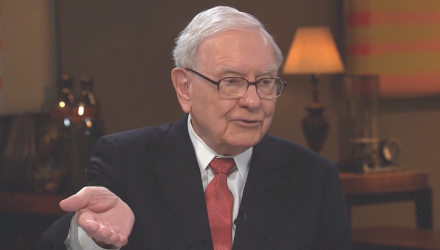

“I clearly like Apple… I’d love to own 100 percent of it… We like very much the economics of their activities. We like very much the management and the way they think,” Warren Buffett said on CNBC’s “Squawk Box.”

Buffett’s statements have reflected in the form of an increasing position in Apple (AAPL) in Berkshire Hathaway’s (BRK.A) portfolio. In fact, as of March 30th, Berkshire owned over 239 million shares, or 4.7%, of Apple, constituting 21% of Berkshire’s public company portfolio, as reported by WhaleWisdom.com. Rounding out the top five holdings include Wells Fargo (WFC) at 12.7%, Bank of America (BAC) at 10.8%, Kraft Heinz (KHC) at 10.7%, and Coca-Cola (KO) at 9.2%.

Related: Apple Eyes Record Breaking $1 Trillion Market Cap

Berkshire Hathaway began investing in Apple in the March 2016 quarter, when it purchased 9 million shares. At the time, the stock was trading between the high $80s and below $110. The fund’s next buy was a purchase of 42 million shares during the December 2016 quarter, with the stock fluctuating between $100 and $115. In the March 2017 quarter, Berkshire made another considerable purchase of Apple: 72 million shares between $115 and $140. Fast forward to today, Berkshire now owns almost 240 million shares of the tech giant, with a stock price near $191.

For more news and strategy, visit our current affairs category.