The United Nations World Meteorological Organization (WMO) issued a “red alert” warning for the climate crisis after 2023’s record-breaking year. This year looks to smash even more climate records and underscores the need for aggressive response, investment, and action.

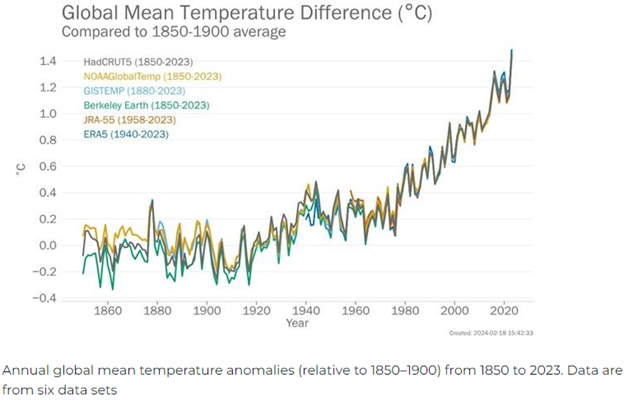

The WMO officially declared 2023 the hottest year on record, with surface temperatures averaging 1.45 ° Celsius. That’s according to the latest State of the Global Climate 2023 report released last week. That number will likely edge even closer this year to the 1.5 ° C threshold set by the Paris Agreements. The last decade was the warmest on record.

“Sirens are blaring across all major indicators… Some records aren’t just chart-topping, they’re chart-busting,” said UN Secretary-General António Guterres in the WMO press release. “The WMO community is sounding the Red Alert to the world.”

Image source: WMO

For many people, last year brought record heat in the warm months, as well as prolonged heatwaves. For others, climate disasters in the form of floods, droughts, wildfires, and intense tropical cyclones. As the world warms further, the likelihood of natural disasters, as well as their intensity, increases.

A dangerously warming world threatens food security and widens inequality margins globally. Weather catastrophes also cause increasing population displacement.

Why Climate Investing Matters

It’s almost irrelevant whether investors buy into climate strategies for impact or opportunity. In the climate transition, any climate investor stands to benefit enormously.

Renewable energy sources continue to make huge strides in their contribution to power grids. Last year renewable energy capacities nearly doubled to 510 gigawatts, a multi-decade high reported WMO.

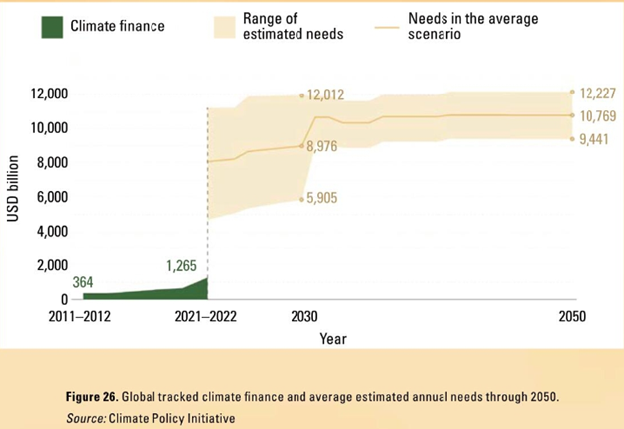

As far as renewable energy strides have come, there is substantially further to go. The same holds true for climate investing. Clean energy investing reached $1.8 trillion last year according to BloombergNEF. However, that number must surpass $4.8 trillion annually to meet Paris Agreement goals. Other estimates put that number high or lower, but all agree that an exponential increase is necessary in the coming years.

Image source: WMO

“The cost of inaction is even higher,” WMO wrote. “Aggregating over the period 2025-2100, the total cost of inaction is estimated at USD 1,266 trillion.”

While investment needs are high, the potential benefits to climate transition investors are equally substantial.

“It’s not about ESG, it’s about real economic opportunities being produced,” Luke Oliver, managing director, head of climate investments at KraneShares said in a recent interview with VettaFi. “It’s tectonic in scale, but it’s moving way faster than that.”

See also: “Luke Oliver Talks Carbon Market Investing in 2024”

Portfolios stand to benefit by being on the correct side of the climate transition as industries and countries decarbonize. One method of capturing that transition is through carbon allowance investing.

Carbon allowance markets are heavily regulated and bring increasing pressure to bear on polluting companies. They do this by tightening supply, either annually or in an expected trajectory, thereby raising prices over time. KraneShares offers a number of ETFs with exposure to the major global carbon markets.

The KraneShares Global Carbon ETF (NYSE: KRBN) was the first of its kind to offer an investment take on carbon credits trading. The fund provides diversified exposure to major carbon markets worldwide and is one of the only major funds to target RGGI.

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. The fund’s benchmark tracks the most-traded EUA futures contracts in the oldest and most liquid carbon allowances market.

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance market. This includes California’s cap-and-trade carbon allowance program. It’s one of the fastest-growing carbon allowance programs worldwide.

For more news, information, and analysis, visit the Climate Insights Channel.