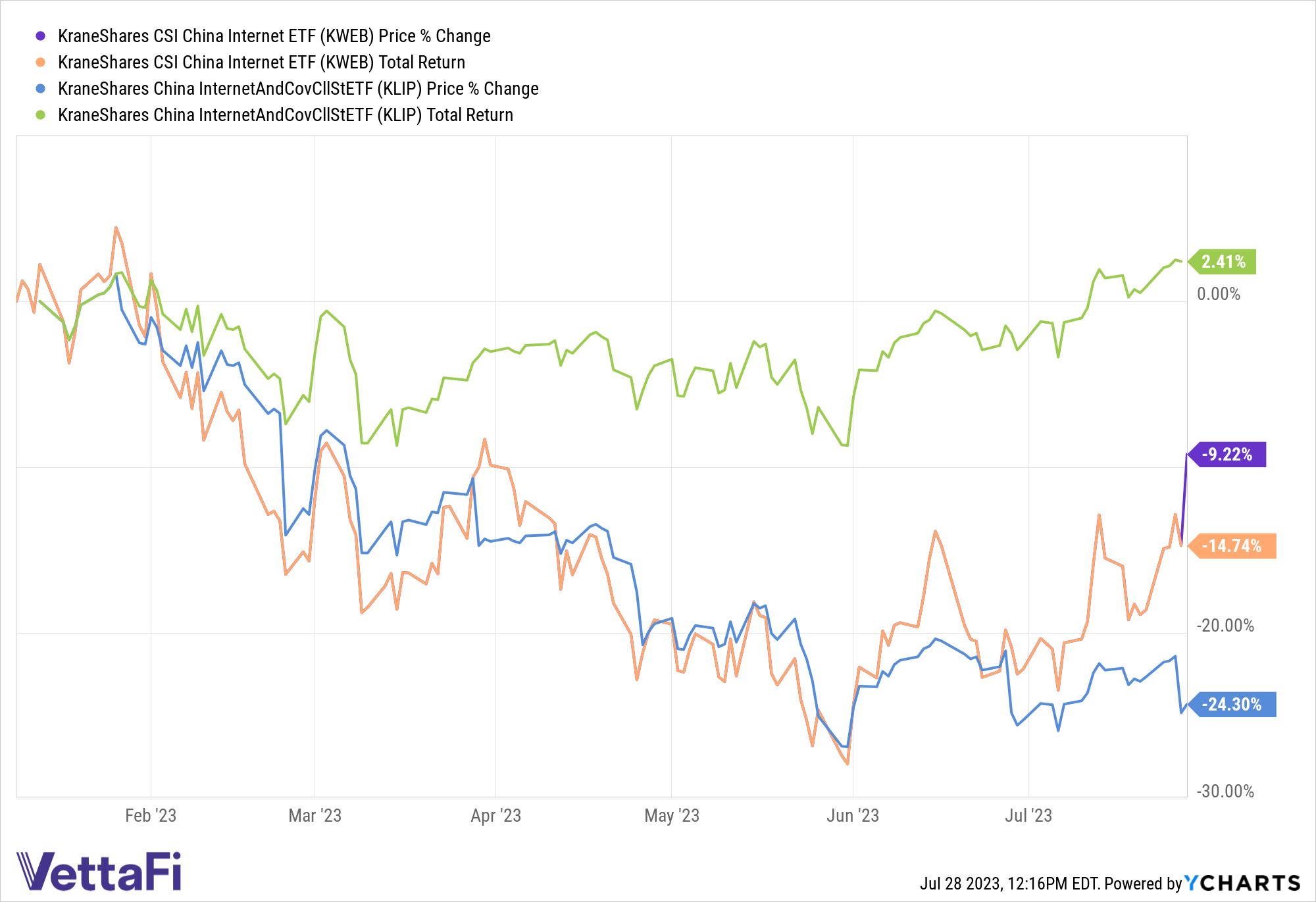

News of China’s commitment to greater support for economic recovery at this week’s Politburo carried Chinese stocks higher this week. Chief amongst those making sizeable gains are the technology giants as China pledges support for the sector in the second half. It creates strong investment opportunity, both within China’s tech sector and for related funds like the KraneShares China Internet and Covered Call Strategy ETF (KLIP).

The KraneShares CSI China Internet ETF (KWEB) continues its rally on news of China’s commitment to further economic support. The fund is up 11.68% between July 21 and July 28 in mid-day trading. Chinese officials specifically committed to supporting the “platform economy,” or China’s tech sector, in recent weeks. That support was underscored again at this week’s Politburo.

The change in tone and language is a massive narrative shift from the regulatory threat the sector operated under for much of the last 18 months. It makes the second half outlook for companies like Alibaba, Tencent, Baidu, and others look increasingly bright.

See also: “China Tees Up for More Policy Support, KBA Gains”

Harnessing Volatility for Income in China’s Tech Sector

KLIP seeks to provide income through written covered calls on the KraneShares CSI China Internet ETF (KWEB). Because of the increased volatility, it has the potential to offer higher yield than investing in tech in the U.S. or other technology sectors globally.

A covered call entails holding the underlying security while writing calls on that security. This earns a premium from selling the covered call that can then be utilized to generate income for the fund.

KLIP offers a current yield of 52.67% as of July 27, 2023. Current yield is a measure of the most recent distribution, annualized, and then divided by the most recent NAV.

The ETF is benchmarked to the CSI Overseas China Internet Index. The index tracks publicly traded Chinese-based internet companies. KLIP can be used alongside KWEB in a portfolio to capture China’s growth in the internet sector. It also benefits from any volatility in the sector through income generation.

KLIP has an expense ratio of 0.95%.

For more news, information, and analysis, visit the China Insights Channel.