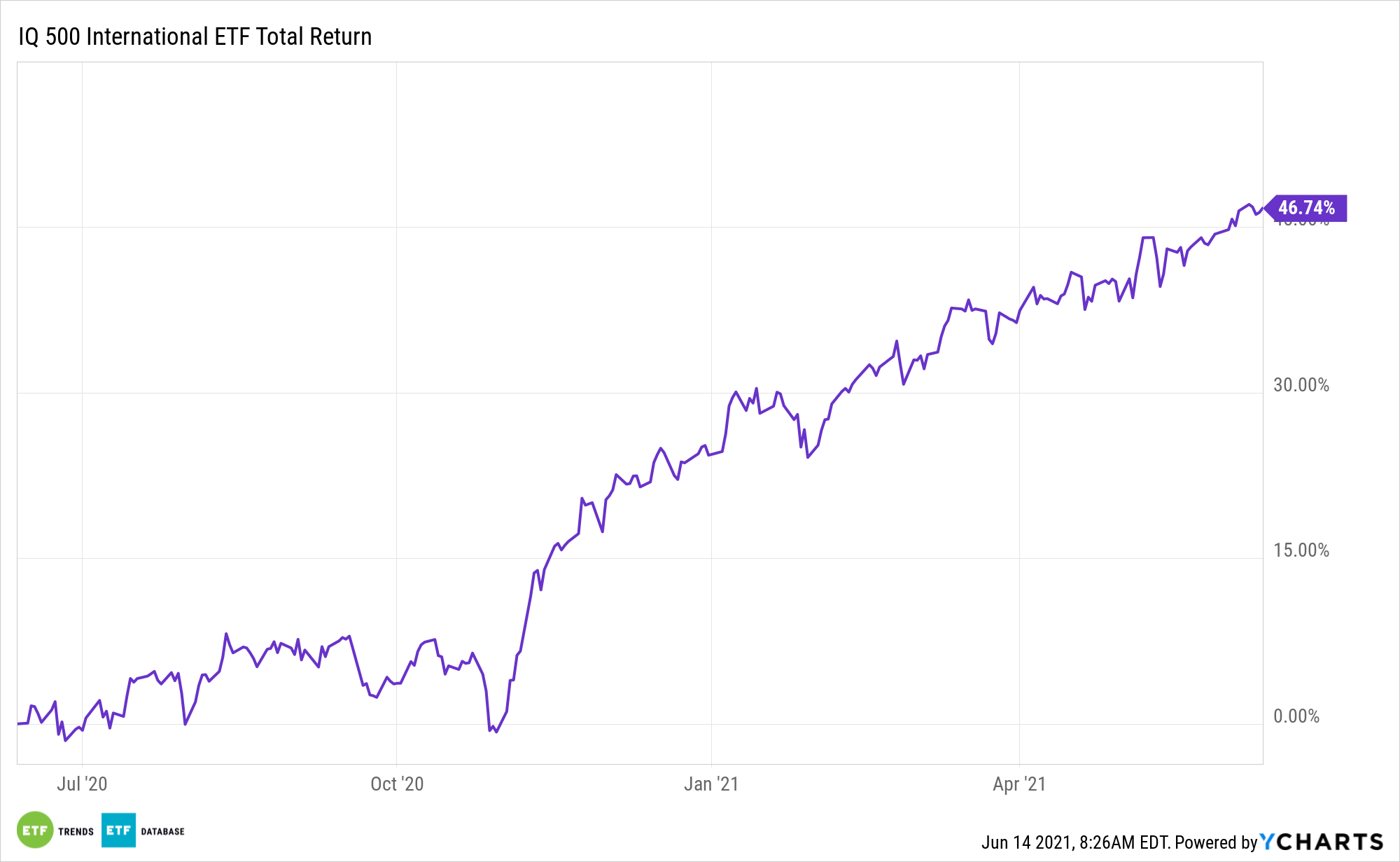

The global re-opening can give international investors renewed exposure to economies abroad for the purpose of diversification. One exchange traded fund (ETF) worth considering is the IQ 500 International ETF (IQIN).

The fund dips into a vast array of international equities to diversify a portfolio and capture upside in other countries around the globe. The fund virtually eliminates concentration risk by never holding more than 1.2% of a stock as part of its portfolio (502 holdings as of June 9).

Per its general fund description, IQIN seeks investment results that track generally to the price and yield performance of its underlying index, the IQ 500 International Index. the price and yield of the IQ 500 International Index. The IQ 500 International Index selects and weights securities utilizing a rules-based methodology incorporating three fundamental factors: sales, market share, and operating margin.

The top 500 international securities, based on their composite rank, are included in the Index. The fund comes with a low expense ratio of 0.25%, which falls 15 basis points below the category average. The ETF lends investors:

- A Fundamental Model: Sales, market share, and operating margin weightings have the potential to improve a portfolio’s risk-return profile over a market-cap-weighted index.

- Enhanced Country and Sector Diversification: Fundamentally driven security selection allows for improved country diversification and sector weightings over a market-cap-weighted index.

- Core International Holdings: Developed international equity ETF with exposure to large companies.

Bullish Trends for International Equities

As mentioned, the fund’s investment spread over 21 countries gives IQIN the necessary diversification to capture upside in a re-opening economy. While a vaccine deployment continues in the U.S., its effects could be waning, while other parts of the globe could beginning their own nascent upswings.

“We’re also seeing global economic data trend in the direction we expected,” wrote Calamos Investments in a Seeking Alpha article. “There’s no doubt that the U.S. economy is in the midst of a strong recovery.”

“If we look at the Citi Economic Surprise Indexes, for example, we see that data in the U.S. is still coming in better than expected, but much less so than last summer,” the article said further. “In 2021, there was a small pick-up in late February/early March, but the trend is decelerating again. Meanwhile, in emerging markets and Europe, expectations moved down due to lockdowns, but economies have adapted more than expected and data continues to surprise to the upside.”

For more news, information, and strategy, visit the Alternative ETFs Channel.