Active management has had a strong year so far, with investors planning future allocations based on solid performance. Actively managed strategies not only lean on managerial expertise but can also operate more nimbly in the market. That has helped some active strategies outperform notable passive funds, such as the Vanguard Total Market ETF (VTI). VTI, one of the largest ETFs by AUM, has trailed active ETF TSPA over one year, for example.

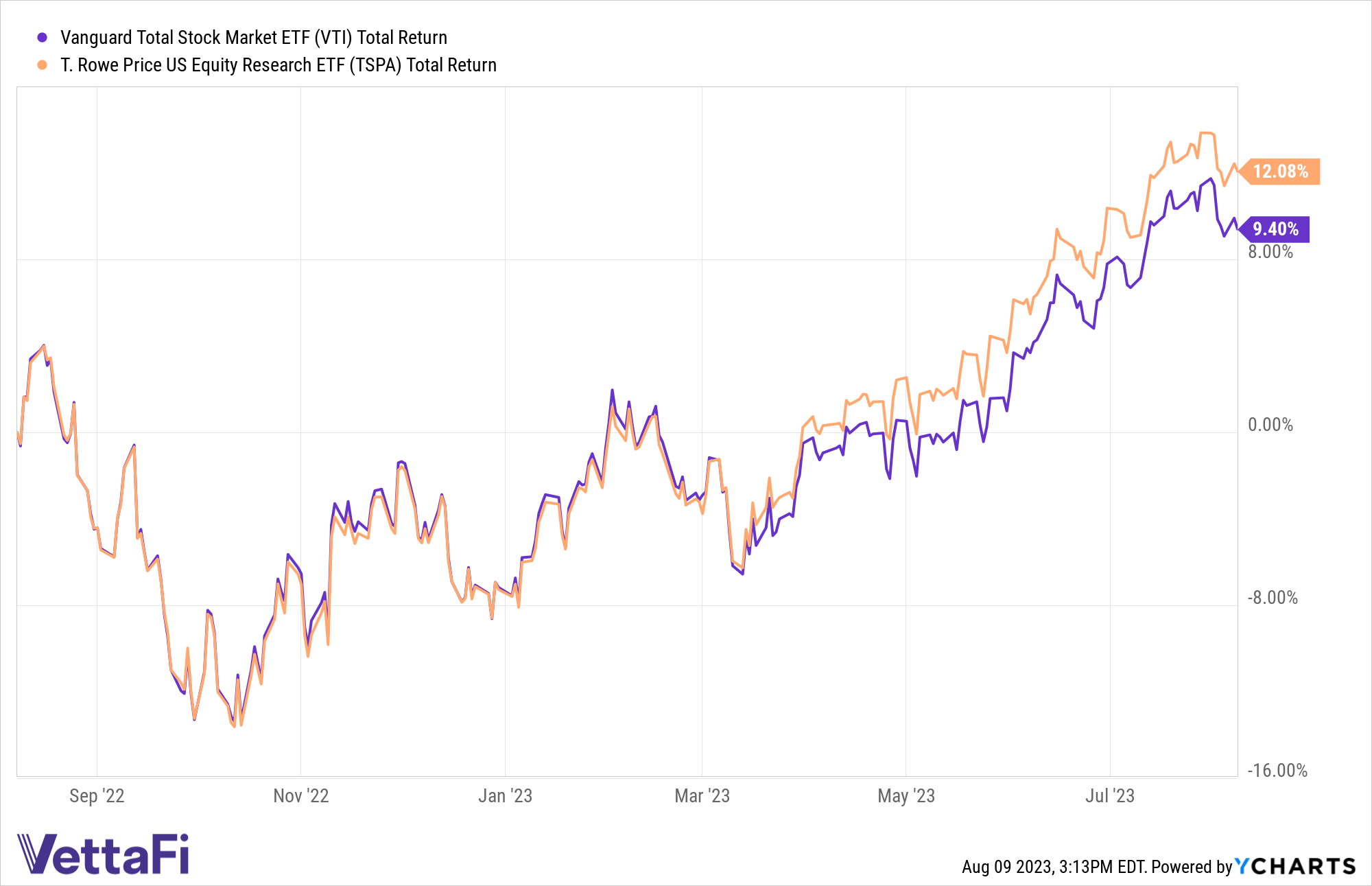

Active ETF TSPA has outperformed VTI over the last 12 months, per YCharts.

While VTI has returned 9.4% over the last 12 months, the T. Rowe Price U.S. Equity Research ETF (TSPA) has returned 12.1% in that time, according to YCharts. Those returns stand out compared to VTI’s, with a notable 300 basis point (bps) difference. For investors and advisors, performance matters above all, so how did TSPA manage those returns?

See more: “So Far in 2023, Active ETFs Top Performance Charts”

The active ETF, which will hit its three-year anniversary next year, looks to deliver similar characteristics of the S&P 500 but with the goal of higher performance through fundamental analysis. Industry-focused equity analysts are directly responsible for selecting stocks across their respective areas of coverage in an attempt to outperform the index. The analysts overweight the most attractive stocks, underweight or avoid less attractive stocks, and have the latitude to add high-conviction, non-index securities from their coverage area.

That’s led to the ETF holding stocks like Nvidia (NVDA) and Eli Lilly and Company (LLY) at a higher weight than they have in the SPDR S&P 500 ETF Trust (SPY). Taken together, the active ETF’s approach has resulted in strong 20.9% YTD returns on top of its one-year 12.1% return.

Charging just 34 bps, the strategy presents an intriguing option moving forward. In a soft landing scenario or recessionary environment, TSPA can lean on the S&P 500’s success while augmenting it based on either of those market situations. For those looking to up their active allocations in the months ahead, TSPA may be one to watch.

For more news, information, and analysis, visit the Active ETF Channel.