Most, if not all of the domestic catalysts we envisioned for 2017-18 have yet to be realized as they all stem from Washington. And whenever politics are involved, the path is sure to be tortuous. Tax reform, infrastructure spending and widespread deregulation were thought to be real economic drivers for the US going forward.

Instead, a lot of time, energy and political capital are being spent trying to repeal Obamacare. Regardless of one’s political stripes, Obamacare is doomed to implode absent some fixes. Its fundamental premise – that plenty of young healthy people will sign up – is flawed. They haven’t; but the sick have. Therein lays the problem.

While there are plenty of risks to our international thesis – China being the primary one – we think a lot of bad news is already priced in and with growth prospects improving in many foreign countries, and interest rates still very accommodative, the chances for continued gains are good. Should the Chinese government allow for a disorderly unwind of the credit bubble currently underway in mainland China, letting corporate bankruptcy occur and housing prices to correct meaningfully, its highly likely th at other EM countries will feel that pain. However, it’s our bet that the powers that be will do whatever it takes to ensure their own survival and the one-party rule that began in its current form in 1949.

Upon being captured in 1952, notorious bank robber Willie Sutton was asked why he did what he did. His response was, “I rob banks because that’s where the money is.”

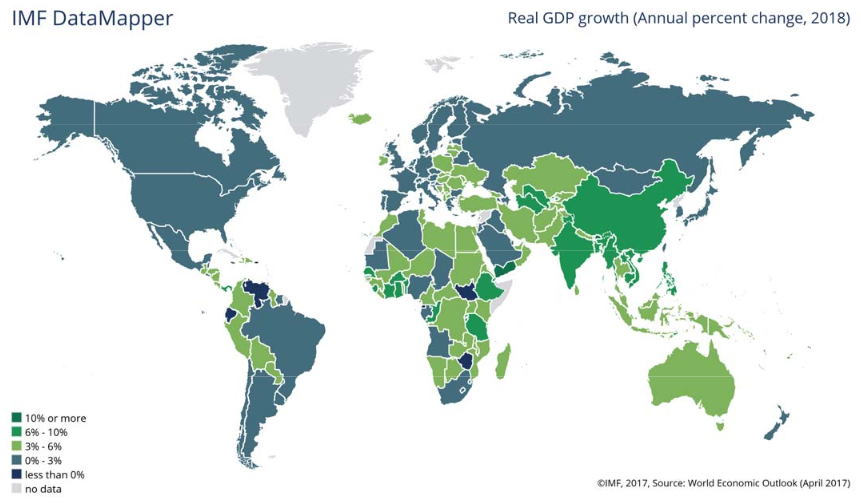

Well, looking at the IMF chart above, where should one invest? Go where the growth is. It’s a simplistic thesis in and of itself; however, in all investment analysis, there is a growth rate to be factored in. Developing countries are still experiencing population growth, with economies that are becoming more capitalistic and competitive with each passing year. And perhaps most importantly, consumerism is gaining ground rapidly in countries like India, Pakistan, China and many countries in Africa.

Most of Nottingham’s strategies have seen a shift take place over the past year, increasing exposure to non US markets. The US Dollar continues to vacillate in the face of hawkish Fed-speak and political rhetoric out of D.C.

Rising rates in the US have historically been tough on emerging markets. This time would appear to be different in the deliberate and gradual approach to hikes adopted by the Fed. As we look out over the next 5 to 7 years, we think there’s a good chance we’ll see strong emerging market growth and equity markets which reflect that.

There are times in our business when we feel that caution is the better part of valor. As we conclude year 8 of this Great Bull Market, born from the ashes of the Great Credit Bust, this would appear to be one of those moments. In a nutshell, we are moderately cautious on US equities, very cautious on US bonds, moderately bullish on international equities, and increasingly fond of cash, despite its meager return. While we don’t envision any calamities on the horizon and will readily admit to the possibility of the US bull market marching on, we feel it’s time we took a little profit domestically and ventured overseas for better opportunities. That’s been the focus of our research efforts over the past year and it’s gratifying to see some of that work pay off. Thanks once again for your commitment to Nottingham, and please feel free to reach out to us anytime with questions or simply to share your thoughts. We would look forward to speaking with you.

Larry Whistler, CFA, is President/Chief Investment Officer at Nottingham Advisors, a participant in the ETF Strategist Channel.