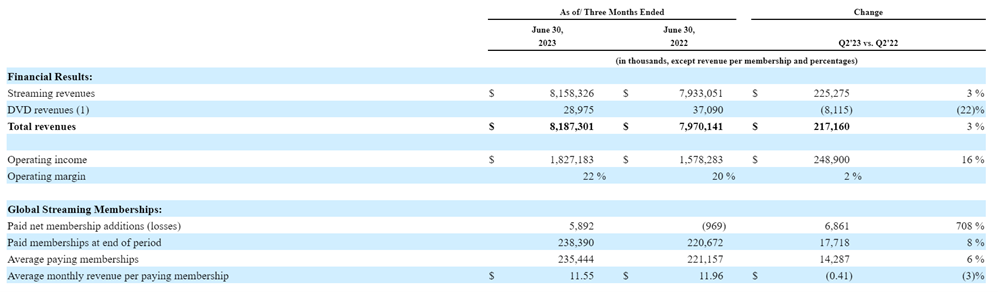

These assumptions can serve as a baseline for volume and revenue but are often tweaked with management guidance or analyst assumptions. Let’s look at a simple stock like Netflix (NFLX). In the case of Netflix, volume would be the number of subscribers and pricing would be the cost per membership. On a basic level, pricing x volume = gross revenue. Or in Netflix’s case: average paying memberships x average monthly revenue per paying membership x 3 = quarterly streaming revenues.

However, here is where some idiosyncrasies are first seen — Netflix revenue has grown at a faster rate than the broader industry which makes sense because: 1) Netflix is the dominant player in the industry, 2) Netflix recently cracked down on password sharing, forcing people to share an account to create a new account, and 3) Netflix added lower price tiers which may have enticed additional people to join (which is why average pricing went down but the amount of subscribers increased enough to boost revenue).

Source: Netflix, Inc. Form 10-Q, July 21, 2023

How Does Revenue Diverge From Earnings?

While top-line revenue assumptions are important, costs are where you typically see the most variance from broader trends. Companies typically have costs like marketing, general and administrative, and salary expenses. After taking these expenses out, you are left with the operating income (or EBIT, which stands for earnings before interest and taxes). Generally, a successful company can grow revenue at a faster pace than it can grow expenses.

But this can vary significantly depending on several factors. First of all, broad macro factors can also affect costs. During the pandemic, it was not possible to travel so travel expenses went down. And with many companies laying off employees, they’re looking to save on salary expenses without losing revenue. In the case of Netflix, the company is profitable, but it is investing more money into marketing its original content—so marketing costs may be elevated compared to other quarters.

What Does This Actually Mean for Stock Performance and Therefore ETF Performance?

Companies are rarely valued by revenue except in cases where a company is in a new high growth industry—for example, many electric vehicle companies are valued off of revenue estimates since they are not yet profitable. But in most cases, companies are valued off of EBITDA (earnings before interest, taxes, depreciation and amortization) or even further down the line by earnings per share (EPS). It is possible (and common in certain cases) for a company to have significant top-line growth but still not be profitable.

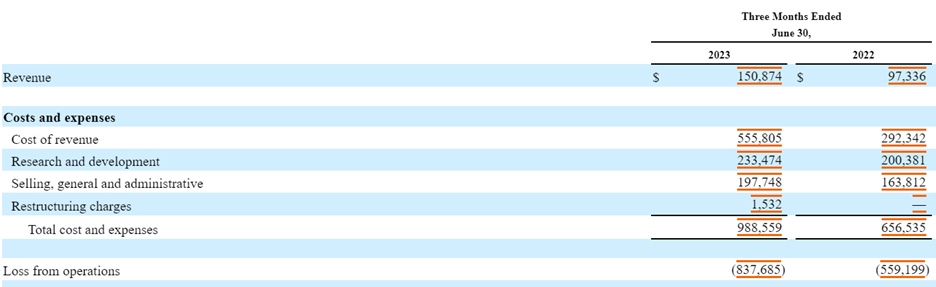

Going back to our example of electric vehicle companies, companies like Lucid Group (LCID) have finally reached revenue after many quarters of supply chain issues that delayed deliveries. But they are still in the negative for operating income and EPS due to high production costs and high research and development costs, among other expenses. (Interesting fact—besides Tesla, most electric vehicles are not yet profitable. Legacy automakers that make both EVs and traditional vehicles make money on traditional internal combustion engine vehicles while losing money on their EV alternatives).

Source: Lucid Group, Inc. Form 10-Q, August 7, 2023

To sum it up, a stock won’t always make money even if all the macro and industry conditions are right. On top of this, stocks often trade on investor sentiment, and it can be difficult to predict the direction of a stock price even with sound assumptions.

What Does This Have to do With ETFs?

Investors will often own an industry or thematic ETF because they believe a certain trend will prevail, for example, streaming, electric vehicles, or e-commerce as I mentioned above. While these trends are real and materializing in terms of overall industry revenue, it often does not always translate into stock performance or ETF performance because of idiosyncrasies in individual companies. This can be frustrating for investors who can clearly see a trend in EV demand, for instance, but see a single company like Tesla outperforming an EV ETF like the Global X Autonomous & Electric Vehicles ETF (DRIV) or the iShares Self-Driving EV and Tech ETF (IDRV). Or also for investors who are struggling between investing in Netflix or an ETF like the First Trust S-Network Streaming and Gaming ETF (BNGE).

Many investors do keep a large portion of their portfolio in stocks, particularly well-known stocks like Netflix or Tesla mentioned above. But since a lot of trends are newer themes with few pure-play companies, it is easier for an investor to miss out on some of the growth potential of smaller stocks outside of the Netflixes or the Teslas.

These smaller stocks may not be household names and there may also not be enough available research out there for an investor to make their own decision. That is why it may be easier to invest in pre-set portfolio of these names. Industry or thematic ETFs can serve as smaller satellite positions in portfolios so there is not much pain if the ETF underperforms but a greater reward if the ETF outperforms (i.e., many investors are willing to risk small shocks of 1-2% in their portfolio in exchange for the potential of gaining 1-2%).

While it’s sometime difficult to balance out expectations vs. reality when it comes to broader trends and how they apply to investments, in many cases top-line revenue trends are more persistent and eventually outweigh inconsistencies and cost issues on a company level. Using an ETF balances out some of that single-stock risk, while maintaining exposure to an overall investment trend.

VettaFi will host its Equity Symposium webcast on September 21, 2023 at 11AM ET/8AM PT. Free registration available here. This event is eligible for CE credits.

For more news, information, and analysis, visit the Equity ETFs Channel.