Throughout April and May, the Q1 2017 corporate earnings were the market’s focal point as results exceeded expectations.

As of this writing, 98% of S&P 500 companies reported corporate results with 75% beating mean EPS and 64% beating mean sales estimates. Growth compared to last year also improved.

The blended earnings growth rate was 14.7%, the highest year-over-year earnings growth for the index since Q3 2011, and the blended sales growth rate for Q1 2017 is 7.9%. At the beginning of the reporting season, the expected EPS growth rate was 9.0%. The positive news from earnings helped to support the performance of the overall U.S. equity market.

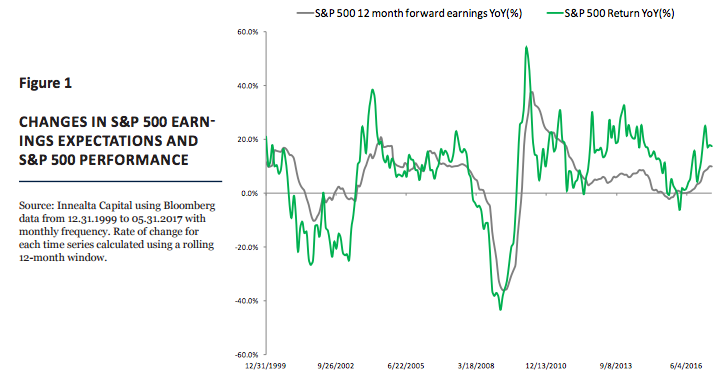

Shown in figure 1 is the rolling year-over-year change in twelve-month forward S&P 500 earnings expectations and S&P 500 performance. Earnings expectations appear to be highly correlated to S&P 500 performance and vice versa (66%). The strong corporate results and the increase in forward earnings expectations have helped support the 17.7% one-year performance (as of 05.31.2017) of the S&P 500.

Trump Trades

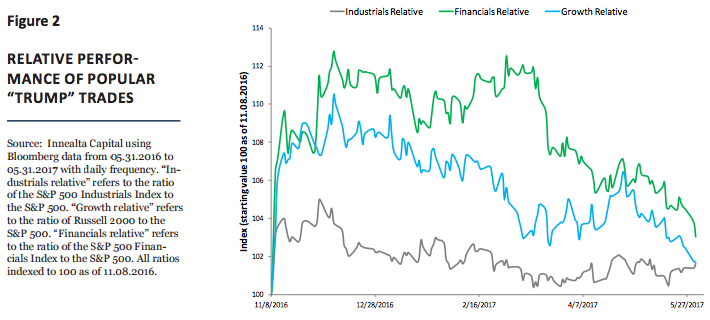

As earnings were the bright spot in data during May, popular investment themes that hinge on fiscal and monetary reforms, known as “Trump” trades, continue to deteriorate as concerns that Trump reforms will take longer to materialize. In particular, the likelihood that the U.S. Congress will enact infrastructure, tax, and financial reforms before year end has declined.

Figure 2 shows the performance of the S&P 500 industrial sector relative to S&P 500, the S&P 500 Financials sector relative to the S&P 500, and the Russell 2000 relative to the S&P 500. We use the first two time series as proxies for the infrastructure and financials reforms respectively while the third time series is a proxy for growth.

Theoretically, an infrastructure spending bill would strengthen the Industrials sector and a reform of the Dodd-Frank bill would likely improve financial companies’ return on assets. Cumulatively the infrastructure spending, financials reforms as well as other reforms not mentioned in this writing would theoretically stimulate growth.

Relative performance increased dramatically following the U.S. presidential election; however, since the start of 2017, each theme has underperformed. In the case of financials and growth proxies, these themes have almost entirely retraced move from November and are now offering increasing asymmetric opportunities to potential reforms.

Emerging Markets

Within global equity markets, the major story during May occurred in Brazil. On Wednesday, May 17th, 2017, allegations surfaced that Brazilian President Michel Temer attempted to bribe a jailed, former congressional leader.

The previous Brazilian President, Dilma Rousseff, was removed from office via impeachment less than one year ago. When trading opened on Thursday, May 18th, 2017, the Brazilian Bovespa index closed down -8.80% in local terms, and the Brazilian Real depreciated relative to the U.S. dollar by -7.1%. The combined effect to Brazilian equities owned in US dollars was a decline of approximately 16%. Since May 19th, 2017 through the end of the month, the Brazilian Bovespa, in USD terms, has returned 5.6%.

Within various Innealta portfolios, we used the market volatility created around the Brazilian presidential corruption allegations to increase that desired Emerging Market exposure. Despite all of the uncertainty within the US and Brazilian executive offices, it is important to remember that one person does not define an economy and in the case of the Brazil, the macroeconomic data and the potential fiscal reforms appear supportive of future growth.