Foreign investors remain reticent when it comes to investing in China. It’s no surprise, given the country’s slow recovery this year and tensions between the U.S. and China. As China rolls up its sleeves in the second half to support continued recovery, however, it means many investors are missing out on strong gains in China-centric funds, such as the KraneShares CSI China Internet ETF (KWEB).

The picture in China remains a complex one. The government continues to roll out supportive policy measures aimed at boosting consumption and providing stability in real estate. Indeed, at this week’s Politburo, government officials indicated several areas the government is looking to shore up in the second half.

See also: “China Tees Up for More Policy Support, KBA Gains”

Meanwhile, the country grapples with stunning youth unemployment rates, with more than 20% of urban youth unemployed as of June. It’s also no secret that the strong recovery forecast has been stuttering at best this year as the country grapples with reduced demand both overseas and domestically.

That said, one of the primary areas that officials continue to look to in supporting growth and recovery is what they term the “platform economy”. These are the internet giants that are China’s growthiest companies, comprised of big names like Alibaba, Tencent, and more.

The Politburo specifically mentioned support of the platform economy according to KraneShares. It follows on the heels of officials declaring regulatory risk over in the sector earlier this month, a major headwind of the last year and a half.

See also: “An End to Regulatory Risk in China’s Internet Sector”

Don’t Miss Out as KWEB Gains

A brightening outlook for the sector resulted in strong gains in the KraneShares CSI China Internet ETF (KWEB) this month, particularly in the last week. What’s more, investors are pouring back into the fund; KWEB has net flows of $330 million this month as of July 26.

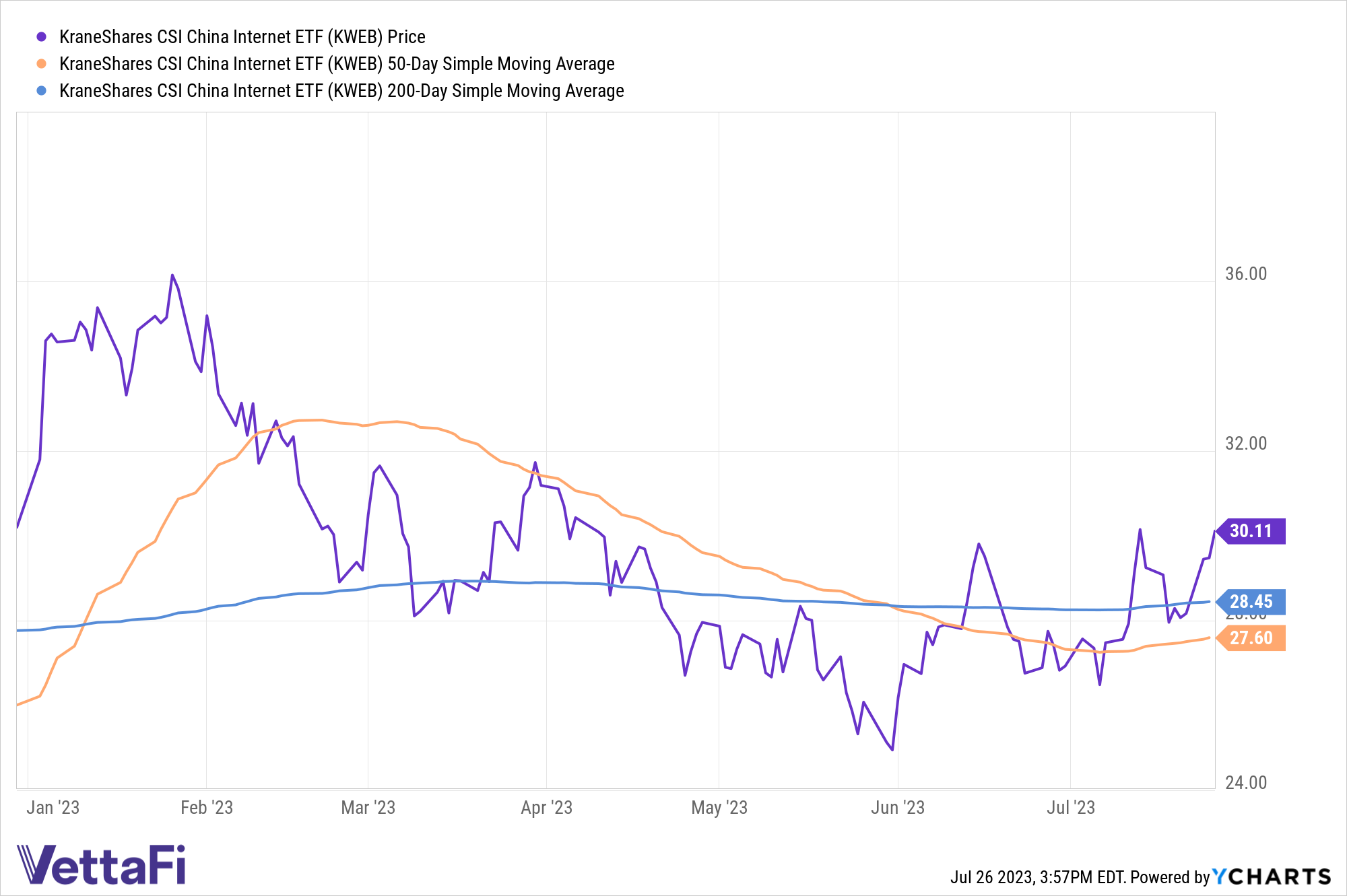

Between July 21 to July 26, KWEB gained 6.87%. Year-to-date, the fund is down just 0.31%. KWEB is also currently above both its 50-day Simple Moving Average and its 200-day SMA. Funds trending above their SMAs are considered to be in buy territory by investors and trend followers.

KWEB measures the performance of publicly traded companies outside of mainland China that operate within China’s internet and internet-related sectors. The fund provides exposure to the Chinese internet equivalents of Google, Facebook, Amazon, and eBay. The fund worked to convert all possible share classes over to Hong Kong shares instead of ADRs to protect investors from risk.

The ETF carries an expense ratio of 0.70% and has $5.6 billion in AUM.

For more news, information, and analysis, visit the China Insights Channel.