In finance, there are often well-known rules of thumb for investing that can easily become embedded in consensus thinking. For market timing, the well-worn “Buffet ratio” compares the value of stocks relative to the nation’s economic output. Other market timing formulas compare the relative value of government bond rates to the dividend yield provided by stocks. But are these generic sound bites telling the whole story in value investing?

“This time it’s different” is a mantra often used to justify historically high stock valuations. Near the turn of the century, the Internet boom was heralding a new dichotomy that would disrupt society as never before – and thus assigning a multi-million valuation to a company, pets.com, whose primary asset was a sock puppet, could be justified.

In reality, the projections of massive societal change coming from a technical revolution were proven more than hyperbole. Technology has revolutionized society to levels that, in many cases, have exceeded the early hyperbole. But many of the companies without strong product offerings, such as pets.com, fell by the wayside. Others, such as Amazon.com and Google, who built a behemoth from the early search engine Alta Vista, have endured and rewarded patient investors and proven wrong those who said at the time stocks were overvalued.

This all leaves a question: Can general “rules of thumb” be accurate regarding stock market valuations?

The “Insecurity Analysis” blog points out that as it relates to today’s market valuations, he doesn’t know if the market is set to fall. Rather, it is important for investors to understand that indicators pointing to an over-valued stock market generally have flaws.

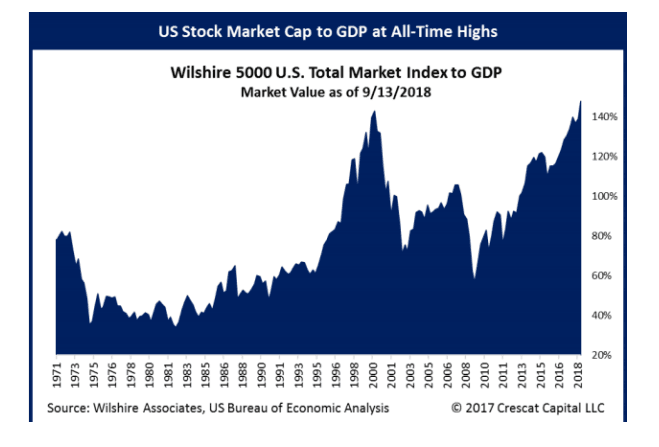

The most popular of the stock market valuation indicators, the Buffet ratio, started by simply comparing the value of the stock market to Gross National Product (GNP). While recognizing limitations, Buffet said “it is probably the best single measure of where valuations stand at any given moment. If the ratio approaches 200%–as it did in 1999 and a part of 2000–you are playing with fire.”

The ratio was later altered to substitute Gross Domestic Product (GDP) but the problems persist.