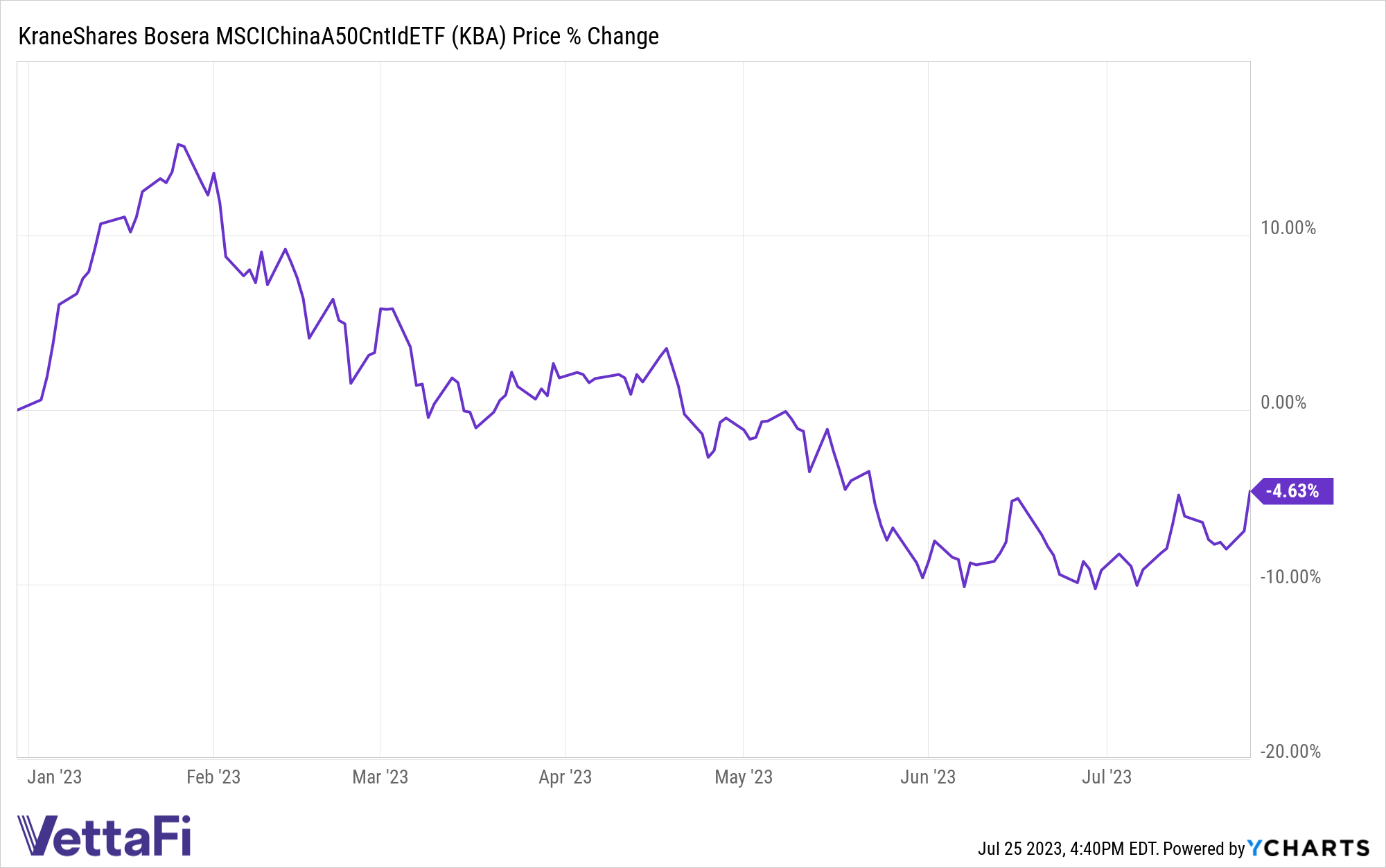

China’s President Xi presided over the Communist Party’s Politburo this week, with firm messaging of policy support threaded throughout the meeting’s language. The indication of further support to boost economic and consumer recovery sent domestic stocks soaring to the benefit of the KraneShares Bosera MSCI China A Share ETF (KBA).

Chinese officials indicated continuing interest rate cuts were likely this year, as well as more rapid release of local infrastructure bonds, and an increase in bond issuance, reported Bloomberg. Supportive policies for real estate could also be on the way alongside a noteworthy language shift regarding property ownership.

Overall, the meeting was “slightly more dovish” than analysts anticipated per Goldman Sachs Group economists.

Economic recovery in China remains muted this year as domestic demand faltered. Officials noted in the meeting that “counter-cyclical adjustments and policy reserves, as well as a proactive fiscal policy and a prudent monetary policy” would be necessary to boost recovery, reported KraneShares.

It remains a balancing act for the government to add enough stimulus to encourage growth without tipping the scales too heavily. Economists at UBS Group AG currently forecast policy rate cuts of 10 basis points later this year alongside reducing the reserve requirement ratio and adding liquidity through the open market.

Specifically highlighted by Chinese officials was a desire to “activate capital markets”, likely given weak foreign investor sentiment. The commitment comes on the heels of a favorable meeting last week between Chinese regulators and foreign investors.

The announcement of policy changes could start as early as next week.

Foundational Policy Support in China a Boon for Investors

Domestic stocks in China soared overnight in their best day of trading in almost eight months. The KraneShares Bosera MSCI China A Share ETF (KBA) invests in Chinese A shares within Mainland China across multiple sectors — specifically those from the MSCI China A 50 Connect Index, and transacts in the renminbi.

On Chinese stock surges overnight, KBA gained nearly 2.5%.

This fund seeks to capture 50 large-cap companies that have the most liquidity and are listed on the Stock Connect, while also offering risk management through the futures contracts for eligible A shares listed on the Stock Connect. The index utilizes a balanced sector weight methodology to give exposure to the breadth of the Chinese economy.

KBA carries an expense ratio of 0.56% with fee waivers that expire on August 1, 2023.

For more news, information, and analysis, visit the China Insights Channel.