There is a saying on Wall Street that “credit leads.” The meaning of this adage is that high yield investments are often the first to falter during a significant downturn.

Junk bonds, bank loans, and other riskier types of debt have often been analogized to the canary in the coal mine when gauging the health of global markets. Perhaps it is because these investments have historically been quite sensitive to liquidity and risk appetites as investors shift their capital accordingly.

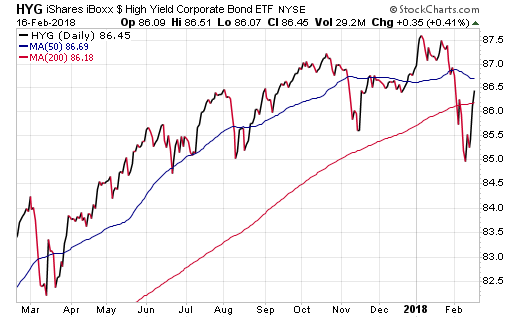

If this maxim is indeed true, the relative strength of credit-sensitive investments during the February stock market correction is a positive sign. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) fell just 3% from high to low as the SPDR S&P 500 ETF (SPY) nosedived more than 10%. HYG has since recovered the majority of those losses and is within 1% of its previous high.

This exchange-traded fund is one of the most heavily-traded in the high yield world and beloved by income enthusiasts for its above-average dividends.

HYG owns a basket of over 1,000 fixed-income securities issued by corporations with below investment grade credit ratings. It sports a 30-day SEC yield of 5.52%, an expense ratio of 0.49%, and an effective duration of 3.85 years.

As a percentage of total market value, 48% of the underlying holdings in HYG are clustered around the BB rating category, according to S&P data. That is followed by 38% in the B category and nearly 11% rated CCC.

Those who may opt for a slightly riskier portfolio may be interested in the SPDR Bloomberg Barclays High Yield Bond ETF (JNK). It shifts approximately 4-5% of its portfolio down the credit ladder, which also boosts the current 30-day SEC yield to 5.69%.

It’s interesting to note that HYG and JNK have experienced less overall influence by the recent move higher in interest rates as well.

This risk factor is traditionally more prevalent in higher quality fixed-income such as Treasury, municipal, and investment-grade corporate bonds. However, it can still meaningfully impact the junk bond market if the perceived rise in rates is accompanied by a sell-off in stocks.