Brexit Uncertainty Biting Hard on Banks and Investment Managers

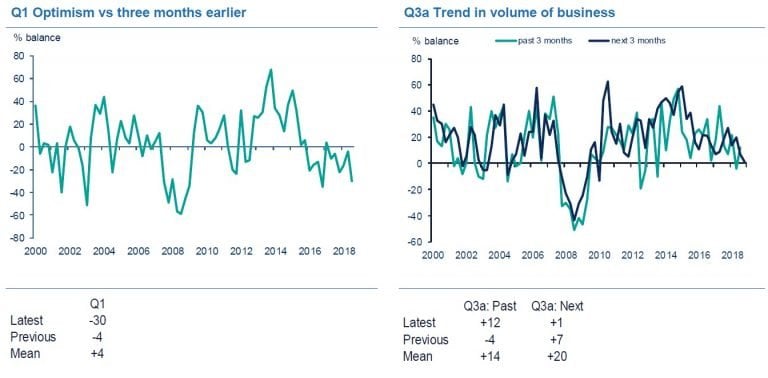

Optimism in the financial services sector fell sharply in the quarter to September, amid signs of a listless operating environment, according to the latest CBI/PwC Financial Services Survey.

The quarterly survey of 100 firms found that optimism about the overall business situation in the financial services sector fell further, having declined in all but one quarter since the start of 2016. The deterioration of sentiment in banking and investment management was particularly widespread – only finance houses reported an improvement in optimism.

![]()

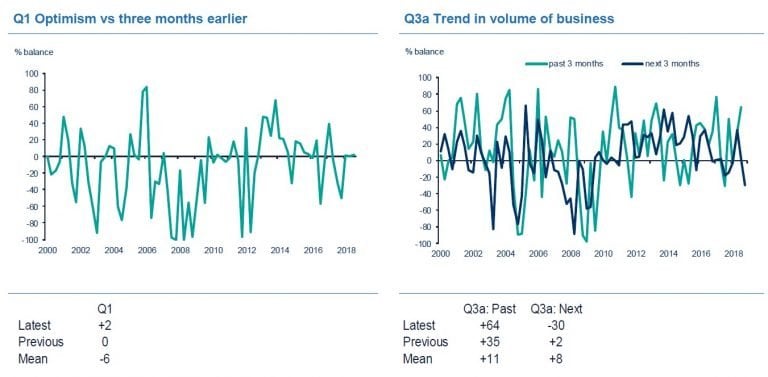

Overall business volumes increased slightly in the three months to September, although the level of business dipped slightly below normal. Conditions varied again across the sector. Whilst many sectors saw business volumes rise – notably insurers – banking volumes were stable for a second successive quarter and investment managers said volumes contracted, confirming a striking loss of momentum during 2018. Looking ahead to the next three months, overall business volumes are expected to be unchanged, marking the weakest growth expectations since 2009.

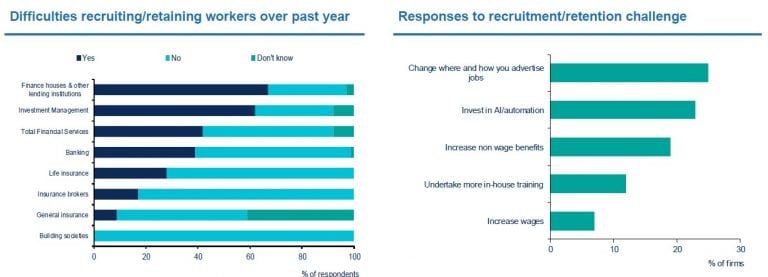

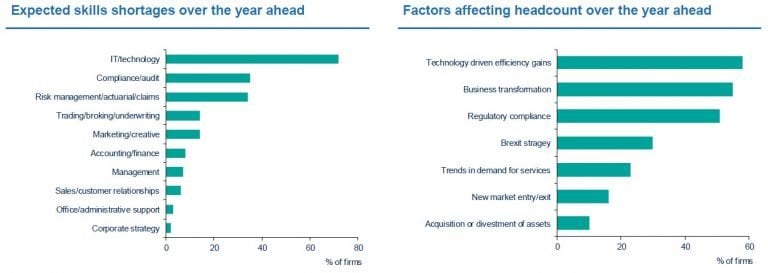

Also asked about recruitment and skills, two fifths of firms said they had found it more difficult to recruit and retain workers over the past year. Almost half of firms said skill shortages could constrain business expansion in the year ahead – the highest share since the start of the survey in 1989. Nearly three quarters of firms expect to find it more difficult to recruit IT workers in the year ahead.

Overall Financial Services

Banking

Building Societies

Rain Newton-Smith, CBI Chief Economist, said:

“While it’s good to see that demand for financial services is holding up, with business volumes edging higher last quarter, it’s simply impossible to ignore the dangerous signs of strain on the sector arising from the combined challenges of a subdued economy, Brexit, regulation and rapid advances in technology.

“For the sector to continue to be one of the UK’s most attractive economic assets, it is fundamental that a Withdrawal Agreement with the EU is agreed. This will provide temporary but essential relief for financial services firms of all sizes. Then attention can turn to the vital task of finalising our future economic relationship with the EU, in which services need to play a pivotal part.

“In the long run, it’s clear the sector needs to think more creatively about recruiting and retaining its skilled staff. Investing in employees with the right skills – especially technological skills – and ensuring the sector offers a more diverse and attractive career path are key.”

Finance Houses

![]()